The Ohio House has passed a bill allowing residents to make up to $200 in crypto payments tax-free, marking a step toward broader digital currency adoption.

A plan to legally shield different cryptocurrency operations, such as mining and staking, and exempt some transactions from capital gains tax was passed by the Ohio House.

A bill that would provide several protections for cryptocurrency and exempt transactions under $200 from capital gains taxes was enacted by the Ohio House of Representatives.

House Bill 116, also known as the Ohio Blockchain Basics Act, was approved by the state House on Wednesday by a vote of 70–26. It will now go to the state Senate before reaching Governor Mike DeWine.

Earlier in the day, by a vote of 13-0, the state’s Technology and Innovation Committee approved the law with bipartisan support.

Republican Representative Steve Demetriou is the bill’s principal supporter. He stated on Wednesday that the bill’s “two main focuses” are “protecting digital asset mining businesses from discriminatory government overreach” and “facilitating easier crypto payments.”

According to the digital asset law tracking website Bitcoin Laws, 40 of 50 US states have introduced more than 160 crypto-related measures, indicating that many state politicians are considering passing crypto legislation.

Bill to make tax-exempt $200 cryptocurrency payments.

All cryptocurrency transactions under $200 would be excluded from capital gains taxes under the law; this amount would increase annually in line with inflation.

When, or if, the law is passed, the $200 cap will be applied in the first tax year and will be increased to the closest $5 based on the Consumer Price Index.

The law would also forbid the state government and state agencies from enacting regulations limiting citizens’ ability to use cryptocurrency as a form of payment, and it would prevent the state tax commissioner from lowering the cap after it has been established.

Ohio wants to allow cryptocurrency mining.

As long as they abide by local noise restrictions and regulations, the bill permits anyone to mine cryptocurrency in a residential neighborhood.

According to the bill, cryptocurrency mining companies that comply with local laws would also be permitted to “operate in any area of this state that is zoned for industrial use.”

In addition to protecting cryptocurrency mining operations, the measure states that the state shouldn’t impose regulations or legislation unique to the industry “that do not also apply to other similarly situated businesses.”

Additionally, it would prohibit the state from rezoning land that would impact a cryptocurrency mining company “without going through the proper notice and comment process.” If crypto miners feel that they are being discriminated against, they can challenge the rezoning in court.

Deregulating nodes, wallets, swaps, staking, and mining

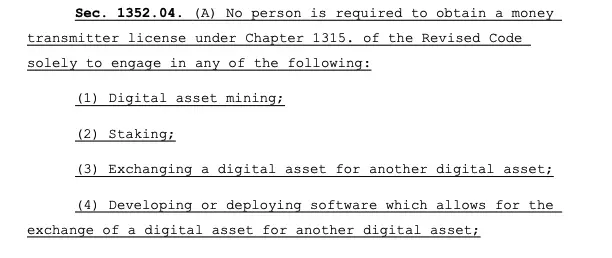

According to the Blockchain Basics Act, several activities that support blockchain operations or do not need fiat currency are exempt from needing a money transmitter license.

According to the law, a license is not required “solely to engage” in cryptocurrency mining, staking, running a blockchain node, trading one cryptocurrency for another, or creating or implementing software that facilitates cryptocurrency swaps.

Additionally, it declares that organizations that offer cryptocurrency mining or staking services are “not considered to be offering a security or investment contract,” as federal regulators associated with the Biden administration contended in their legal actions against dozens of cryptocurrency companies.

Additionally, the law forbids the government and its agencies from enacting regulations preventing or hindering Ohioans from managing cryptocurrency through self-hosted or hardware wallets.

A bill establishing an “Ohio Bitcoin Reserve Fund” was presented in January and sent to the Financial Institutions, Insurance, and Technology Committee; Ohio is also scheduled to discuss it.