Two users of the renowned non-fungible token (NFT) marketplace OpenSea have filed a class-action lawsuit in a U.S. federal court, accusing the platform of selling unregistered securities contracts.

According to a report by Law.com, the plaintiffs, Anthony Shnayderman and Itai Bronshtein, started the lawsuit in Florida on September 19.

The plaintiffs contend that the putative illegal nature of certain NFTs purchased through OpenSea, including those from the once sought-after Bored Ape Yacht Club collection, has rendered them worthless.

Plaintiffs Reference OpenSea’s Well’s Notice

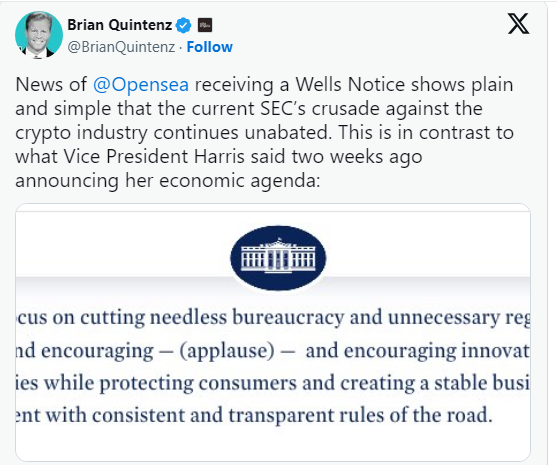

OpenSea’s recent disclosure of receiving a Wells notice from the U.S. Securities and Exchange Commission (SEC) is critical to their case.

A Wells notice is a formal notification that the SEC has completed an investigation and may take enforcement action against the recipient.

Shnayderman and Bronshtein argue that this notice suggests that OpenSea may be held accountable for facilitating the exchange of unregistered securities, including specific NFTs sold on the platform.

The lawsuit is similar to previous SEC actions against NFT ventures, including Stoner Cats 2 and Impact Theory, which were both accused of selling unregistered securities.

The plaintiffs contend that the NFTs they acquired satisfy the criteria of an investment contract as defined by the Howey test, a legal standard employed to ascertain whether a transaction qualifies as a security.

They assert that their investments in these NFTs were part of a shared enterprise, with the expectation of profit derived from the efforts of others.

Shnayderman and Bronshtein contend that OpenSea’s platform listings were deceptive, which led them to acquire NFTs that they characterize as “worthless and unlawful unregistered securities.”

They also allege that OpenSea needs to adequately moderate its marketplace for such securities, breaching a user warranty.

The plaintiffs also contend that OpenSea unjustly enriched itself by collecting fees and accepting payments from transactions that it allegedly knew, or should have known, were associated with unregistered securities sales.

CryptoPunks NFT is being sold at an 80% Discount

In 2022, a CryptoPunk NFT was sold for $23.2 million in August and subsequently transferred for 1,500 ETH at an 80% discount, resulting in a value of approximately $3.9 million.

The original proprietor, Deepak Thapliyal, purchased the NFT for 8,000 ETH. He bid farewell to the token on X (formerly Twitter).

The new buyer, VOMBATUS, subsequently confirmed the purchase and compared the low price to receiving a “free” token.

In the interim, there has been a trend of corporations withdrawing from the NFT sector.

Starbucks, the internationally recognized multinational coffee chain, terminated its NFT rewards program in March.

GameStop, a gaming retailer, announced the cessation of its NFT marketplace in January. This decision was made after the company reduced its crypto services over the previous two years.

Recently, X, which is currently under the ownership of Elon Musk, discontinued a feature that permitted premium users to use NFT images as their profile photographs.