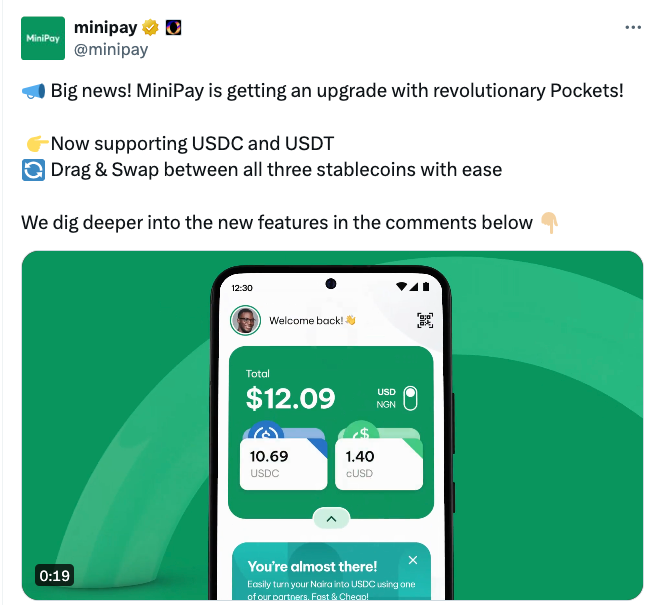

Opera Mini’s MiniPay application has attracted three million users since its launch in September 2023, and the wallet now includes USDT and USDC.

Opera, a major technology conglomerate, is enhancing the cryptocurrency wallet on its mobile browser Opera Mini by incorporating the largest stablecoins on the market, Tether USDT and Circle’s USDC.

Pockets, a new feature that facilitates one-click swaps between the Celo dollar (cUSD) and the newly incorporated stablecoins, is being introduced by MiniPay. This self-custodial wallet is based on stablecoins and integrated into Opera Mini.

According to an announcement on July 3, MiniPay users can effortlessly transition between USDC and cUSD with “sub-cent fees and no hidden costs” using a drag-and-drop motion with Pockets.

Jørgen Arnsen, executive vice president (EVP) of Mobile at Opera, stated to Cointelegraph that this feature abstracts assets swapping in Web3, enabling users to effortlessly switch between all three stablecoins by dragging coins between virtual pockets without the need to be concerned about gas fees.

Most wallet consumers are concerned about high transaction fees

MiniPay, introduced in September 2023, is based on the Celo blockchain and utilizes Mento’s stablecoin cUSD, which is linked to the value of the U.S. dollar. The wallet extension was initially implemented in Africa to facilitate the transfer and receipt of stablecoins via mobile phone numbers.

“We acknowledged the substantial potential of blockchain-enabled peer-to-peer solutions within the continent, given the high internet costs and lack of fixed internet access,” Arnsen stated.

“Our research indicated that most consumers harbored apprehensions regarding the high fees, unreliable service uptimes, and lack of transparency regarding transaction progress associated with local payment options.” However, the issue of excessive mobile data costs was and continues to be ubiquitous.

MiniPay has implemented a Discover Page for the decentralized applications (DApps) that are integrated into the wallet, in addition to the new Pockets feature.

The page is intended to facilitate the organization of numerous native DApps, providing users with direct access to tools such as Universal Basic Income protocols, savings applications, and games.

MiniPay sees significant growth in Africa

One of the fastest-growing digital wallets on the continent, MiniPay has experienced over three million wallet activations across Nigeria, Ghana, Kenya, and South Africa since its inception last year.

Arnsen, the EVP of Opera Mobile, observed that Africa has been a mobile-first continent for a long time, with a young population and widespread smartphone adoption.

“Opera Mini is the most downloaded mobile browser in Africa today, with nearly 100 million users,” he declared.

Africa has been rapidly becoming a continent with a substantial interest in cryptocurrency. Africa boasts one of the world’s youngest and fastest-growing populations, which presents a significant opportunity for the adoption of digital assets.

As of 2023, the top five African countries adopting Bitcoin were South Africa, Nigeria, Zimbabwe, Kenya, and Ghana, as reported by sources such as BitcoinAfrica.io.