PancakeSwap now offers one-click cross-chain swaps with Across Protocol to reduce bridge risk and improve DeFi UX across Arbitrum, Base, and BNB Chain.

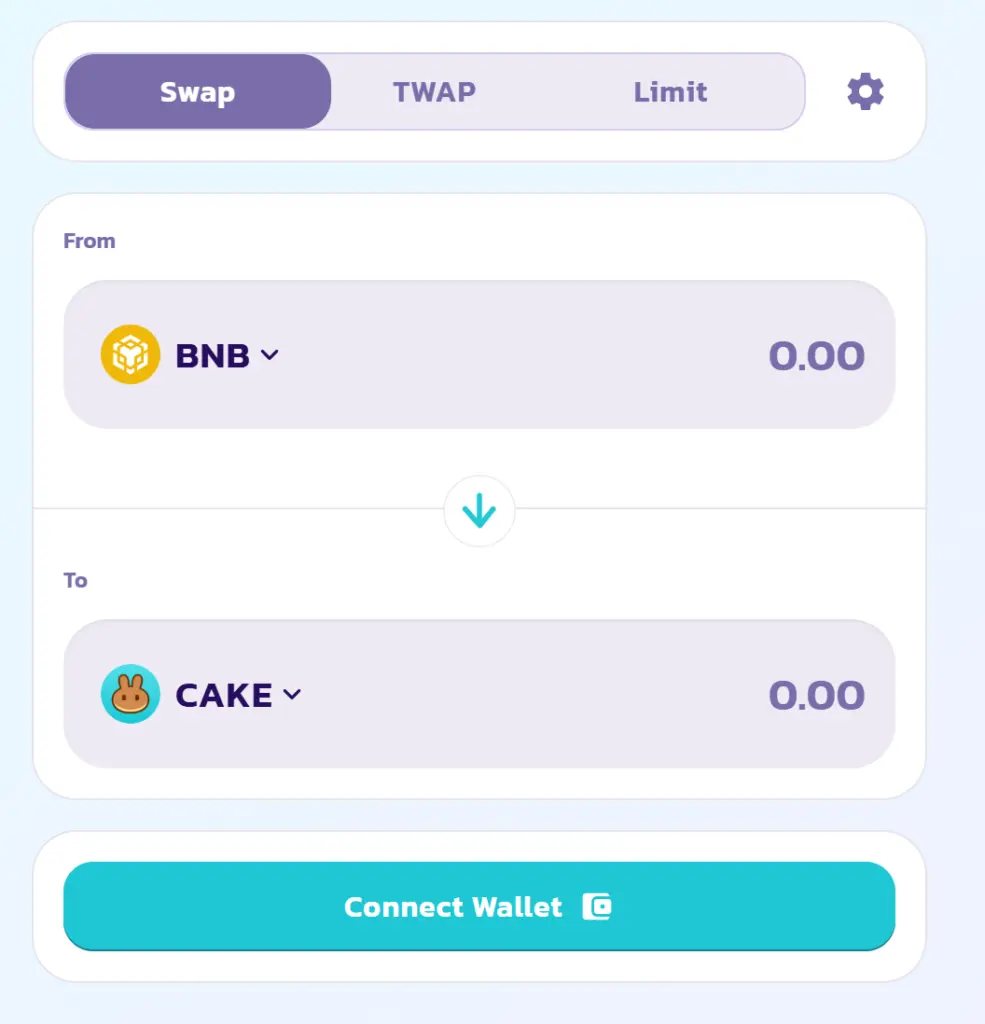

DEX stands for decentralized exchange. Using Across Protocol, PancakeSwap has introduced one-click cross-chain swaps to solve one of the most urgent user experience (UX) problems in decentralized finance (DeFi).

Customers can exchange assets through the connection without needing intricate blockchain bridges or other third-party infrastructure, which can be costly and complicate the user experience.

Users can easily specify the desired result with Across’s intent-based transfers, such as exchanging USDC (USDC$0.9997) on Base for Wrapped Ether (WETH) on Arbitrum, and a network of relayers will compete to complete the transaction.

One-click cross-chain swaps make moving tokens between disparate blockchain networks easier by enabling direct token swaps between BNB Chain, Arbitrum, and Base using PancakeSwap’s interface.

Blockchain bridges have historically been the foundation of cross-chain activity. However, they are weak.

In 2022, one of the biggest cryptocurrency exploits in history drained more than $600 million worth of bitcoin from Axie Infinity’s Ronin Bridge. A private key multi-signature technique, a security solution that later turned out to be insufficient, was the target of the breach.

According to Chef Kids, the head chef at PancakeSwap, “Cross-chain swaps using intent-based bridges are generally safer because they don’t lock your assets in a contract, which reduces the risk of exploits.”

Instead, a decentralized network of relayers resolves swaps in real time. In addition to providing a faster, more seamless user experience, this configuration enhances security,” he continued.

Institutions believe that simplified DeFi has potential.

DeFi infrastructure will be safer, faster, and simpler to connect with current systems thanks to intent-based cross-chain swaps. Chef Kids said that this might open the door for the next phase of institutional DeFi adoption.

“Cross-chain swaps reduce operational complexity, lower smart contract risk by avoiding asset lockups, and offer clearer execution paths.”

Hart Lambur, co-founder of Across, also sees intent-based blockchain architecture as the “key to onboarding institutions” and retail.

He said that it provides security, auditability, and clean execution without the operational overhead usually needed to communicate across chains.

Other protocols have also been developing cross-chain transfer solutions to eliminate the friction that comes with blockchain bridges.

ERC-7683, a standard that formalizes data transmission across several networks and expedites cross-chain transactions, was proposed by Unichain in October 2024. This enables orders from any protocol to be picked up by a decentralized network of solvers.

ERC-7683 is “an open standard for marking cross-chain orders,” according to Vitalik Buterin, a co-founder of Ethereum.

With a decentralized network of 30 solvers, Across—which is also integrated with UniswapX—quickly provides the user with their cash on the destination chain and assumes the risk of finality. On average, swaps take three seconds.

On June 10, DEX aggregator 1inch released its Pathfinder upgrade, which it claims will improve swap rates by 6.5% and speed up and simplify operations.