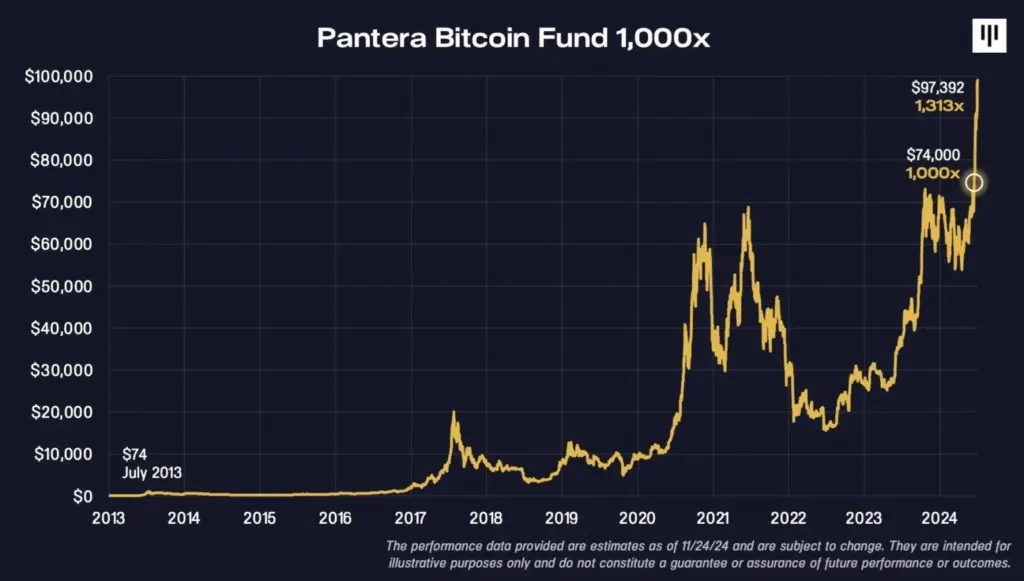

Pantera Capital’s Bitcoin Fund has achieved a 1,000x return since its 2013 launch, with a lifetime gain of 131,165%. Founder Dan Morehead highlighted Bitcoin’s transformative potential, noting the fund’s early acquisition of 2% of the global supply.

Pantera Capital Prediction

Pantera Capital, a prominent cryptocurrency-focused investment firm, has achieved a remarkable milestone by managing the Pantera Bitcoin Fund, which has generated a 1,000x return since its inception. On Tuesday, Dan Morehead, the founder of the company, posted the following on the social media platform X:

Pantera Bitcoin Fund recently achieved an insane milestone – 1,000x. The post-election surge has taken the fund a further 30% higher. The fund’s lifetime return is now 131,165% – net of fees and expenses.

This performance underscores the transformative potential of bitcoin as a financial asset. Launched in 2013, the fund acquired 2% of the global bitcoin supply and took an early position during bitcoin’s price low.

In his latest “Blockchain Letter,” published Tuesday, Morehead explained his optimism about blockchain’s future, emphasizing its largely untapped potential. He wrote: “We’re still early. 95% of financial wealth has not addressed blockchain. They are just beginning this massive transformation now. When they do, bitcoin might be at something like $740,000 /BTC.”

To expand access to bitcoin investments, the founder of Pantera Capital cited recent regulatory clarity in the United States and institutional steps by firms such as Blackrock. Morehead observed that prior performance does not guarantee future outcomes.

If the trend were to continue, bitcoin would hit $740,000 in April 2028. I think it will take a few years longer, but I do think there’s a decent chance of doing so.

He continued: “I wouldn’t bet my life on it, I’m not 100.00% sure blockchain assets will go up, but … the result ends up being way better than other assets one could invest in. The expected value of the trade is the most compelling I have seen in almost forty years of doing this.”