PEPE’s current trajectory matches the price behavior that happened before a 40% drop in January

On May 27, the price of Pepe (PEPE) reached an all-time high, propelled by the recent endorsement of a crucial Ether ETH worth $3,933.

Exchange-traded fund (ETF) filings in the United States have caused traders to perceive memecoins based on Ethereum as opportunities with substantial reward and risk.

The price of PEPE reached an all-time high of $0.00001725, an increase of 7.60%. Since the U.S. Securities and Exchange Commission (SEC) authorized the Ether ETF filings on May 20, this represents an impressive 88% increase.

Other memecoins that adhere to the Ethereum standard include Dogecoin ($0.17) and Shiba Inu SHIB ($0.000026), as well as Mog Coin (MOG), experienced substantial increases subsequent to the approval of the ETF filings.

Furthermore, the daily RSI for PEPE has already surpassed 70, an indicator of overbought conditions that generally signal an impending phase of price consolidation or correction. This further heightens the risk of PEPE market sell-offs following a year of robust performance.

In the event of a correction, the price of PEPE could decline by 40% from its present level by June, reaching its 50-day exponential moving average (50-day EMA; the red wave) at approximately $0.00000965. Similar to the price correction that occurred prior to the bearish divergence signal in January.

On the contrary, PEPE could potentially encounter its 2.618 Fibonacci retracement level near $0.00002203 in the future weeks, representing an increase of around 32% from its present price levels, should the uptrend persist.

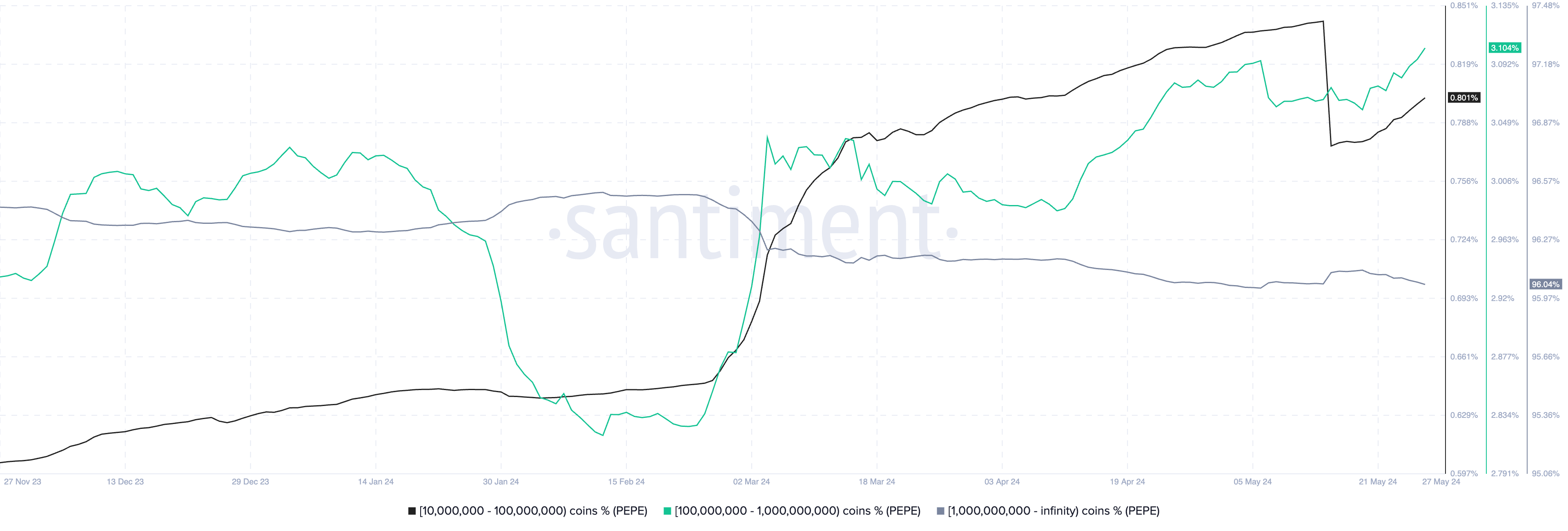

Wealthiest PEPE investors are divesting PEPE’s ongoing profit-taking activities provide additional support for the bearish technical outlook.

It is worth noting that the supply of PEPE held by entities with balances surpassing 1 billion tokens has decreased significantly during the market uptrend. This suggests that the prices of these “whales” have peaked locally. As a result, the quantity of PEPE that lesser investors currently hold has increased.

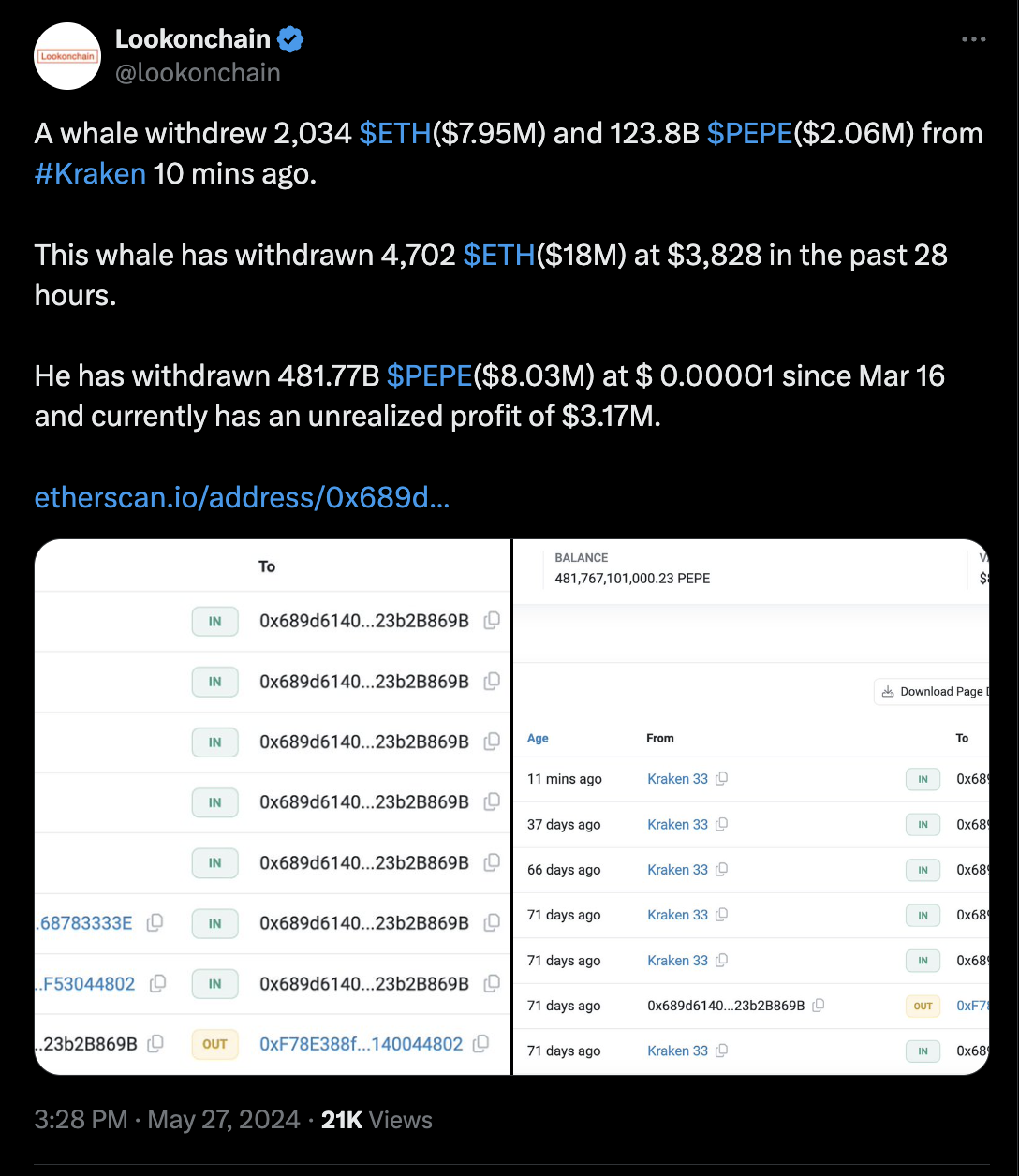

However, instances have arisen in which traders withdrew PEPE tokens worth millions of dollars from exchanges following the most recent surge, indicating that they wished to retain the memecoin rather than sell it at its current highs.

However, the effect of these withdrawals on overall whale supply data remains unknown, which increases the risk of PEPE’s June correction.