A major PEPE whale returns after two years, withdrawing 2T tokens from Binance and stirring buzz in the crypto market.

This unexpected event has sparked a new surge in interest in the meme coin, resulting in both price increases and increased trading volumes.

PEPE Trading Experiences a Surge in Activity as a Whale Transfers $29 Million in Tokens from Binance

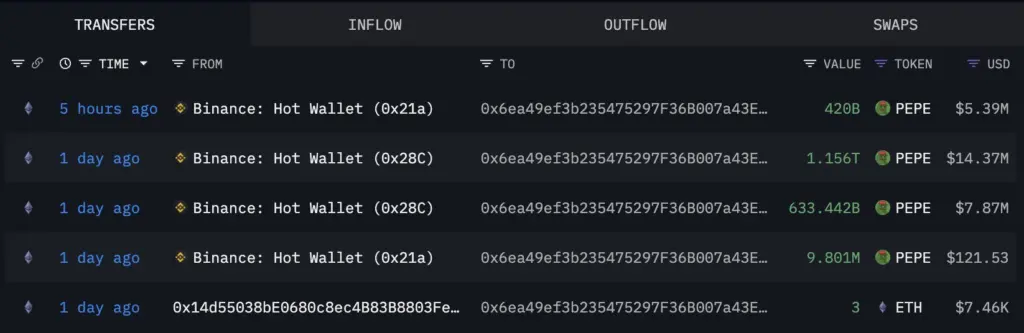

Lookonchain, a blockchain analytics firm, reported on May 17 that a whale initiated a significant transaction involving PEPE tokens. The investor transferred 1.79 trillion PEPE, equivalent to $22.23 million, from Binance to a newly activated wallet.

A day later, the whale withdrew an additional 420 billion PEPE tokens, which are estimated to be worth $5.39 million, from the crypto trading platform.

Consequently, the whale has successfully removed 2.21 trillion PEPE tokens, valued at $29 million, from Binance in two distinct transactions within 24 hours.

Binance’s PEPE reserves have been reduced by approximately 2% due to these actions, as noted by market observers.

The whale’s confidence in the token’s long-term value is indicated by the withdrawals, which are directed into self-custody wallets, which suggest a deliberate accumulation strategy. Typically, this conduct indicates a transition from short-term speculation to a buy-and-hold strategy.

In the interim, the whale’s return and the rapid accumulation of tokens were concurrent with a PEPE price rally.

The meme coin has experienced a 10% increase in the past 24 hours, as indicated by data, and is currently trading at $0.00001345. This represents an extraordinary 87.5% increase in the past month alone.

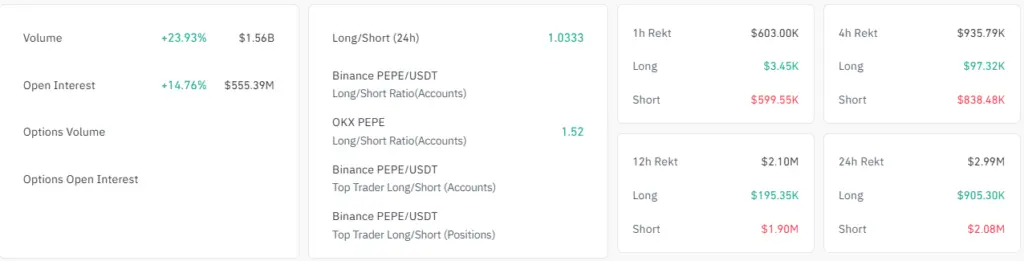

Additionally, the rally has significantly impacted the derivatives markets of digital assets.

Over the past 24 hours, approximately $2 million in liquidations were experienced by short positions that were wagering against PEPE’s price increase, according to CoinGlass data. Long traders also experienced losses of approximately $907,000.

Simultaneously, the open interest in PEPE futures increased by 15%, surpassing $500 million, a level that was last observed in January. Open interest is a metric frequently employed to assess market sentiment and trading activity, as it represents the aggregate value of active, unresolved futures contracts.

PEPE’s status as a premier digital asset is further solidified by this new surge of activity, which a significant investor is propelling. It also ranks the token as one of the volatile market’s most closely monitored meme coins.