In response to the increasing demand for Bitcoin from institutions and whales, Peter Brandt has established $125,000 as the target price of Bitcoin.

Every day, the Bitcoin price has set new records, suggesting that the market has a strong confidence level in the asset. Notably, this rally occurs in the context of increasing institutional interest and whale accumulation, which implies that the demand for BTC remains robust despite the recent rally. In contrast, Peter Brandt, a seasoned trader and market expert, has issued a bold prediction for Bitcoin (BTC) amid this, which has sparked additional market discussions.

Peter Brandt predicts that the price of Bitcoin will surpass $125,000

Investors’ attention has been drawn to the recent robust rally in the price of bitcoin. The institutional interest remained strong and expanded following Donald Trump’s election victory. This is particularly noteworthy. It is important to note that Trump has pledged to establish the United States as a crypto capital and has strongly supported Bitcoin during his campaigns.

Furthermore, he has recently stated, “We are going to do something great with crypto,” which suggests a competitive focus in the digital asset space. He also reiterated his commitment to establishing BTC as the strategic reserve of the United States.

Conversely, the robust inflow of US Spot Bitcoin ETFs in recent months also serves as evidence of institutional interest. The investment instrument has experienced a consistent increase in volume over the past few weeks, with BlackRock’s IBIT being the most significant contributor. On December 16, the US Spot BTC ETF experienced an aggregate inflow of $636.9 million, as indicated by Farside Investors data.

In the interim, this substantial inflow indicates that the asset was still viewed favorably by both Wall Street players and investors. Additionally, the recent on-chain data and the BTC price performance suggest a robust BTC demand, which could serve as an additional impetus for the rally in the days ahead. Amid this, veteran trader Peter Brandt has issued a bullish BTC forecast.

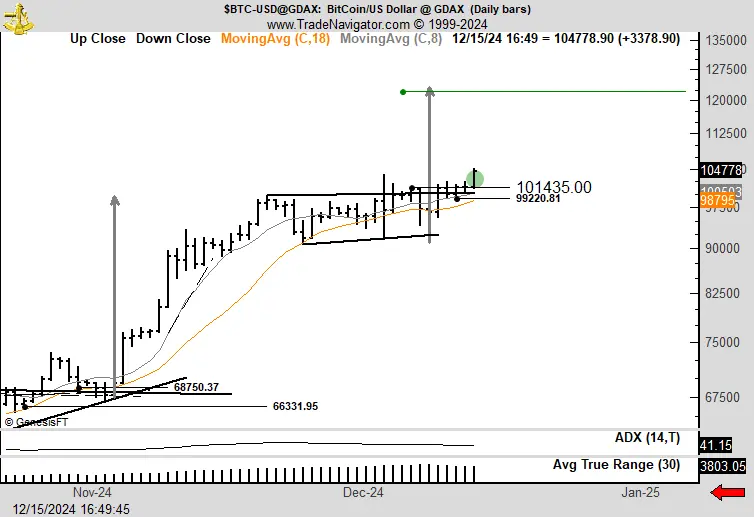

He has established $125,000 as the subsequent objective for BTC in a recent X post, during which he shared a price chart. Additionally, the expert expressed his high confidence in the flagship cryptocurrency, asserting that “everything else is a pretender.”

What is the future of Bitcoin?

BTC has experienced a substantial increase in value due to Donald Trump’s recent suggestion that BTC could serve as the United States’ strategic reserve and Peter Brandt’s audacious forecast. The most recent BTC price experienced a 2% increase from yesterday, reaching $106,729, and its trading volume increased by 25% to $79 billion.

It is worth noting that the cryptocurrency has recently reached an all-time high (ATH) of $107,780 within the past 24 hours, resulting in a monthly gain of nearly 18%. Additionally, the data from CoinGlass indicated that the open interest of BTC futures increased by 2%, implying a sustained surge in momentum in the future. Additionally, a Bitcoin price prediction suggests that the flagship cryptocurrency may experience a rally to $115,208 this month, which could elevate market sentiments.

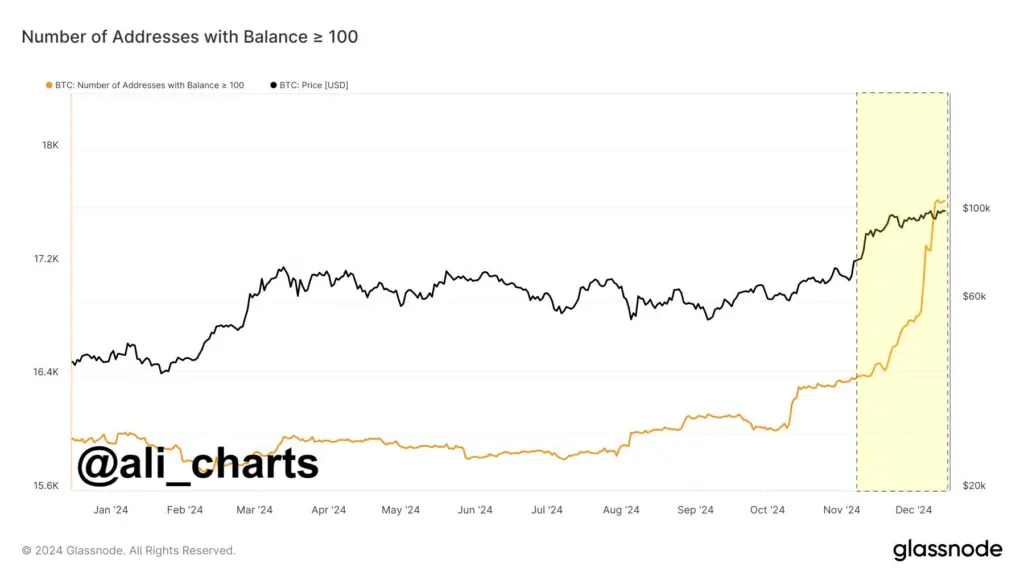

A prominent crypto market analyst, Ali Martinez, has recently emphasized the BTC whale trend. The “number of Bitcoin (BTC) whales on the network went parabolic ever since Donald Trump won the US presidential elections!” he stated in a recent X post. This demonstrates the increasing confidence of whales in the asset, which could lead to additional price increases in the future.

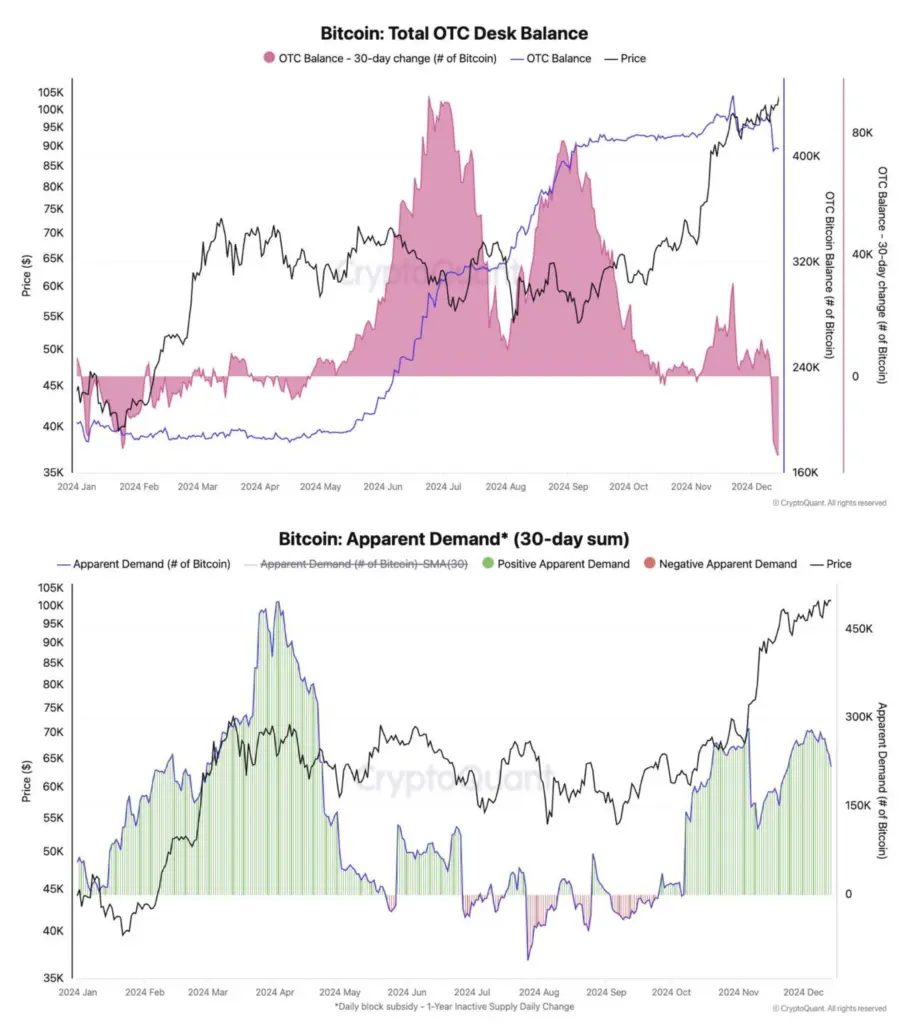

Furthermore, CrytoQuant, the foremost on-chain analytics firm, has recently identified a bullish trend. CryptoQuant stated in a recent X post that the demand for Bitcoin continues to exceed the supply as the price reaches its all-time high. Julio Moreno, the head of Research at the firm, stated that the highest monthly balance decline seen by BTC OTC Desks in 2024 is occurring in the face of increasing BTC demand. The balance has decreased by 40K BTC since November 20, suggesting a bullish trend in the future.