Peter Schiff calls Bitcoin a hedge, not a currency, as Chanos shorts MSTR and buys BTC to counter Saylor’s risk strategy.

A Bitcoin critic, Peter Schiff, has recognized the “first real use case” for Bitcoin. Peter Schiff, recognized for advocating gold over digital assets, has consistently maintained that Bitcoin is of no practical use.

Nevertheless, in a recent post on X, he cited a scenario involving investment manager Jim Chanos to illustrate how Bitcoin could fulfill a practical purpose.

Critiques of Peter Schiff’s Bitcoin Purchasing Strategy of Michael Saylor

In an X post, Peter Schiff, a Bitcoin critic, stated that Bitcoin may eventually have a purpose, albeit not the one that Bitcoin advocates uphold. He cited investor Jim Chanos, who recently disclosed that he acquired Bitcoin as a hedge against his short position in MicroStrategy stock (MSTR).

Executive Chairman Michael Saylor has presided over Strategy’s ongoing expansion of its Bitcoin portfolio. The company currently possesses approximately 570,000 Bitcoins. This has resulted in certain market observers considering MSTR as a proxy for Bitcoin with an additional layer of corporate risk. Saylor has “accidentally created a real use case for Bitcoin,” according to Schiff, who mocked this strategy. Investors utilize BTC to safeguard themselves from the risks associated with Saylor’s firm.

Chanos, an investment manager, is recognized for his practice of shorting securities of companies that he believes are structurally weak or overvalued. He is reportedly of the opinion that MSTR is overleveraged as a result of its Bitcoin strategy, similar to Peter Schiff. Chanos intends to mitigate losses if Bitcoin prices increase by shorting MSTR and owning Bitcoin.

Chanos Places a Bet Against MicroStrategy’s Valuation

Chanos elucidated in an X post that investors are paying an excessive amount for each dollar of Bitcoin exposure through Strategy. As per his statement, MSTR stock is currently trading at a premium significantly greater than its Bitcoin holdings’ actual value. He contended,

“Investors are paying $3 of stock price to gain $1 of Bitcoin exposure.”

Chanos’s hedge strategy suggests that his Bitcoin could mitigate the losses from MSTR’s stock’s overvaluation.

Additionally, Strategy has been criticized for borrowing funds to acquire Bitcoin. The company recently acquired 13,390 BTC for an estimated $1.34 billion. The concerns of Bitcoin critic Peter Schiff have been reiterated, as he has stated that substantial declines in the price of Bitcoin could transform paper profits into genuine financial strain for Strategy.

Schiff contended that Strategy is no longer functioning as a software company but as a Bitcoin-holding entity. He questioned the rationale behind purchasing shares of a company whose primary business activity is the acquisition of Bitcoin, as opposed to investing directly in Bitcoin or companies with actual operating revenues. He stated,

“If you want to buy Bitcoin, then buy Bitcoin. If you want to invest in the stock market, buy a company with an actual business.”

Despite this backlash, pro-XRP lawyer John Deaton has praised Michael Saylor, equating his long-term Bitcoin strategy to Warren Buffett’s investment approach with Berkshire Hathaway. Despite the ridicule, he suggested that Saylor may be striving to maintain control over up to 5% of the total Bitcoin supply in circulation.

Stock Performance of MicroStrategy (MSTR)

In 2025, the stock of MicroStrategy (MSTR) increased by nearly 40%, indicative of the upward trajectory of Bitcoin. Nevertheless, Peter Schiff contends that this expansion is more closely associated with the fluctuations in the price of Bitcoin than with the company’s fundamental business operations. This has raised concerns regarding Bitcoin’s sustainability if it undergoes a correction phase.

Nevertheless, the recent acquisitions by Metaplanet and Twenty One Shares, a company funded by Tether, have increased the likelihood that the Bitcoin price will surpass the resistance and reach a new all-time high.

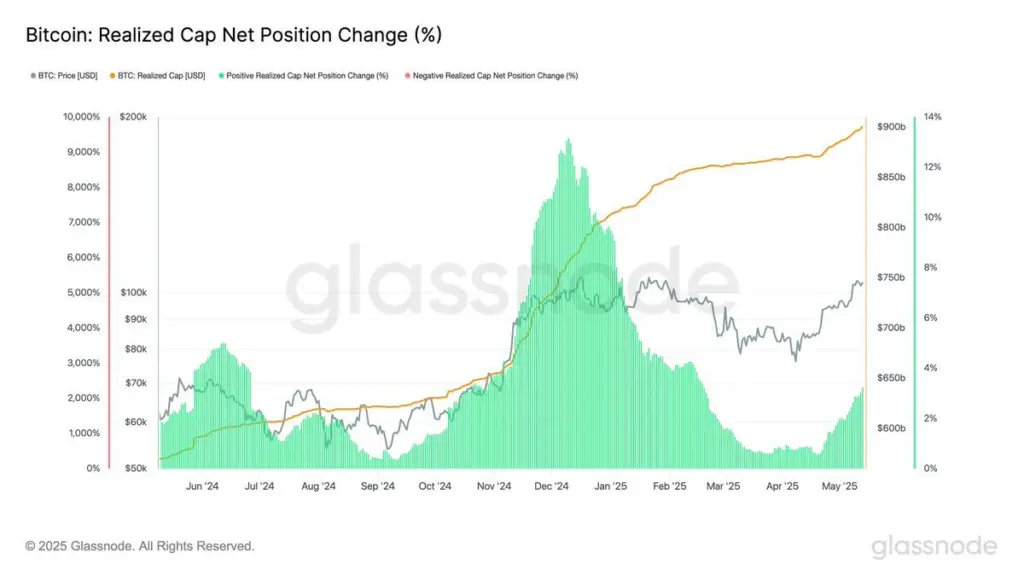

The Bitcoin market is currently in a state of price consolidation, with a range of $100,678 to $105,700. Analysts anticipate a potential breakout if the BTC price remains above critical prices. Since April 20, the realized capitalization of Bitcoin has increased by $30 billion, according to Glassnode data. This indicates that new capital is entering the market, a precursor to a bullish breakout.