Peter Schiff regrets not buying Bitcoin in 2010, as long-term holders see huge profits from BTC’s recent surge to $110K.

A seasoned Bitcoin critic, Peter Schiff, has recently expressed a surprising sense of remorse regarding the cryptocurrency. The gold advocate, who has consistently expressed doubt regarding the long-term value of Bitcoin, acknowledged that he now regrets not purchasing it when he first became aware of it. Schiff’s remarks were made after Bitcoin’s substantial price increase, which captivated the attention of both advocates and detractors.

Peter Schiff Acknowledges the Missed Opportunity of Bitcoin

Peter Schiff has consistently advocated for gold as the preferable store of value, frequently dismissing Bitcoin as a speculative asset.

Nevertheless, in a recent X post, Schiff admitted that his greatest regret concerning Bitcoin was not purchasing it when he first encountered it. “I regret not purchasing it when I first became aware of it,” he stated, indicating a change in his perspective despite his ongoing apprehension regarding the cryptocurrency’s future.

Schiff’s comments were in response to a significant increase in the price of Bitcoin (BTC) that exceeded $110,000. However, the prevailing sentiment is that the cryptocurrency has the potential to return to its all-time high. Schiff’s most recent statements suggest that he is beginning to comprehend the volatility of Bitcoin and its unforeseen market fluctuations despite his previous skepticism.

Max Keiser’s Comments regarding Bitcoin and Peter Schiff

Max Keiser, an American filmmaker, and Bitcoin evangelist has been one of the most vocal critics of Peter Schiff with respect to his stance on BTC. Keiser, who has been a proponent of Bitcoin for a long time, responded to Schiff’s most recent statements by poking fun at the opportunities that the gold proponent had wasted. Keiser emphasized that he had advised Schiff to purchase Bitcoin at significantly lower prices, such as $1, $10, $100, and $10,000.

The American filmmaker was forthright in his assessment of Schiff’s decision to dismiss BTC. He referred to Schiff as the “WORST MONEY MANAGER EVER!” and made fun of his decision to establish a bank in Puerto Rico on X.

Nevertheless, Schiff maintains his conviction that gold is the more dependable and stable asset despite publicly expressing regret for not investing in BTC earlier. Schiff acknowledged the Bitcoin price surge yesterday but remained steadfast in his belief that Bitcoin’s volatility renders it an unreliable store of value compared to gold.

Bitcoin’s Unexpected Price Increase and Expanding Profits

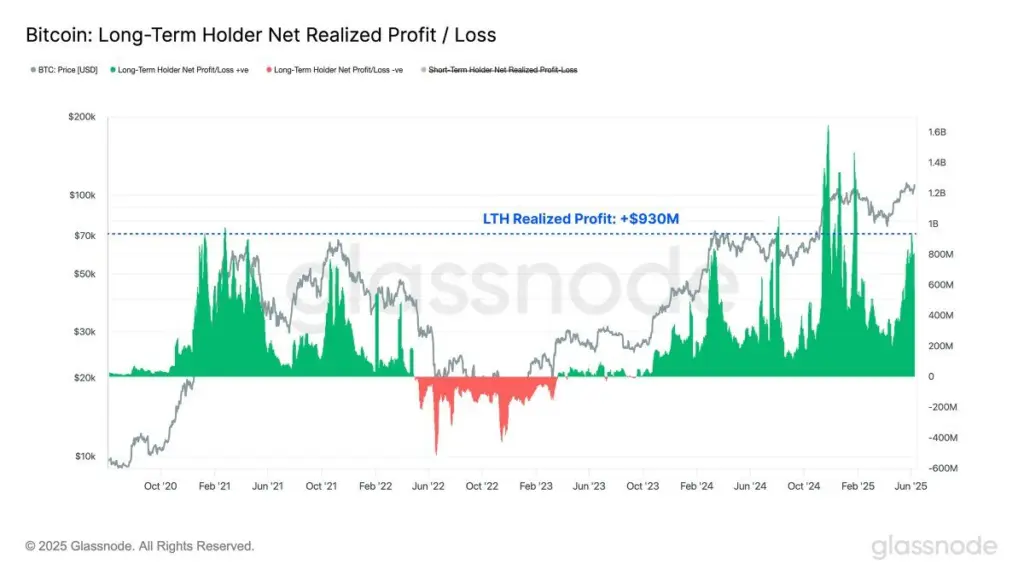

The recent increase in the price of Bitcoin (BTC) has elicited substantial responses from the cryptocurrency community, with numerous individuals observing the increasing profits that long-term holders are achieving. A “unique dynamic” has emerged in this Bitcoin cycle, as indicated by data from Glassnode.

While simultaneously increasing their Bitcoin holdings, long-term holders (LTHs) are achieving unprecedented profits. The data indicated that Bitcoin’s profitability has experienced a substantial increase, with a net realized profit per day of $930 million.

Glassnode has also observed an unusual phenomenon: the long-term holder supply is increasing even though realization occurs in vast profits. This trend has been substantially influenced by the accumulation of ETFs, which has also sparked interest in BTC among institutional investors.

This group of long-term holders accumulates Bitcoin despite the increasing profitability, a phenomenon that has never been observed in the history of the market cycle.