On Tuesday, Polygon’s price experienced a modest increase as the crypto fear and greed index returned to the greed zone

Polygon (POL), a top-tier layer-2 network, reached a high of $0.3340, a 10% increase from its lowest point this month. It is still 25% below its zenith in September, when it transitioned from MATIC to POL.

The recovery of Polygon was concurrent with the enhancement of on-chain data. The network’s transaction volume increased significantly from the low of 2.3 million in September to 3.1 million on Monday, as reported by PolygonScan.

The number of distinct addresses on the network increased by 190,000 from the previous day, reaching 470 million, as indicated by additional data. The utilization of the Polygon PoS chain also increased marginally, reaching 49%.

Polymarket, a prediction market platform that has garnered popularity, has significantly contributed to Polygon’s status as a key player in the blockchain industry. The network’s greatest prediction market is reported to have assets exceeding $2.6 billion, according to our data.

The trading volume of DeFi Llama Polymarket increased significantly from $533 million in the previous month to over $2.08 billion in October, according to data. Its 24-hour trading volume exceeded $118 million, a trend that may persist in the days ahead.

In order to engage in trading, users must deposit USD Coin (USDC) on Polygon’s network, which is the platform on which Polymarket operates.

Nevertheless, additional data indicates that the Polygon network has experienced a decline in market share in critical sectors of the blockchain industry. For instance, it is the third-largest layer-2 network, following Base and Arbitrum, with a total value of over $1.12 billion that is sealed in the decentralized finance industry.

Polygon has also experienced a decline in its market share within the decentralized exchange industry. In October, its DEX volume was $5.1 billion, which is significantly lower than that of Base ($25 billion) and Arbitrum ($15 billion).

This decline is particularly noteworthy due to the fact that Polygon was one of the first mainstream layer-2 networks.

Polygon is making an effort to recuperate

The Polygon token reached its lowest point of $0.3050 on Oct. 25 and has since rebounded to $0.3330, its highest level since that date, as indicated by the 4-hour chart.

It continues to be below the 50-period and 25-period Exponential Moving Averages, as well as the 23.6% Fibonacci retracement level.

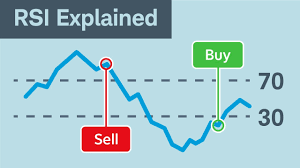

A bullish crossover pattern has been established between the two lines of the MACD indicator, which is a frequently observed bullish signal. Furthermore, the Relative Strength Index has reached the neutral level of 50 and is currently trending upward.

Consequently, it is probable that Polygon’s price will continue to increase as bulls pursue the 50% retracement level at $0.3750.