Here is how predictive trading bots are reshaping crypto in 2025, as they now dominate markets, outpacing humans with unmatched speed, precision, and profit.

- 1 Introduction

- 2 What Are Predictive Trading Bots?

- 3 The Rise of Predictive Trading Bots in 2025

- 4 How AI Predicts the Markets

- 5 Use Case Spotlight: Blockchain-Based Nations and AI Trading

- 6 Regulation and Transparency in the Age of Autonomous Trading

- 7 Conclusion: The Algorithm Is the New Alpha

- 8 Frequently Asked Questions (FAQs)

Introduction

From human intuition to machine prediction, the evolution of crypto trading has entered a new chapter. In 2025, the markets no longer sleep, and neither do their most efficient participants.

Welcome to the era of predictive trading bots, autonomous algorithms designed to analyze vast datasets in real time and execute high-frequency trades with astonishing precision.

Predictive trading bots are artificial intelligence systems that leverage machine learning, statistical modeling, and blockchain-native data to forecast short- and long-term asset price movements.

Unlike traditional bots that rely on static indicators, these models continuously learn and adapt. In today’s decentralized financial ecosystem, where token prices fluctuate by the second, they’re not just tools; they’re market movers.

These bots are particularly vital in blockchain-native economies, where transparency, programmability, and 24/7 market activity create an ideal playground for autonomous agents.

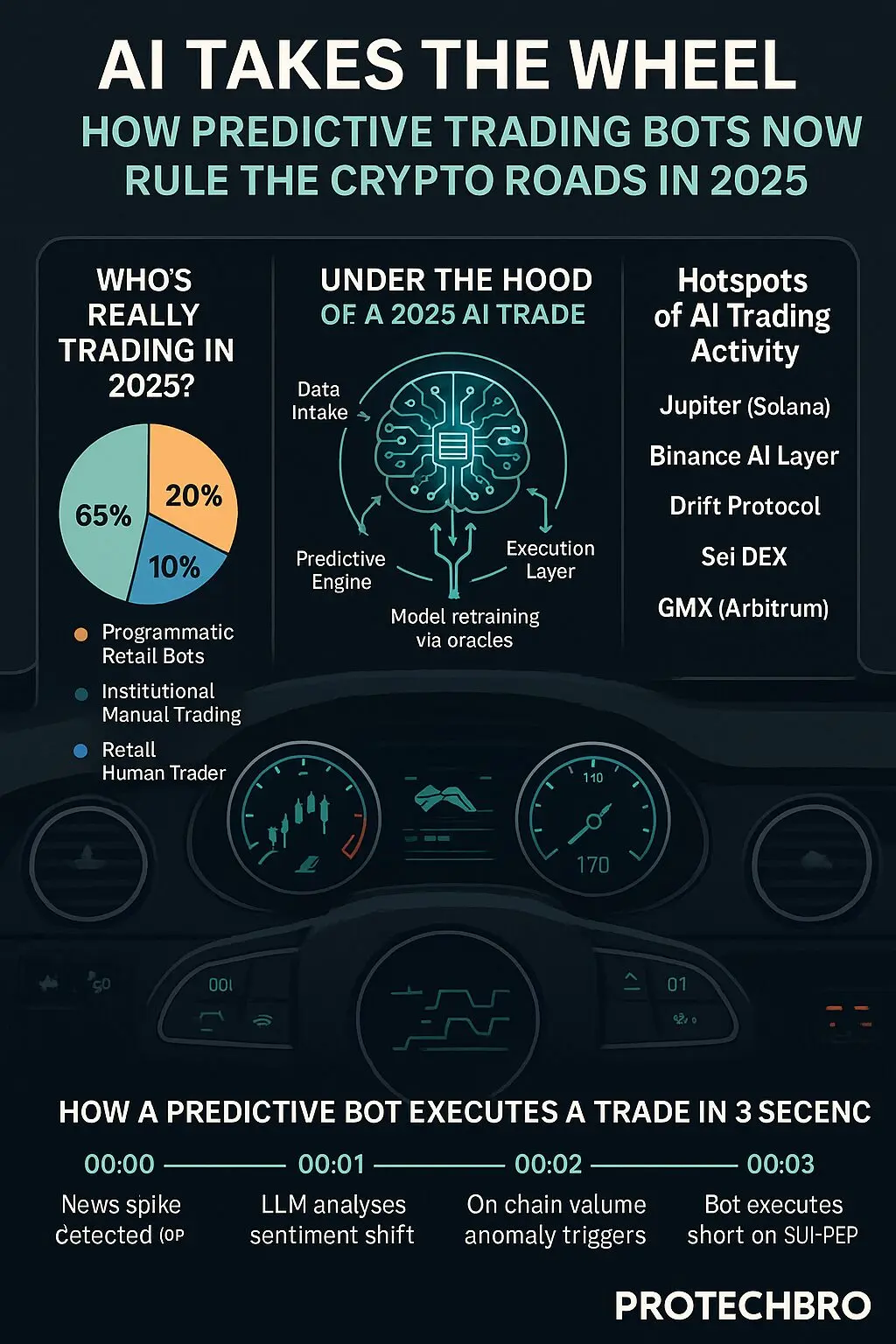

In 2025, over 72% of decentralized exchange (DEX) trading volume is influenced or initiated by predictive bots. From liquidity management on Ethereum rollups to MEV-optimized arbitrage across Solana and LayerZero, their reach is as broad as it is invisible.

So, what happens when instinct and experience are replaced by lines of code? When do milliseconds determine profitability?

As predictive trading bots redefine market efficiency, volatility, and even fairness, a new generation of traders must confront a fundamental question: in a world run by algorithms, is there still room for human edge?

What Are Predictive Trading Bots?

In 2025, predictive trading bots are sophisticated AI-driven systems engineered to forecast market movements and autonomously execute trades across both centralized and decentralized exchanges.

Unlike older rule-based bots that reacted to market conditions, predictive trading bots anticipate them, often seconds or even minutes before the rest of the market reacts.

These systems are trained on vast datasets including historical price action, blockchain analytics, on-chain sentiment, macroeconomic indicators, and even social media discourse.

At their core, predictive trading bots consist of four primary components:

- Data Ingestion Pipelines: These bots stream terabytes of data from live exchange order books, blockchain nodes, Twitter/X sentiment feeds, Telegram trading groups, and even GitHub repositories. Using tools like Kafka, The Graph, and Chainlink OCR, they normalize this data in real time.

- Model Training Engines: Leveraging cloud GPUs and on-chain compute layers, predictive trading bots use supervised learning and fine-tuned transformers to detect patterns across asset classes. In 2025, most bots retrain their models every 12–24 hours to remain responsive to regime changes in market structure.

- Sentiment Analysis Modules: These systems decode collective trader psychology by scraping community chatter from dYdX governance forums, Discord DAO channels, and LayerZero bridge activity. NLP-enhanced models score market sentiment, allowing bots to front-run narrative shifts, such as a token about to trend due to an airdrop announcement or partnership leak.

- Automated Execution Layer: Once a signal is confirmed, the bot executes trades through optimized smart contract routes or via API integrations on centralized platforms. Execution algorithms consider slippage, gas fees, MEV risk, and cross-chain latency to maximize profit per trade.

Various types of predictive trading bots are in use today. Large Language Model (LLM)-powered bots like those based on GPT-5 derivatives specialize in narrative detection and speculative momentum.

Reinforcement learning agents continuously refine their strategies based on real-time feedback loops, ideal for volatile memecoin environments.

Hybrid quant models, meanwhile, blend econometric indicators with deep learning, offering balance across high-frequency, swing, and macro positions.

As of mid-2025, predictive trading bots dominate liquidity provision and market-making activities on Binance, dYdX, Jupiter, and Scroll DEXs. On Binance, AI-driven bots account for roughly 48% of altcoin volume.

Jupiter, Solana’s flagship aggregator, sees over 60% of routing activity optimized by bot heuristics, particularly during volatile NFT drops and token unlock events.

In this age of algorithmic supremacy, predictive trading bots have become the invisible architects of market movement. Their strategic precision and execution speed aren’t just reshaping the trader’s role; they’re redefining the very structure of modern crypto markets.

The Rise of Predictive Trading Bots in 2025

What began as experimental code in 2020 has become a dominant force in today’s crypto markets. Predictive trading bots, once the domain of quant-savvy developers and black-box hedge funds, are now the primary drivers of market activity.

In just five years, the crypto ecosystem has transitioned from human-led intuition to machine-dominated precision.

The adoption curve steepened sharply between 2022 and 2024, fueled by advancements in decentralized AI infrastructure and composable DeFi protocols. By mid-2025, over 65% of all spot and derivatives trading, both on centralized platforms and across decentralized exchanges (DEXs), is initiated by AI-driven bots.

These predictive trading bots operate with machine-speed reflexes, scanning multiple chains and liquidity pools simultaneously to identify and exploit arbitrage, momentum shifts, and narrative volatility.

Solana and SUI stand as the most active playgrounds for this evolution. Daily bot-driven trading volume on their respective DEXs consistently exceeds $3 billion, with over 70% of volume routed via automated strategies.

On SUI, predictive trading bots integrate directly with AI oracles and Layer-1 mempools, enabling them to react to whale transactions and governance proposals before they fully propagate through the network.

The rise of predictive trading bots can be attributed to three key forces:

- Real-time, composable data: On-chain activity is now streamed with sub-second latency thanks to modular indexers and oracle services. Bots can process wallet behaviors, liquidity shifts, and NFT trades as they happen, allowing predictive models to front-run market shifts.

- Decentralized identity (DID) integration: Predictive trading bots can now profile traders and DAOs using DID frameworks. This allows bots to distinguish between novice users, whales, and known arbitrageurs, adapting strategies accordingly.

- Perpetual inefficiency: Crypto markets are global, fragmented, and operate 24/7. Unlike traditional finance, no closing bell exists. These conditions create persistent inefficiencies that predictive trading bots are uniquely equipped to exploit, especially during low-liquidity hours or high-emotion events like token unlocks and exploit news.

In 2025, predictive trading bots are not just reacting; they’re anticipating. Their ability to synthesize vast data flows, interact with smart contracts autonomously, and evolve through reinforcement loops has made them indispensable to the crypto economy.

What started as a niche tool is now the new norm, defining the tempo, volume, and volatility of the markets they inhabit.

How AI Predicts the Markets

Predictive trading bots operate like digital super-intelligences, trained to anticipate rather than merely respond. Their core advantage lies in data diversity.

In 2025, these bots aren’t just fed historical price charts; they absorb multi-modal data inputs, including Twitter/X sentiment shifts, Reddit thread virality metrics, Telegram influencer signals, and even GitHub commit histories tied to key protocol upgrades. The goal: detect actionable alpha before the rest of the market blinks.

Through fine-tuned transformer architectures and temporal graph networks, predictive trading bots analyze token-specific narratives in real time. A sudden spike in GitHub activity tied to an obscure Layer 2 often precedes speculative runs.

Bots trained on such patterns deploy liquidity before humans recognize the signal. Combined with NLP pipelines parsing FOMC minutes and CPI releases, these models adjust positions ahead of macroeconomic shifts, effectively turning global news into trade triggers.

Transparency is also evolving. Many 2025 bots utilize zero-knowledge AI proofs (zk-AIPs), which allow bot owners to prove performance or compliance without exposing proprietary logic.

For example, a DAO could verify its trading bot complies with ESG mandates without revealing trade logic—offering both trust and obfuscation.

The real-world applications of predictive trading bots now stretch far beyond crypto hedge funds. One standout: anticipating whale movements.

By analyzing wallet clustering, gas usage patterns, and unusual DEX activity, bots can detect when influential holders are preparing to buy, sell, or bridge assets across chains.

Similarly, bots are increasingly skilled at flagging rug-pull precursors, like sudden liquidity withdrawals, contract permission changes, or marketing hype with no underlying dev activity.

Perhaps most provocatively, predictive trading bots are now embedded in sovereign systems.

Use Case Spotlight: Blockchain-Based Nations and AI Trading

In the world’s first blockchain-native jurisdictions, predictive trading bots underpin a new form of economic governance.

These microstates, built on-chain, use AI-powered trading systems to manage public funds, stabilize national tokens, and optimize yield across stablecoin treasuries. Rather than a central bank, they operate sovereign liquidity protocols fine-tuned by real-time bot analytics.

One prominent example is tax revenue optimization: as citizens pay taxes in stablecoins, predictive bots dynamically allocate those assets into DeFi protocols, maximizing APY while minimizing exposure.

Bots rebalance positions daily based on market forecasts and rate volatility, ensuring that public services are funded with precision.

Even more radical is the concept of citizens-as-nodes. National UBI systems in these digital nations are increasingly managed through AI rebalancing bots.

Each citizen’s wallet is algorithmically adjusted based on a portfolio strategy set by community DAOs. Predictive trading bots determine allocation between inflation-protected assets, governance tokens, and speculative growth plays.

But these advances invite ethical tension. Who owns the logic that governs a nation’s financial destiny? Is it the dev team that wrote the model, the DAO that deployed it, or the blockchain that enforces it?

Predictive trading bots have become more than tools; they are economic actors, shaping destinies at scale. As they evolve, the need for accountable, auditable intelligence becomes as critical as the trades they place.

Winners and Losers: Who Gains from Bot Domination?

The proliferation of predictive trading bots in 2025 has created both windfalls and fractures across the crypto economy. For some, these bots represent empowerment; for others, disruption.

On the winning side, retail users are seeing unprecedented access to alpha through copy-trading platforms. Services on Binance, dYdX, and Jupiter now allow users to mirror predictive trading bots with a single click, often with adjustable risk settings. This has democratized access to once-exclusive strategies, narrowing the performance gap between institutional and individual participants.

Another clear benefit: liquidity provisioning has reached new heights. Predictive trading bots constantly rebalance LP positions across DEXs, reducing slippage and tightening spreads. On Solana, 24/7 bot-managed liquidity accounts for over 80% of stablecoin and blue-chip token trading volume, leading to smoother price discovery and reduced impermanent loss for passive LPs.

But there are losers too. Human discretionary traders — once the heart of crypto Twitter’s influencer economy — are increasingly marginalized. As predictive trading bots outperform in both speed and accuracy, many manual traders find themselves priced out or front-run by milliseconds.

Moreover, predictive trading bots are not immune to failure. Flash crashes, like the March 2025 incident on Polygon where a misconfigured bot triggered a 17% dump in under 60 seconds, reveal the fragility of algorithmic dominance. When multiple bots react to a single anomaly, feedback loops can spiral into systemic risk.

Perhaps most concerning is the growing concentration of AI trading power. A handful of VC-funded labs and protocol teams control the majority of top-performing predictive trading bots. These entities often operate with opaque governance, raising concerns about information asymmetry, market manipulation, and centralized influence in a supposedly decentralized ecosystem.

Regulation and Transparency in the Age of Autonomous Trading

As predictive trading bots shape trillions in volume, the question of oversight has become urgent. In 2025, regulatory debates are no longer focused on banning bots; they’re centered on how to ensure explainability and fairness in their behavior.

DAO-based regulators, such as those on Arbitrum’s Open Governance Council, are pioneering frameworks for “explainable AI” (XAI) in DeFi.

Proposals now require bots operating above certain volume thresholds to publish proof of model intent, detailing what kind of data influences decisions and under what parameters trades are executed.

Public model registries are emerging as a cornerstone of this new compliance layer. On chains like Arbitrum and Polygon, smart contract registries list verified predictive trading bots along with metadata including performance history, risk profiles, and zk-proof attestations of non-manipulative behavior.

These registries act as both audit trails and reputational anchors in an increasingly bot-governed landscape.

As predictive trading bots become economic actors, not just tools, the push for transparency is existential.

In the age of autonomous trading, it’s no longer just about whether a bot wins or loses; it’s about whether the system remains fair, auditable, and resilient to the very intelligence it has unleashed.

The Future: Decentralized Predictive Bots and Composable Finance

As we look beyond 2025, predictive trading bots are not just becoming smarter; they’re becoming decentralized.

The monolithic, closed-source trading systems of today are giving way to open-source bot templates hosted on GitHub and deployed by DAOs, indie devs, and even retail investors.

This decentralization mirrors the broader Web3 ethos: anyone can fork, fine-tune, and deploy their own AI-powered trader with a few lines of code and a liquidity grant.

The future of predictive trading bots is inherently modular. Through the DeFi “money Lego” design philosophy, these bots are increasingly composable, plugging directly into yield farms, perpetual DEXs, NFT marketplaces, and stablecoin vaults.

Imagine a predictive bot that monitors NFT floor prices on Blur, detects early buy pressure, and auto-leverages long positions on a linked perp DEX, all executed autonomously through smart contract hooks.

Composability is turbocharging experimentation. Already, developer collectives on Arbitrum and zkSync are releasing AI middleware layers, mini-modules that can be chained into existing bots to enhance specific functions like volatility detection or real-time liquidity migration.

These plug-ins function like DeFi APIs for intelligence, allowing predictive trading bots to adapt to rapidly shifting protocols and markets without being fully retrained.

On the innovation frontier, swarm-based trading agents are gaining momentum. Rather than one central AI, these systems deploy dozens, or even hundreds, of lightweight predictive bots that specialize in niche strategies: microcap detection, MEV sniping, gas arbitrage, or social sentiment momentum.

The swarm coordinates via shared on-chain memory and reinforcement loops, allowing it to outperform monolithic models through collective intelligence.

Another emerging trend: bot-vs-bot combat leagues. Built on-chain with transparent rules, these arenas pit predictive trading bots against each other in isolated market simulations.

DAOs sponsor bots, speculators bet on outcomes, and developers earn bounties for optimal design. These leagues act as both entertainment and research incubators, accelerating the development of more robust models in adversarial environments.

Predictive trading bots are evolving from financial tools into decentralized financial agents. As open infrastructure, composable AI layers, and community-driven governance converge, we’re witnessing the rise of a permissionless AI trading ecosystem, one where anyone, anywhere, can deploy intelligence into the market itself.

In this world, the future of finance isn’t just automated, it’s programmable, remixable, and profoundly decentralized.

Conclusion: The Algorithm Is the New Alpha

In just half a decade, predictive trading bots have reshaped the DNA of crypto markets. What began as an experimental upgrade to retail trading has evolved into a full-scale AI revolution, redefining liquidity, price discovery, and the very notion of market participation.

These bots now drive the majority of trading volume across Solana, SUI, Ethereum, and beyond, exploiting inefficiencies with machine-speed precision and adapting to volatility before most traders even notice the shift.

But the rise of predictive trading bots is about more than just market gains. As blockchain-native nations architect programmable economies, these bots are being woven into the core of governance and financial infrastructure.

They’re not just parsing charts; they’re managing public treasuries, distributing universal basic income, and shaping monetary policy. In this new paradigm, bots are no longer just tools. They’re economic citizens.

And as digital identity systems mature, the line between human and algorithm begins to blur. Your wallet interacts with DeFi on your behalf. Your preferences train models that trade your assets. Your digital twin, encoded in prompts and portfolio heuristics, might already be out-trading you.

So the final question isn’t whether predictive trading bots have taken over, it’s what role you’ll play in their world. In a future where citizenship is code and capital flows through autonomous agents, will your portfolio still be yours… or will it belong to the intelligence that manages it?

Frequently Asked Questions (FAQs)

What are predictive trading bots?

AI-powered software that analyzes market data to predict future price movements and execute trades automatically.

Are predictive trading bots legal?

Yes, though regulations vary by country and blockchain jurisdiction.

Can retail investors use predictive trading bots?

Absolutely. Many platforms offer accessible bots or copy-trading features for everyday users.

How accurate are predictive trading bots in 2025?

Some bots claim 70%+ predictive accuracy in short-term trades, though results vary widely.

Do predictive bots work on decentralized exchanges?

Yes. Many bots now operate seamlessly across DEXs like Uniswap, Jupiter, and Drift Protocol.