Solana-based memecoin platform Pump.fun is facing a $5.5 billion class-action lawsuit, alleging it operates an unlicensed casino.

Pump.fun, a memecoin platform based on Solana, is currently the subject of a consolidated class action lawsuit. The lawsuit alleges that the platform operates an unlawful “Meme Coin Casino,” resulting in estimated losses of $4 billion to $5.5 billion for retail traders and generating over $722 million in revenue.

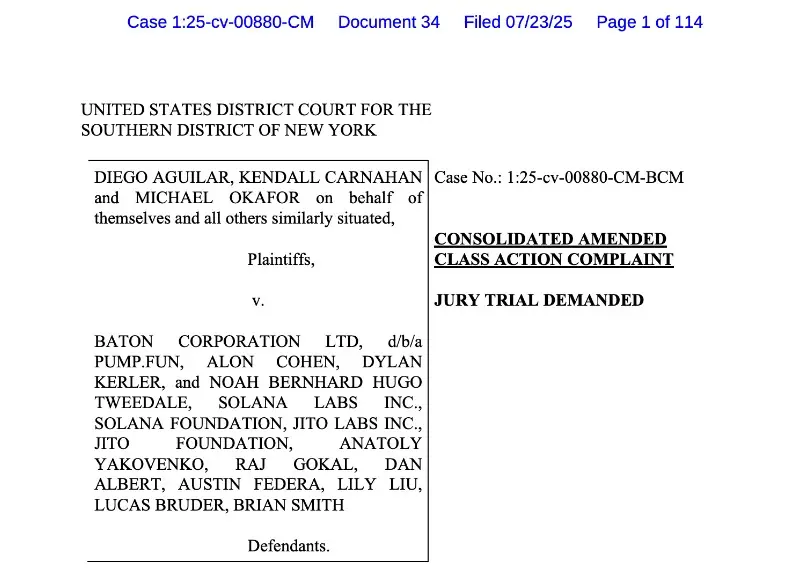

The lawsuit, which was filed in the United States District Court for the Southern District of New York, is directed at the Pump. Fun operator, Baton Corporation; its founders Alon Cohen, Dylan Kerler, and Noah Bernhard Hugo Tweedale, and executives from Solana Labs, the Solana Foundation, and Jito Labs.

Supposed Criminal Enterprise

The plaintiffs, Diego Aguilar, Kendall Carnahan, and Michael Okafor, contend that the defendants have established a “Pump Enterprise” as a coordinated racketeering conspiracy violating the Racketeer Influenced and Corrupt Organizations Act.

The complaint refers to Pump. fun as the “front-facing slot machine cabinet” where users deposit SOL currency to receive unpredictable token outcomes.

The platform allows juveniles to participate in speculative trading without requiring age verification or Know Your Customer (KYC) screening.

Jito Labs is accused of “rigging the games” by monitoring profitable transactions and dispatching them to the highest bidders through Maximal Extractable Value bundling.

Solana Labs and the Solana Foundation purportedly provide the blockchain infrastructure, which monetizes each wager by selling block space and validator fees.

The lawsuit alleges that the enterprise allowed insider front-running through Jito bundles while promoting a deceptive “fair launch” narrative.

The platform is also accused of facilitating intellectual property theft, which includes issuing tokens that imitate publicly traded companies such as Apple, Tesla, and Meta, as well as celebrity names, without authorization.

Pump.fun was purportedly employed by the Lazarus Group, a sanctioned cybercrime unit, to launder $1.08 million from cryptocurrency theft.

Platform’s Financial Success Built on User Losses and Regulatory Violations

Pump.fun was accused of extracting $741 million in fees from users since May 2024, per a report that Cryptonews covered earlier in June. The company was charged with selling approximately 4.1 million SOL tokens through the Kraken exchange.

Meanwhile, profits exceeding $10,000 have not been realized by 99.6% of its 13.55 million trader addresses.

The platform recently implemented a 0.05% revenue-sharing model for token creators and collects a 1% transaction fee on every trade.

According to court documents, pump.fun generated more than $400 million in fee revenue from the purported wagering enterprise in 2024. Jito Labs has become one of the most profitable entities in the Solana ecosystem, having collected over $633 million in user-paid gratuities.

The company constructed the ” Jito-Solana Block Engine, ” which sells preferential block-inclusion rights and obtains MEV on behalf of Solana stakeholders.

By late 2024, SOL’s price had increased by more than 1,000% from its lows in 2022, resulting in a substantial financial gain for Solana Labs and the Solana Foundation.

Both entities generate substantial profits from expanding blockchain activity by managing substantial SOL reserves and operating validators.

The lawsuit specifies 20 specific “Pump Tokens” as unregistered securities, including StakeCoin, QuStream, DeepCore AI, and Apex AI.

These tokens were purportedly advertised as “real-world utility and value that are linked to the success of future projects” without the necessity of SEC registration or risk disclosures. When the tokens he had purchased collapsed, Michael Okafor, the lead plaintiff, suffered a loss of approximately $242,076.

The platform launches an estimated 27,305 new tokens daily and processes over $66 billion in cumulative trading volume.

Legal Battles Escalate as Token Launch Fails to Meet Expectations

In July 2025, Fun’s native PUMP token was introduced; however, it experienced a 30% decline within 24 hours from its pre-market peak of $0.0072 to $0.005 due to aggressive whale shorting.

The token has failed to meet the community’s expectations, losing nearly 50% of its value since its introduction.

During a recent livestream, Founder Alon Cohen affirmed that no immediate token airdrops are in the works. This news resulted in a 14% decline in PUMP over 24 hours.

The token is currently trading at $0.0031, and numerous presale investors have liquidated their positions due to losses exceeding $1 million.

In June 2025, the X platform suspended Pump.fun’s official and Cohen’s personal accounts, prompting concerns regarding potential SEC investigations or securities law violations. The platform has also been the subject of numerous lawsuits alleging violations of the sale of unregistered securities disguised as meme tokens.

LetsBonk, a competitor, has amassed a substantial market share, with a daily share of 44.87%, as opposed to Pump.fun’s 43.73%.

Plaintiffs seek class certification, compensatory damages, treble damages for RICO violations, the appointment of a federal equity receiver, and permanent injunctions to prohibit defendants from operating similar platforms without the necessary licenses and compliance controls.