Chainlink is still in the lead, but Pyth’s sharp increase in total value secured suggests that the dynamics of the oracle market are changing.

Despite being a long-standing dominant force in the oracle business, Chainlink, a decentralized provider, is seeing rising competition.

Pyth, a decentralized Oracle network, has experienced substantial growth through 2024. In just nine months, it increased its total value secured (TVS) from $98.4 million to $4.7 billion, a factor of 46.

Leading but losing market share is Chainlink.

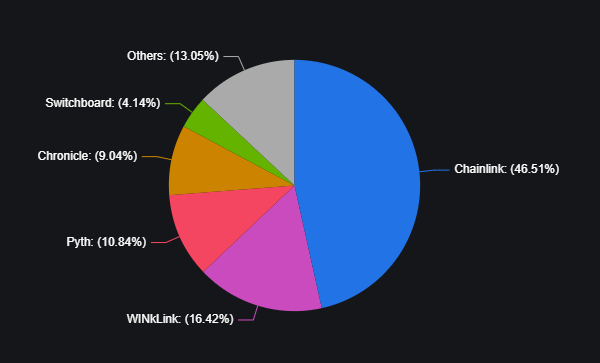

As of September, Chainlink is still the leading oracle supplier, with $20.1 billion across 404 chains and a 46.46% market share despite Pyth’s explosive rise.

On January 1, the Oracle market leader’s 48.64% market share shows a slight dip from its earlier position in the year.

Pyth’s expansion, Chainlink’s declining market share, and the arrival of new oracle providers are all contributing to the gradual erosion of Chainlink’s unchallenged dominance.

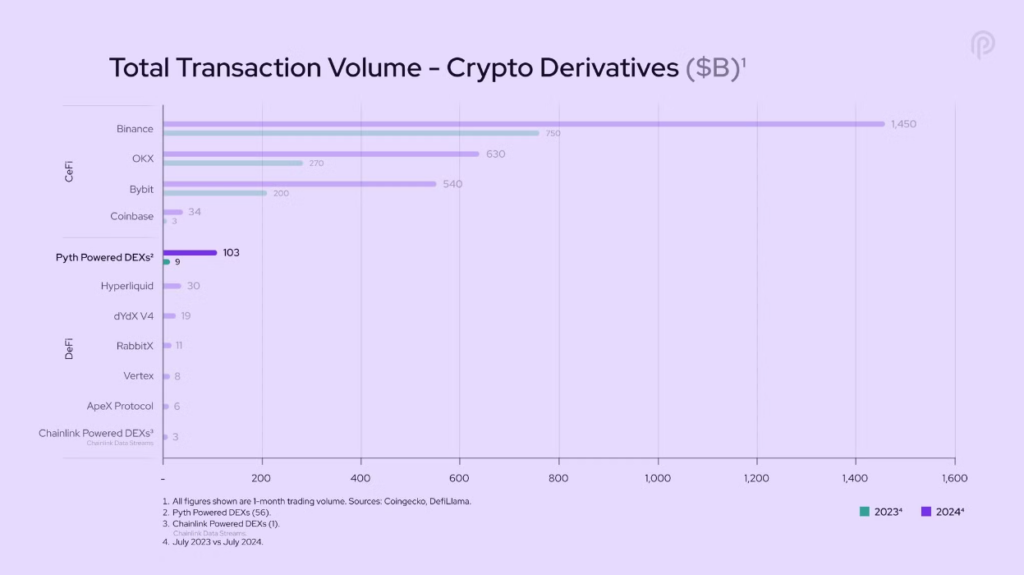

Pyth “leads all oracles, including Chainlink, by total trading volume facilitated as an oracle,” according to Michael Cahill, co-founder and CEO of Douro Labs, a key contributor to the Pyth network.

“Chainlink is leading in the world of lending protocols by total value secured (TVS, or oracle-powered TVL), and Pyth Network is the leader in derivatives volumes. To date, Pyth has secured over $800 billion in total traded volume on-chain.”

leading competitors in the Oracle market

After WINkLink, which has a market share of 16.47% and a TVS of $7.13 billion, Pyth is still in third position with a market share of 10.79% despite its notable rise.

Only two blockchains are supported by WINkLink: Tron and BNB Smart Chain. Despite this, the Tron ecosystem heavily relies on WINkLink, which accounts for its high TVS.

With a 9.05% market share and a TVS of $3.916 billion, Oracle provider Chronicle, which held a monopoly across the whole industry until late May 2019, trails Pyth in the rankings.

After Chainlink dethroned Chronicle in June 2020, the decentralized oracle network gradually lost its hegemony.

Co-founder of Chainlink is pro-oracle

Due to a technical issue, the values of some large-cap equities, such as Berkshire Hathaway, McDonald’s, and Wells Fargo, fell by as much as 99.9% on the New York Stock Exchange on June 3.

Following the incident, CEO and co-founder of Chainlink Sergey Nazarov reminded the public of the flaws in older financial systems.

According to Nazarov, at the time, Oracle networks could “mitigate” the hazards associated with these systems by “providing accurate, tamper-proof data.”