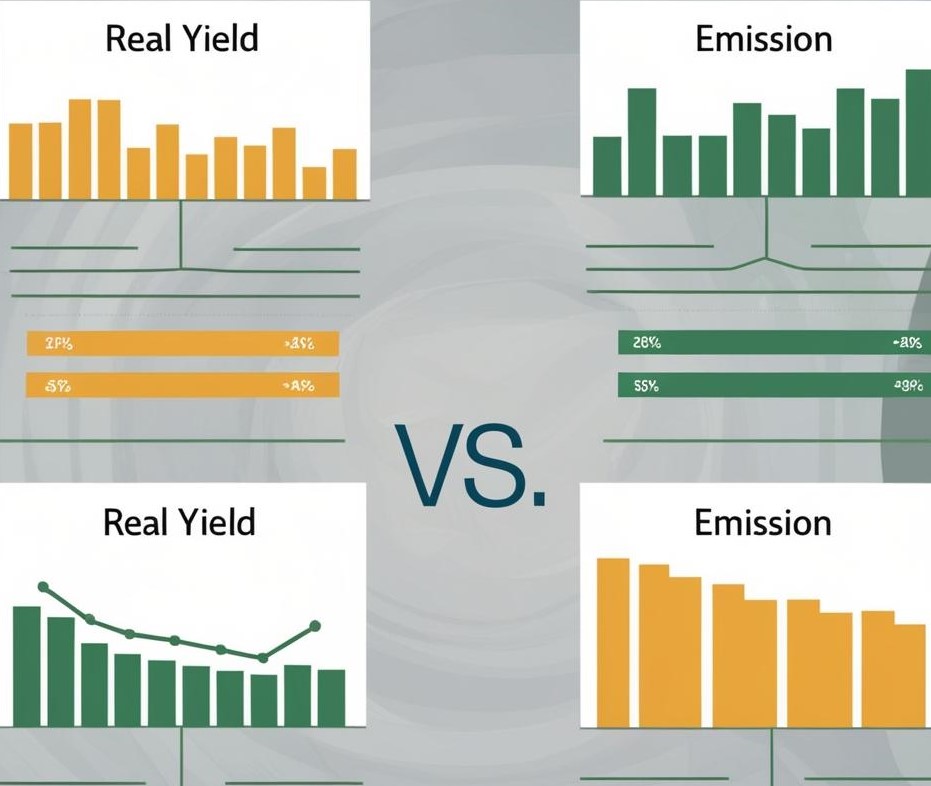

The comparison of real-yield and emission-based incentives reveals a significant shift in the DeFi landscape.

Let’s start by understanding incentives in DeFi protocols.

Table of Contents

Understanding Incentives in DeFi Protocols

Incentives are essential to decentralized finance (DeFi) protocols, acting as the key mechanism for driving user engagement, liquidity provision, and platform growth.

In the competitive, rapidly evolving DeFi ecosystem, these incentives are crucial because they attract participants who provide the liquidity and activity that many protocols require to function properly.

The Role of Incentives in DeFi

User Engagement and Participation

Incentives are an effective motivation for people to engage actively in DeFi ecosystems. Whether through staking, lending, or yield farming, incentives provide attractive rewards to participants, enticing both new and experienced users.

Protocols frequently utilize these incentives to set themselves apart from competitors, as higher returns attract more users and liquidity.

Liquidity Provision and Protocol Growth

DeFi protocols rely greatly on user-supplied liquidity. Liquidity pools, for example, enable users to earn rewards for lending their assets to the system.

These pools then supply the required liquidity for operations like trading and lending, thereby strengthening the broader ecosystem. Protocols that offer rewards ensure that they attract enough liquidity to operate and be viable, especially in their early stages.

Maintaining Long-Term Engagement

While initial incentives might swiftly draw users and liquidity, maintaining interest, in the long run, can be difficult.

As the DeFi sector matures, protocols must discover strategies to maintain their user base while preventing capital flight to other projects with larger incentives.

The emphasis on long-term incentives has resulted in the introduction of models such as real-yield, which aims at maintaining user engagement by offering rewards that align with actual revenue.

Evolution of Incentive Models in DeFi

In the early days of DeFi, emission-based incentives were dominant. Protocols would create and distribute new tokens to reward users for participating in various activities.

However, this model had a significant disadvantage: as more tokens were released, inflation rose, frequently lowering the token’s value over time. This left projects struggling to preserve the token’s value and user interest.

To address these limitations, DeFi protocols are progressively adopting real-yield incentives. Unlike emission-based models, which rely on newly minted tokens, real-yield models reward users based on the actual revenue created by the system.

This strategy links user rewards with the protocol’s long-term performance and financial health, resulting in a sustainable incentive structure that appeals to both investors and users.

Real yield is particularly significant in the current DeFi environment, where customers are more picky and want reliable, predictable returns backed by real value.

In the discussion of “Real-yield vs. Emission-based incentives,” it is critical to understand the underlying impact of each incentive model on DeFi protocol sustainability.

While emission-based incentives encourage rapid user acquisition, real-yield incentives provide a long-term stable alternative. Both models are changing how DeFi protocols work, emphasizing the need to align incentives with realistic, long-term value.

What are Emissions-Based Incentives?

Emission-based incentives are rewards offered to users by minting new tokens, frequently at regular intervals, to encourage user participation, staking, or liquidity provision.

This inflationary model is a common strategy for encouraging rapid adoption, as newly issued tokens serve as incentives for users to engage in protocol operations. Emission-based incentives are widely utilized in DeFi protocols, where projects aim to rapidly grow their user base and liquidity pool.

Advantages

Rapid Growth Potential: Emission-based incentives can fuel exponential growth, attracting users and liquidity providers quickly. With the promise of big profits, these incentives frequently attract a large number of participants in the early phases.

High Initial Liquidity Attraction: By rewarding participants with newly created tokens, protocols can quickly build the liquidity required to facilitate various DeFi activities like lending, borrowing, and yield farming. This extra liquidity improves the protocol’s stability and user experience.

Community Engagement: Emission-based incentives can help protocols build a strong community of early adopters who are motivated to raise awareness and contribute to the ecosystem’s growth.

The disadvantages

Token Inflation: The inflationary nature of emission-based incentives causes a growth in the number of tokens, which can dilute their value over time. This inflation frequently results in unsustainable downward pressure on the token price, especially after initial interest fades.

Dependency on High Emissions: Emission-based models rely on constant high emissions to keep users engaged. If the benefits are reduced, users may transfer their funds to other platforms with higher incentives, resulting in a cycle of high emissions and high user attrition.

Capital Flight: As emission benefits diminish, users may remove their funds, potentially leaving the protocol with less liquidity and participation, disrupting long-term growth and stability.

Emission-based incentives can drive quick growth in a protocol’s early phases, but they face difficulties in maintaining long-term value due to inflation and reliance on continuous token emissions.

This model is a major factor in the “Real-yield vs Emission-based incentives” debate, which weighs the benefits of short-term liquidity appeal against long-term growth.

What Is the Real-Yield in DeFi?

Real-yield is a newer, sustainability-focused incentive model in DeFi, in which rewards are based on the actual revenue created by the protocol rather than new token issuance.

In real-yield models, participants receive a piece of the protocol’s earnings, which are typically obtained from transaction fees, lending interest, or other revenue streams, resulting in returns based on economic activity rather than token inflation.

Advantages

Sustainable Value Creation: Real-yield models prioritize sustainable incentives by matching rewards with the protocol’s real performance, lowering reliance on token inflation, and enhancing long-term token stability.

Reduced Inflation: By avoiding excessive emission rates, real-yield models help to maintain the token’s value and appeal to long-term investors.

Consistent returns for investors: Because real-yield rewards are linked to revenue, they provide more predictable returns for investors who prefer stability over high-risk, high-reward models, which can attract a more mature and loyal user base.

The Disadvantages

Slower Growth: Real-yield models may attract users more slowly than emission-based incentives since they do not offer the high initial returns that inflationary rewards do. This can limit early-stage growth opportunities, especially in a competitive DeFi space.

Need for a Revenue-Generating Model: For real-yield to be effective, the protocol requires a stable revenue-generating mechanism capable of supporting continuous payouts. This requirement can be difficult for newer protocols or those lacking a consistent revenue stream.

Real-yield represents a sustainable approach to DeFi growth by linking user rewards with protocol revenue, hence supporting long-term stability.

As DeFi protocols seek sustainable growth models, the battle over “Real-Yield vs Emission-Based Incentives” highlights the shift toward motivating users through value based on economic activity rather than inflationary token issuance.

Here’s a concise table comparing Real-Yield and Emission-Based Incentives based on technical aspects:

| Aspect | Real-Yield Incentives | Emission-Based Incentives |

| Reward Source | Derived from protocol revenue (e.g., trading fees, lending interest). | Generated through inflationary token issuance. |

| Sustainability | High rewards are tied to real economic activity. | Low requires continuous token emissions, risking inflation. |

| Attraction of Liquidity | Moderate depends on the protocol’s revenue and activity. | High initially, as large token rewards attract liquidity providers. |

| Inflation Impact | None does not affect token supply. | High causes token dilution over time. |

| Target Audience | Long-term investors seeking consistent and sustainable rewards. | Short-term participants prioritizing high APYs. |

| Adoption Curve | Slower requires robust revenue generation for appeal. | Faster boosts early adoption but may struggle to maintain loyalty. |

| Security Reliance | Dependent on stable revenue streams and a well-functioning platform. | Requires mechanisms to prevent sell-offs and inflationary spirals. |

| Examples | GMX, Trader Joe | Synthetix, Curve Finance |

The table above highlights the key differences between Real-Yield and Emission-Based Incentives, providing a comprehensive side-by-side comparison.

Market Impact: How Real-Yield Is Changing DeFi Protocols

DeFi has seen a growing trend toward real-yield incentives as protocols seek more consistent, long-term development. This shift reflects a maturing market in which projects are shifting away from the high-risk, high-reward incentives of emission-based models toward rewards based on revenue.

Many protocols, notably in DeFi sectors like lending, staking, and yield farming, are implementing real-yield mechanisms, laying the foundation for user rewards based on actual economic activity.

This trend indicates a broader push toward sustainable tokenomics, which helps ensure that incentives are aligned with protocol success rather than inflation.

Community Preference

The DeFi community has shown an increasing preference for real-yield protocols, especially among long-term investors and risk-averse participants.

Real-yield appeals to individuals who see DeFi as a viable long-term investment and want to generate passive income without worrying about inflationary pressures that could impact token value.

This preference shift indicates a market need for protocols that favor value creation and stability above high emission rates, resulting in a more resilient user base that is less inclined to seek short-term benefits in volatile ecosystems.

The Real-yield vs. Emission-based incentives issue has had a considerable impact on DeFi’s development, with real-yield emerging as a crucial driver of long-term growth.

As more protocols adopt real-yield structures, the DeFi market is expected to become more stable, attracting users who value steady revenue and contributing to the long-term survival of the DeFi ecosystem as a whole.

Key Examples and Case Studies

Real-Yield Protocols

- GMX

GMX is an excellent example of a real-yield DeFi protocol. It generates revenue through trading fees on its decentralized everlasting exchange.

A percentage of these fees are allocated to token holders as rewards, providing stable returns that are directly tied to platform activity. This model aligns incentives with protocol performance and fosters long-term growth and engagement.

- Trader Joe

Trader Joe, Avalanche’s top decentralized exchange (DEX), transitioned to a real-yield model.

By integrating revenue-sharing mechanisms derived from trading fees, the protocol ensures that rewards for liquidity providers and token holders are based on actual economic activity.

This transition demonstrates how real-yield can boost sustainability and generate value for consumers while avoiding inflationary pressure.

Emissions-Based Protocols

- Synthetix

Synthetix is a pioneer in emission-based incentives, employing inflationary token rewards to attract liquidity and encourage staking.

While this strategy has been successful in increasing user adoption, it has also encountered issues with token inflation, raising concerns about its long-term sustainability.

- Curve Finance

Curve has employed emission-based incentives to increase its dominance in stablecoin trading. By rewarding liquidity providers with CRV tokens, Curve successfully attracts liquidity to its pools.

However, the protocol also implemented token-locking measures to reduce inflationary risks and encourage long-term commitment.

These examples make it evident how Real-yield vs. Emission-based incentives differ. Real-yield protocols like GMX and Trader Joe prioritize long-term rewards connected to actual revenue.

On the other hand, emission-based models like Synthetix and Curve rely on high early emissions to attract liquidity, albeit with inflationary risks.

Optimizing for Sustainable DeFi Protocols

Hybrid Models

Some DeFi protocols are exploring hybrid models to balance the strengths of both incentive structures. These models combine emission-based incentives to promote early adoption with real-yield techniques to ensure long-term sustainability.

For example, protocols may first offer inflated rewards to attract users before gradually transitioning to revenue-sharing models as the ecosystem evolves. This strategy resolves the shortcomings of both systems, resulting in a more balanced and resilient incentive structure.

Future Of DeFi Incentives

The DeFi space is expected to shift toward more efficient tokenomics and revenue-driven incentives. Key trends include:

- Real Revenue-Sharing Models: Protocols are expected to prioritize rewards based on actual platform utilization, eliminating reliance on inflationary tokens.

- Diversified Incentive Approaches: To appeal to a wide range of users, new tactics may incorporate staking rewards, cross-chain integrations, and NFT-based incentives.

- Governance-Driven Rewards: As more protocols are implemented, users may be able to receive rewards for actively participating in governance and protocol development, aligning incentives with ecosystem health.

Optimizing sustainable DeFi protocols” is to blend real-yield and emission-based incentives to produce user-friendly platforms. DeFi protocols can ensure development and sustainability in an increasingly competitive landscape by implementing hybrid models that focus on actual revenue.

Conclusion

As DeFi matures, long-term success depends on the adoption of sustainable reward mechanisms.

Developers and protocols ought to explore hybrid models that combine the best parts of real-yield and emission-based incentives, or they should focus on real-world frameworks that promote stability and utility.

Understanding the differences between real-yield and emission-based incentives enables stakeholders to make informed decisions that benefit both users and ecosystems, paving the way for a robust and prosperous decentralized financial future.