The German government’s absence of Bitcoin to sell and the deterioration of the US dollar are the primary factors contributing to Bitcoin’s resurgence

Bitcoin’s recovery from its five-month nadir continued to gain momentum on July 13, as the cryptocurrency rose by approximately 1.70% intraday to approximately $58,885.

The German government’s nearly liquidation of its total 70,000 BTC holdings and a weakening US dollar in the face of a growing deficit are among the key factors driving this resurgence.

Almost $2.5 billion is absorbed by Bitcoin investors.

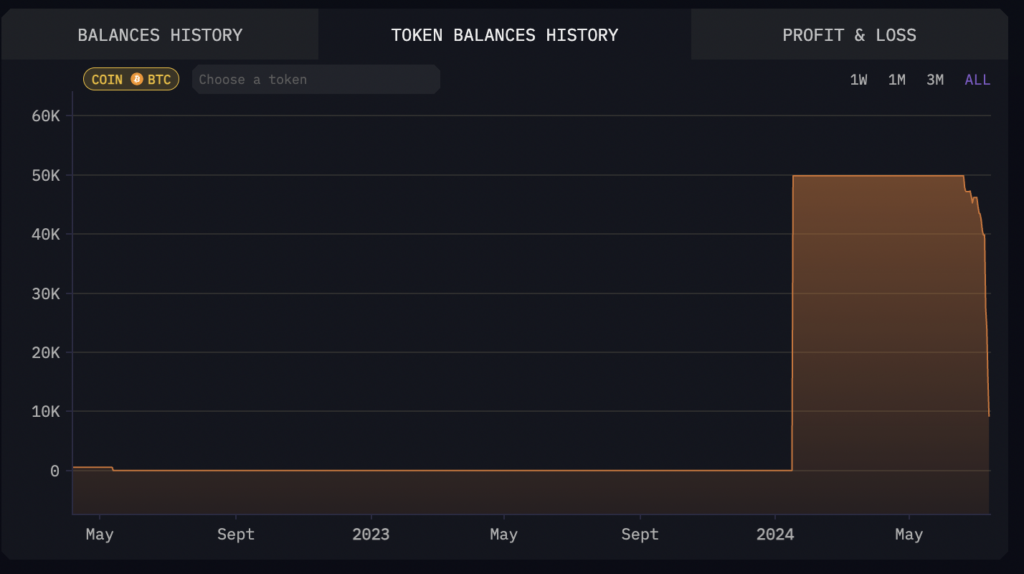

After selling over $2.5 billion in Bitcoin since June 17, the German government has approximately 9,100 BTC remaining. Bitcoin’s price experienced a 12.70% decline during this period, followed by a significant recovery of over 10% over the past eight days.

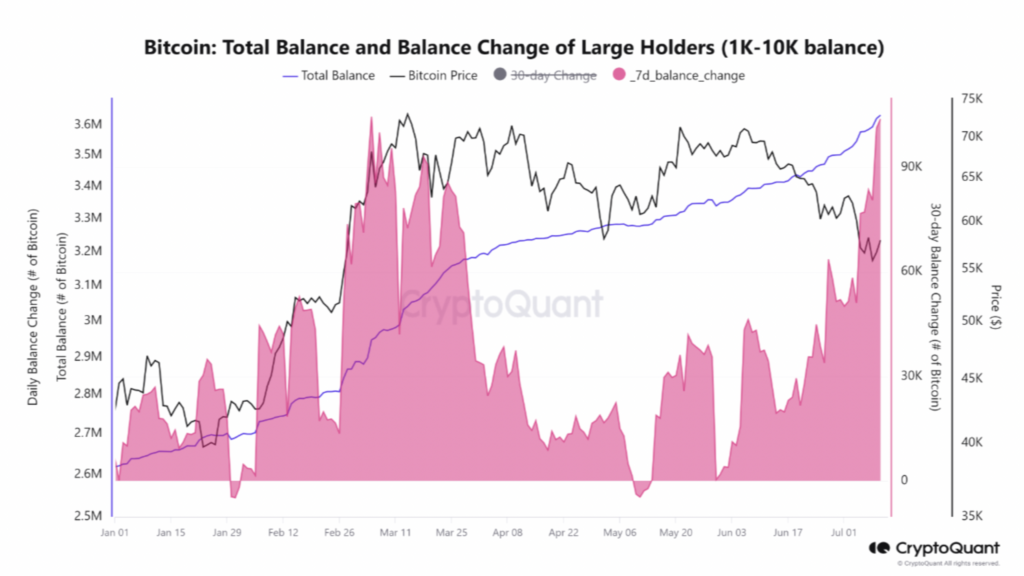

In contrast, an analyst affiliated with on-chain data service CryptoQuant, Cauê Oliveira, has reported that institutional investors have been purchasing Bitcoin during its local declines.

Oliveira noted in a July 11 Quicktake blog post that wallet balances holding between 1,000 and 10,000 BTC have experienced a significant increase since the beginning of June, including during the German government’s BTC sale.

It is important to note that the cohort added more than 10,000 BTC, equivalent to $5.7 billion, during the period, consistent with the 23% decline in its price. This raises the possibility that these so-called “whales” have been purchasing Bitcoin when it falls below $60,000.

Oliveira summarized that institutional players engaged in the largest accumulation process since March, while many novice investors capitulated last week, notably those who purchased coins between one and three months ago.

This data suggests that Bitcoin may be on the brink of bottoming out at its most recent market lows, which are approximately $56,700.

The dollar’s value reached its lowest point in more than a month.

The depressive trend observed on the US Dollar index (DXY) chart is consistent with the recent and current gains in Bitcoin.

It is important to note that DXY, a metric that monitors the dollar’s strength compared to a portfolio of top foreign currencies, experienced a 0.90% decline in a week, reaching approximately 104 on July 12. This was the lowest level in approximately five weeks. This decline was precipitated by the increasing bets of bond speculators on an interest rate reduction in September.

The potential for a growing US government deficit resulted in additional downside pressure for DXY, which reached $1.27 trillion year-to-date as of June.

The dollar may be weakened by a higher deficit and lower interest rates as they increase the likelihood of increased borrowing and raise concerns about the government’s financial health. Consequently, the currency’s value may be diminished.

Investors are inclined to pursue returns in riskier assets, such as equities and cryptocurrencies, when the currency is less expensive.

This explains Bitcoin’s resurgence in defiance of the ongoing reimbursement of more than 140,000 BTC to Mt. Gox clients and the growing apprehension regarding the German government’s BTC dump.

Technical rebound in the Bitcoin price?

Bitcoin’s ongoing price rebound appears to be a component of an oversold recovery from a technical perspective. This is evident in the four-hour relative strength index (RSI), which recently fell below the oversold threshold of 30—a level that frequently indicates an imminent recovery..

As illustrated in the chart above, the purchasing sentiment near the lower trendline of Bitcoin’s prevailing triangle-shaped consolidation pattern is the source of today’s gains. Consequently, the immediate upside target for BTC is approximately $59,000, which is by the resistance of its descending trendline.

The 200-4H exponential moving average (200-4H EMA; the blue wave) will be within reach at approximately $61,235 in July, representing a 4.65% increase from the current price levels, with a distinct break above $59,000.