Republican CFTC commissioner Summer Mersinger, who supports a more crypto-friendly approach, is being considered by President-elect Trump.

Reuters News reports that current and former Commodity Futures Trading Commission (CFTC) officials are being considered by President-elect Donald Trump’s transition team to serve as the organization’s head.

Second only to the Securities and Exchange Commission (SEC), the CFTC is an important player in the US’s regulated cryptocurrency markets.

One candidate for CFTC chair is Republican commissioner Summer Mersinger, who has called for the agency to adopt a more accommodative approach to cryptocurrency, according to Reuters.

Mersinger is a strong candidate for the job, according to Reuters, partly because she served as a senior staffer to Republican Senator John Thune from 2004 to 2016.

After Republicans secured a majority in the US Senate on November 5, Thune was appointed to serve as its leader.

Mersinger has criticized the CFTC for what he called “regulation through enforcement” and objected to the way the agency handles enforcement actions against cryptocurrency companies.

On September 4, Mersinger stated, “I hoped that the commission would soon consider rulemaking, or at the very least guidance, making clear how DeFi protocols could comply with them.”

Josh Sterling, a partner at the law firm Milbank and a former CFTC official, and former Republican CFTC commissioner Jill Sommers are also candidates, according to Reuters.

Gary Gensler, the chair of the SEC, has not been replaced by Trump. Chris Giancarlo, the former chair of the CFTC, announced on November 14 that he would not be taking up the position.

In a post on the X platform, Giancarlo stated, “I’ve made clear that I’ve already cleaned up earlier Gary Gensler mess @CFTC and don’t want to have done it again.”

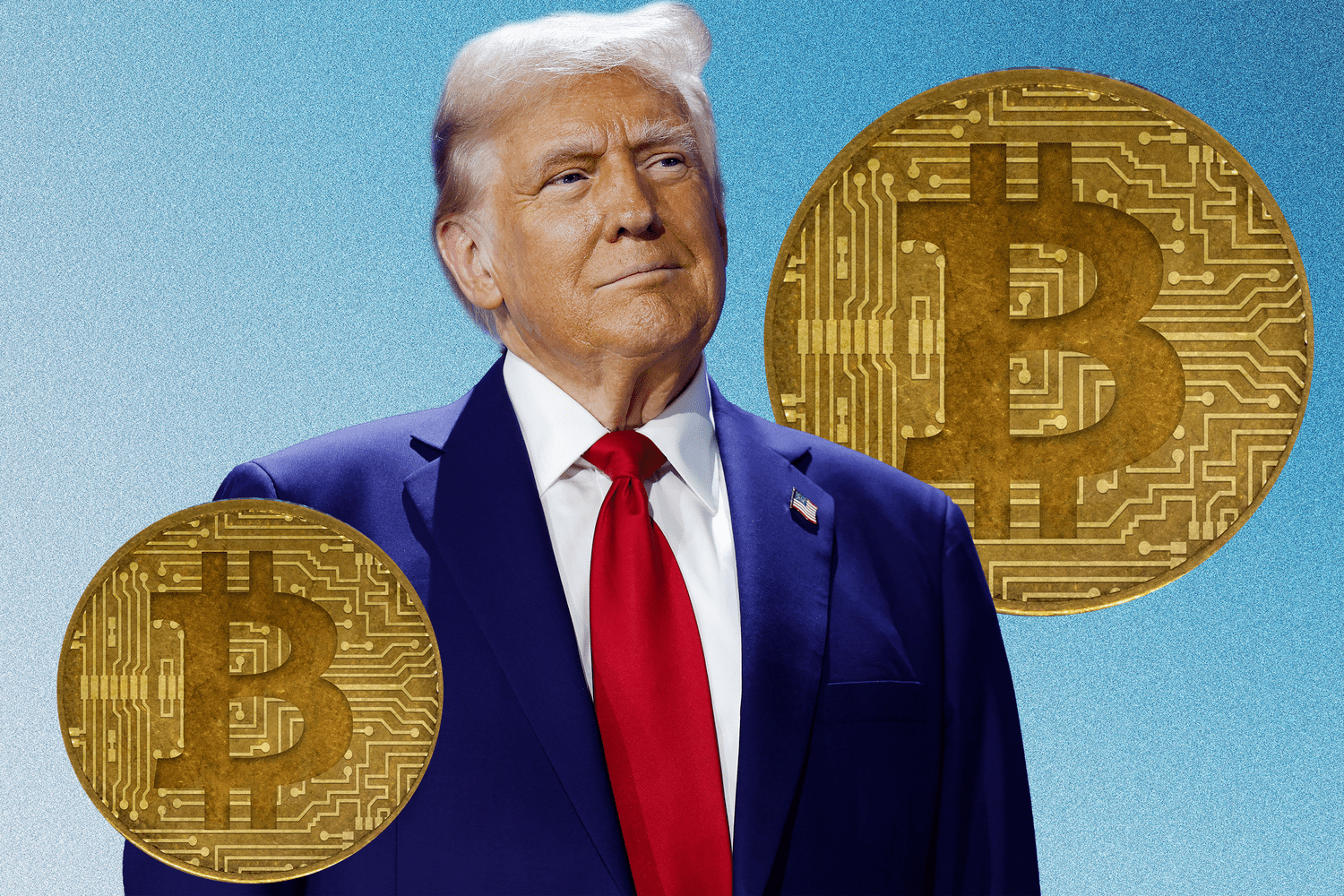

Trump’s victory in the US presidential election caused the cryptocurrency market to soar since many people think it will have a big effect on the sector, according to Cointelegraph Research.

For the first time since 2021, Coinbase’s stock surpassed $300 on November 11 after a more than 20% increase in shares.

In a research report published on Nov. 7, Morningstar Inc. equities researcher Michale Miller stated, “We see Coinbase as a beneficiary of the election results as the firm has been struggling with regulatory pressure from the SEC, with the firm actively fighting the agency in court.”

Trump’s victory also gives the go-ahead for over six planned cryptocurrency exchange-traded funds (ETFs) that are awaiting regulatory clearance to list in the United States.

Asset managers filed numerous regulatory files in 2024 to list exchange-traded funds (ETFs) that included cryptocurrencies, such as Litecoi and Solana.

Additionally, issuers are awaiting clearance for a number of anticipated crypto index exchange-traded funds (ETFs) that are intended to hold a variety of token bundles.