Retail investors offload $258 million in Nvidia stock, raising questions about a potential shift toward Bitcoin amid AI and crypto market trends

Several reports indicate that retail investors who purchased the Nvidia decline are currently selling. Traders are contemplating whether they will allocate their proceeds toward purchasing cryptocurrency.

Institutions are continuing to acquire Nvidia, while retail investors are generating profits from their acquisitions. Retail investors liquidated $258 million of Nvidia stock during the week ending on June 4, according to a report by Vanda Research.

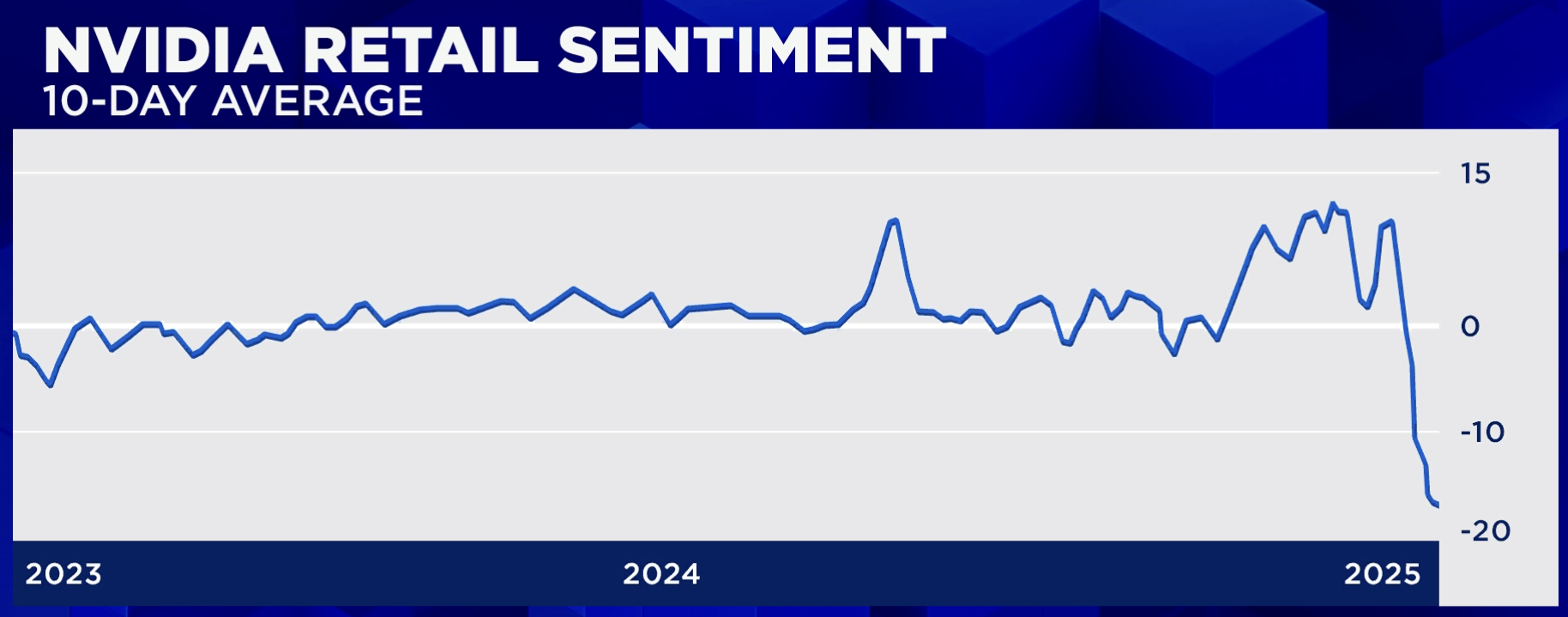

Between 2023 and 2024, numerous retail investors realized substantial profits from their investments in Nvidia. According to a sentiment survey conducted by Vanda Research, they are currently in the process of seeking out new opportunities.

In 2025, retail sentiment experienced a significant decline, transitioning from a 10-point lean toward buying to a 15-point lean toward selling.

This analysis is consistent with a report by Sherwood, which documented $4.9 billion in retail outflows during the third week of May. It was the most significant dollar outflow for Nvidia since 2015 and the longest retail selling streak, spanning two consecutive weeks, since March 2022. The report also observes comparable activity in Tesla, another retail favorite.

What is the reason for the decline of Nvidia among retail investors?

Retail investors who purchased the downturn following the decline in Nvidia shares following the DeepSeek launch are currently seeking more lucrative opportunities.

According to analyst Ben Bajarin, the majority of Nvidia’s development potential has already been factored into the stock price. As a consequence, traders are actively pursuing opportunities for increased upside in other markets.

In addition, there is considerable apprehension regarding the consequence of U.S. tariffs and semiconductor restrictions on China. Investors with a higher risk tolerance are increasingly gravitating toward AI equities and cryptocurrency in this context.

Retail investors are currently considering volatile small-cap AI equities in order to pursue additional gains, as per Vanda Research.

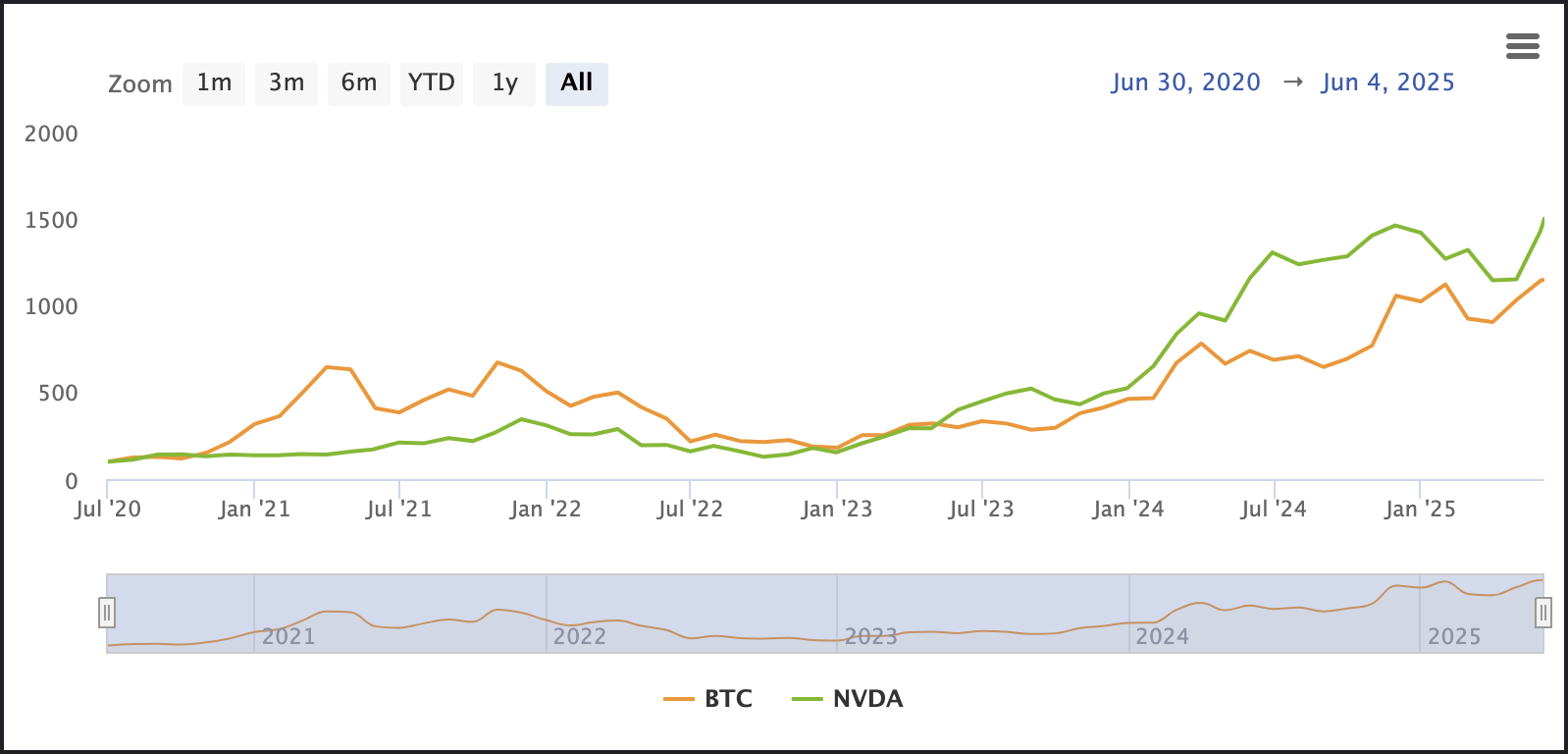

Throughout history, there has been a robust relationship between Bitcoin (BTC) and Nvidia. A 2024 study discovered a consistent correlation between the two assets that exceeded 0.80, primarily as a result of Nvidia’s involvement in the operation of crypto mining infrastructure.

This implies that a significant number of Nvidia investors are already acquainted with, or are actively engaged in the cryptocurrency market.

In the meantime, institutional investors are accumulating Bitcoin, while retail investors are relegating themselves to a lesser role. In the past five years, the most established crypto asset has actually underperformed Nvidia, with a return of 992% compared to Nvidia’s 1,523.1%.

Nevertheless, there is no definitive indication of a comprehensive retail pivot from Nvidia to Bitcoin at this time. Although historical correlations and overlapping investor profiles indicate a potential connection between the two, the current sentiment does not support a distinct rotation into Bitcoin.

The ultimate decision of whether those who are profiting from Nvidia will transition to crypto may be contingent upon broader macro signals. This encompasses regulatory developments, interest rate decisions, and trade policies.