The MEV bot that profited nearly $8 million in stablecoins returned the funds but wanted the Rho Markets team to acknowledge it was not a breach or exploit.

Rho Markets, a decentralized finance protocol, has resumed operations following a misconfigured Oracle issue last week. This incident resulted in an MEV program accumulating $7.6 million in stablecoins from the protocol.

The Scroll-based liquidity layer and lending protocol announced on July 21 that it had recently finished the simulation of repaying all remaining funds to the affected pools.

A subsequent message on X promptly followed, informing users that the protocol had been effectively reactivated and that funds had been allocated.

On July 19, Rho Markets was manipulated, resulting in a loss of $7.6 million in stablecoins.

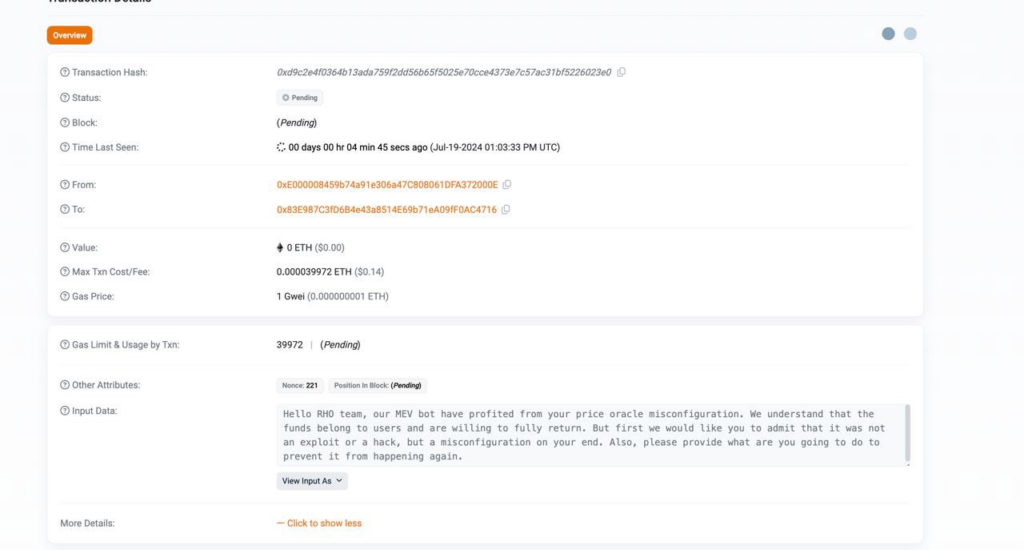

The entity responsible for the bot posted a message on the blockchain on July 19, informing the team that its MEV (maximal extractable value) bot had profited from a price oracle misconfiguration.

“We acknowledge that the funds are the property of the users and are prepared to return them in their entirety,” it declared before imposing a condition.

“But first, we would like you to admit that it was not an exploit or a hack but a misconfiguration on your end.”

The entity requested that the Rho Markets team furnish specifics regarding the measures implemented to prevent future incidents.

The team thanked the community and users for their assistance on July 22 and committed to implementing more stringent security protocols.

“We will introduce additional third-party partners to improve security measures, such as on-chain data monitoring and smart contract audits,” it declared. Additionally, it will “fortify internal security measures, including rigorous simulation environment testing and multiple internal reviews.”

Additionally, it has guaranteed that no funds were misplaced.

No instantaneous response was received by Cointelegraph when it reached out to Rho Markets for additional information.

Rho Markets’ total value sealed plunged by 54% during the misconfiguration, from $51 million to $23.4 million, as reported by DefiLlama. At the time of writing, it has yet to recover and is currently valued at $24.6 million.

The previous week was the second most profitable for crypto hackers regarding misappropriated funds. The Li.Fi protocol was exploited for $10 million on July 16, and the crypto exchange WazirX was compromised for over $230 million on July 18.