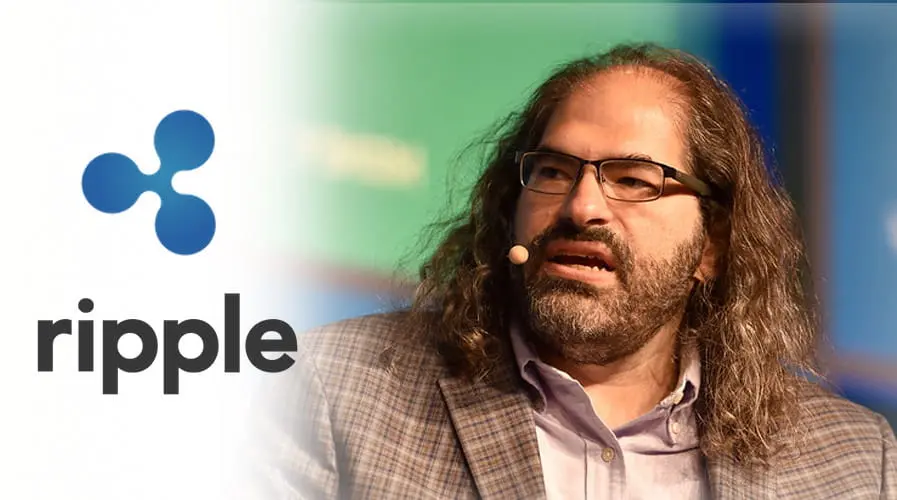

Ripple CTO David Schwartz sparks debate with Nick O’Neill over Bitcoin, clashing with earlier takes on Michael Saylor’s firm, Strategy.

David JoelKatz Schwartz, Ripple CTO, is now involved in a new dispute involving Bitcoin and Strategy (which used to be called MicroStrategy).

Several community members, including Nick O’Neill, have criticized Michael Saylor’s business.

However, the Schwartz comment, which many see as a threat, has now been added to the debate.

Ripple CTO Joins Strategy Discussion

David JoelKatz Schwartz, CTO of Ripple, is only slightly involved in the Strategy discussion.

Nick O’Neill, Co-Founder and CEO of BoDoggosENT, started it all.

A fake crypto investor called “The Digital Asset Investor” said that O’Neill has been making negative videos about the Michael Sayor firm for days.

However, he has shocked everyone with a new video in which he defends the company.

Many people think he is being sued because of his serious face, the fact that he seems to be reading from a script, and that he changed his mind about something he said before.

In a post, Digital Asset Investor put up how people felt:

So this guy has obviously been threatened with a lawsuit…This was just one guy over a day or two taking shots at Microstrategy, and they shut him down.

Many people said, “Blink twice if you need help,” and some said, “He has lost all the credibility he had.”

Schwartz also added his thoughts, which also seem like a warning.

CTO Of Ripple Says New Statement Is “Not Genuine”

The Ripple CTO also joined the conversation and said the video looks unreal.

He even said the person commenting doesn’t look happy, and his original video showed his thoughts.

We’re all smart enough to realize that he was probably coerced into making that statement, and his original videos reflect his true opinions of Microstrategy, which we are free to agree with or think are nonsense as we please. I’m sure he wasn’t happy making that statement.

In addition to saying what he thought about that, he also talked about how important words are and how much they could be worth.

Notably, David JoelKatz Schwartz made it clear that he disagrees with O’Neill’s past criticism of Strategy; he still stands up for his right to free speech and says that companies shouldn’t make people afraid to say what they think.

It Won’t Work Out Well If You Hold Microstrategy

One of these tweets struck a chord with users: David ‘JoelKatz’ Schwartz also discussed Strategy’s plan to buy Bitcoin.

Since it purchased 430 BTC not long ago, Michael Saylor’s business now has 629,376 tokens.

Some people like these methods, while others don’t. Some even say that the company’s stock is a leveraged Bitcoin play, which the Ripple CTO somewhat agrees with.

He also says that thinking that owning MicroStrategy stock will not be a good idea if Bitcoin falls apart is not debatable.

I don’t think it’s controversial that holding Microstrategy won’t turn out well if Bitcoin trends downward and that it’s generally like a leveraged long type position.

This is true, since the rise in Bitcoin’s price has made the MSTR stock very valuable.

Keeping the stock looks like a good idea as long as BTC goes up, but there’s also a risk of losing money because the token goes down.

Even now, BTC is falling from its all-time high of $124.4k.

This can be seen in Strategy, as the price of MSTR stock has dropped 10% over the past week and is now only $363.60.