After SEC scrutiny of its crypto business, Robinhood sues the regulator, calling its actions an attack on innovation. CEO vows to fight.

On May 7, Robinhood Markets, a well-known retail trading platform, declared its intention to initiate legal proceedings against the U.S. Securities and Exchange Commission (SEC) because of allegations about violations of securities regulations.

The company revealed that the SEC had served Robinhood Crypto with a Wells Notice over the weekend, warning that charges may be brought against the company following the resolution of an investigation.

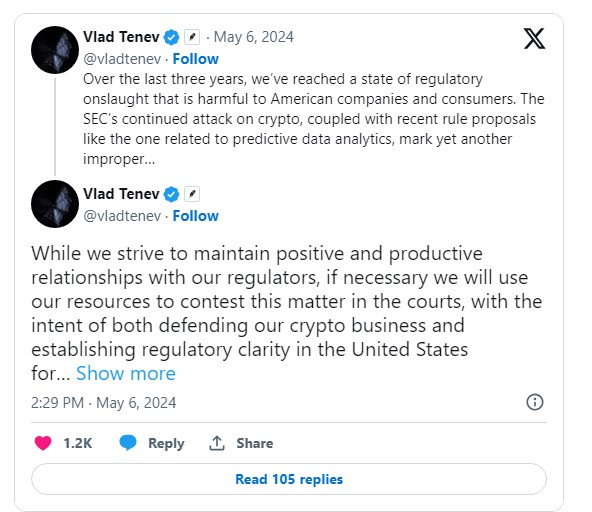

Vlad Tenev, CEO and co-founder, disclosed the company’s position in close proximity to the receipt of a Wells Notice from the securities regulator.

Vlad Tenev, CEO of Robinhood, Critiques the Enforcement Actions of the US SEC

Tenev took to X on Monday to denounce the SEC’s “continued assault on cryptocurrencies,” articulating his displeasure. The individual described the regulatory measures as components of a more extensive “regulatory onslaught,” which, in his opinion, hinders American firms and investors while stifling innovation.

The filing suggests that potential violations of Sections 15(a) and 17A of the Securities Exchange Act of 1934 have arisen due to the SEC’s investigation into Robinhood’s cryptocurrency business, including its cryptocurrency listings, custody, and platform operations.

Potential enforcement actions against Robinhood may encompass public administrative proceedings, cease-and-desist proceedings, civil injunctive measures, and activity limitations. Remedy options may include disgorgement, injunctions, civil monetary penalties, and activity restrictions.

After the SEC sued Binance and Coinbase last year, Robinhood Crypto implemented additional measures to ensure adherence to regulatory requirements. Within a matter of weeks, it terminated support for tokens classified as securities by the SEC, depriving U.S. users of the ability to trade altcoins, including Cardano (ADA), Polygon (MATIC), and Solana (SOL).

Chief legal, compliance, and corporate affairs Officer of Robinhood, Dan Gallagher, was dismayed by the SEC’s ruling.

Gallagher stated, “We are dismayed that the SEC has decided to issue a Wells Notice regarding our U.S. crypto business, following years of sincere efforts to develop regulatory clarity in collaboration with the agency, including our renowned “come in and register” attempt.” “We strongly believe that the assets featured on our platform do not qualify as securities.

We eagerly anticipate interaction with the SEC to demonstrate the legal and factual weaknesses that would render any potential lawsuit against Robinhood Crypto frivolous.”

Tenev stated that Robinhood Crypto has no qualms about engaging in litigation with the SEC to contest the matter.

The SEC’s Examination of Robinhood Cryptocurrency Signals an Industry-Wide Crackdown.

As part of a broader crackdown on the cryptocurrency industry, the SEC is examining Robinhood Crypto. Notable warnings have been issued to other prominent participants, including Consensys and Uniswap Labs.

The proprietor of Uniswap, Hayden Adams, criticized the SEC’s methodology in an April announcement.

“Rather than working to create clear, informed rules, it has been evident for some time that the SEC has chosen to attack long-standing good actors such as Uniswap and Coinbase,” Adams stated.

In contrast, Consensys elected to initiate legal proceedings against the SEC, citing apprehensions that oversight of ether as a security could impede the United States’ capacity to implement Ethereum and other blockchain technologies.

Robinhood Crypto has encountered regulatory obstacles, culminating in a $30 million settlement reached in 2022 with the New York Department of Financial Services regarding non-compliance issues pertaining to transaction monitoring and cybersecurity.

In addition, the company settled with the SEC in 2020 to pay $65 million to address allegations of providing misleading information to investors. Furthermore, in 2021, the Financial Industry Regulatory Authority levied a $70 million sanction against the company for causing harm to its customers, which represents the most substantial monetary penalty the company has ever incurred.