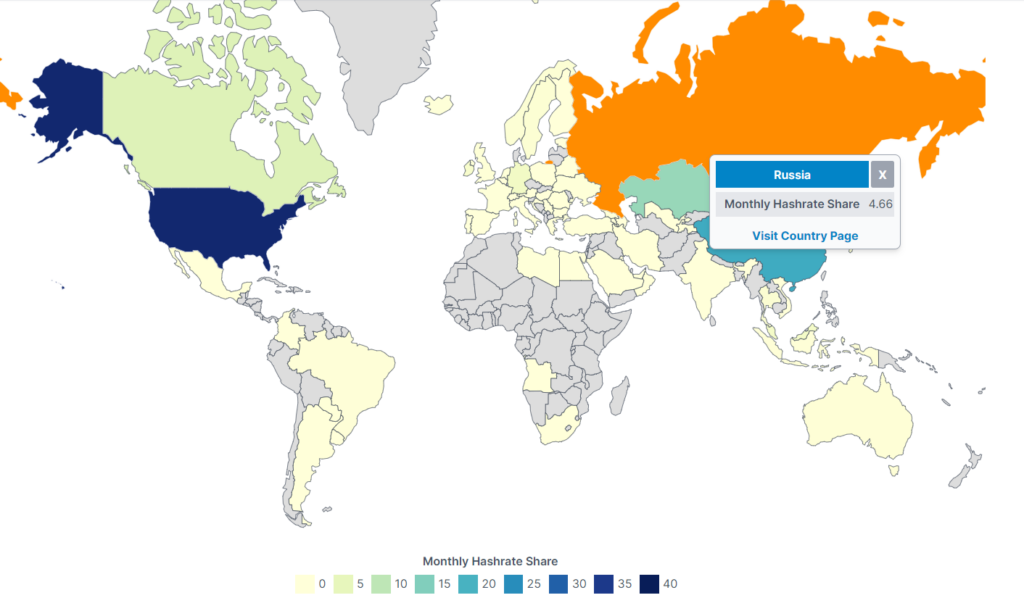

Russia will ban crypto mining in occupied Ukrainian territories, including Donetsk, Lugansk, Zaporizhia, and Kherson, starting December 2024, to ease electricity strain.

Alexander Novak, the Deputy Prime Minister of Russia, organized a conference with senior officials to discuss the country’s electricity supply shortages during the peak autumn and winter seasons. The energy challenges exacerbated by crypto mining, particularly in regions with inadequate electricity capacity, were the primary focus.

Crypto mining restrictions in Russia may persist until 2031

The proposed moratorium will encompass territories under Russian control, such as Donetsk, Lugansk, Zaporizhia, and Kherson, according to reports from the Moscow Times. Citing the detrimental effects on local electricity infrastructures, the government intends to restrict mining operations in these regions.

Beginning in December 2024, a complete prohibition of mining will be implemented in the occupied regions of Ukraine and the North Caucasus.

Additionally, crypto mining in Siberia will be suspended from December 1 to March 15, 2025. Until 2031, comparable limitations will be enforced annually from November 15 to March 15.

“Starting Dec 2024, Russia’s Energy Ministry is clamping down on mining rigs in energy-stressed zones like Irkutsk, Chechnya, and DPR. The takeaway’s clear: energy ≠ infinite, and miners might need to get stealthy or pivot,” Maria Nawfal wrote on X (formerly Twitter).

In the past few months, Putin’s government has been contemplating a number of modifications to Russia’s crypto regulations. The new law permits the direct regulation of mining pools, while the support for the use of cryptocurrency as a payment method remains robust.

The government updated its policy on crypto taxation last week. Cryptocurrency is now classified as property for tax purposes under the new regulations. The market value of the income from mining will be the basis for taxation at the time of receipt.

Nevertheless, the industry can alleviate some of the financial strain by allowing miners to deduct expenses that are incurred during operations. Value-added tax (VAT) exemptions will be granted to cryptocurrency transactions.

Rather, earnings will be subject to the same taxation regime as securities. The personal income tax on crypto-related income will be capped at 15% because of this.

Furthermore, reports suggest that Russia is progressing with its intentions to establish national cryptocurrency exchanges. It is probable that these exchanges will be conducted in Moscow and St. Petersburg.