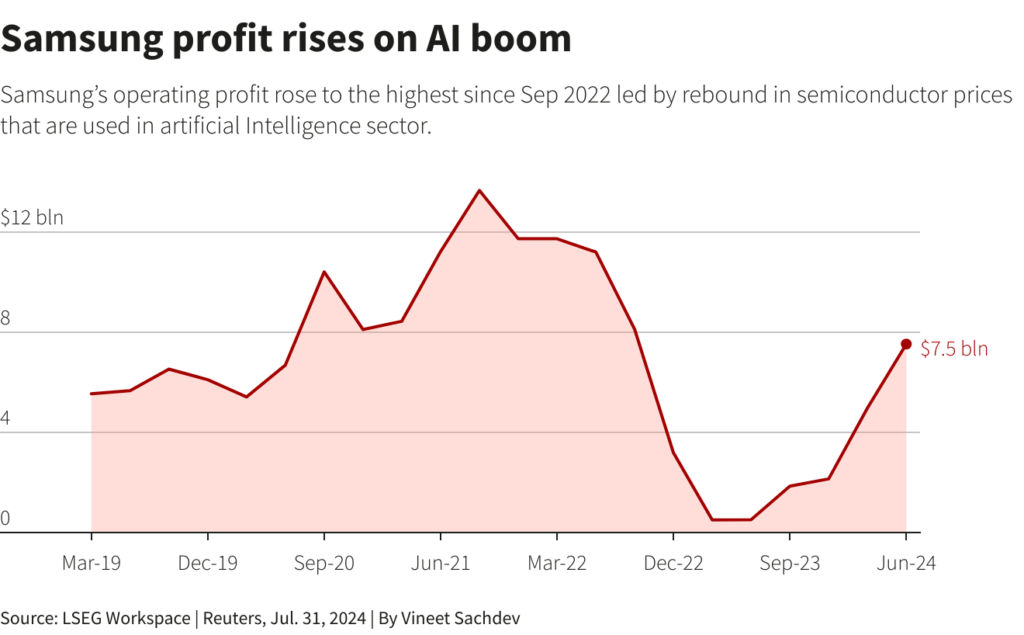

In the second half of this year, Samsung Electronics anticipated a robust demand for processors driven by artificial intelligence following the announcement of a more than 15-fold increase in its second-quarter operating profit

From a low base a year ago, the world’s largest manufacturer of memory chips, smartphones, and TVs experienced a significant increase in June quarter earnings due to the AI boom and the rebounding semiconductor prices.

“In the second half of 2024, AI servers are expected to take up a larger portion of the (memory) market as major cloud service providers and enterprises expand their AI investments,” according to Samsung.

Samsung Electronics anticipated strong demand for processors driven by artificial intelligence in the latter half of this year due to its announcement of a more than 15-fold increase in its Q2 operating profit.

The world’s largest manufacturer of memory chips, smartphones, and TVs experienced a substantial increase in June quarter earnings due to the AI surge and the rebounding semiconductor prices, compared to a low base a year ago.

“In the second half of 2024, AI servers are expected to take up a larger portion of the (memory) market as major cloud service providers and enterprises expand their AI investments,” according to the company.

Revenue increased by 23% to 74 trillion won during the second quarter.

Chipping Boom

The semiconductor division reported a 6.45 trillion won profit, its highest since the second quarter of 2022, and its second consecutive quarterly profit.

The prices of chips have been driven up by the surge in demand for high-end DRAM chips, including high-bandwidth memory (HBM) chips used in AI chipsets and chips used in data center servers and devices that operate AI services.

Samsung reported that its HBM revenue increased by approximately 50% from the previous quarter in the second quarter.

SK Hynix, the leader of HBM and a South Korean competitor, also stated last week that the demand for AI processors will continue to increase. This announcement was made after the company’s highest quarterly profit since 2018.

Sources have informed Reuters that Samsung’s fourth-generation HBM, designated HBM3, has been approved by Nvidia for use in its less-sophisticated graphics processor, the H20, which was developed for the Chinese market. However, Samsung has not yet met Nvidia’s standards for fifth-generation HBM chips, known as HBM3E.

Nevertheless, Samsung anticipated that HBM3E chips would account for 60% of its HBM shipments by the fourth quarter. Analysts have suggested that the aggressive objective may be accomplished if Samsung’s HBM3E receives Nvidia’s final approval by the third quarter.

Samsung stated that the conventional supply of PC and mobile memory processors will be restricted in the second half of the year due to the concentration of production capacity on HBM, server DRAMs, and server solid-state drives (SSDs) for AI applications.

The second-quarter operating profit of the mobile devices business decreased by approximately 810 billion won from the previous year due to increasing materials costs. Nevertheless, shipments remained consistent at 54 million smartphones.

Samsung anticipates that the demand for smartphones in the second half of 2024 will be higher than a year ago, with a rise in demand for premium products with AI capabilities and accessories like wearables.

Earlier this month, the company introduced its most recent AI-enabled flagship foldable phones and mobile accessories to compete with Apple in the premium smartphone segment. The product line includes a new health monitoring ring.

($1 is equivalent to 1,383.0100 won)