Satoshi Nakamoto’s $114B Bitcoin stash could top Buffett and Zuckerberg’s wealth by 2026, with low funding rates fueling a sustained BTC rally.

Last week, Satoshi Nakamoto, the enigmatic creator of Bitcoin (BTC), rose to the 11th richest person worldwide, with their Bitcoin holdings valued at $120 billion.

Satoshi’s Bitcoin Wealth May Soon Surpass Buffett and Zuckerberg

Bloomberg analyst Eric Balchunas noted that if Bitcoin achieves its typical 50% annual growth, Satoshi could soon overtake billionaires like Warren Buffett and potentially rival Mark Zuckerberg’s wealth next year, though Elon Musk remains far ahead.

The fascination with Satoshi’s wealth stems from their anonymity. Unlike most billionaires, Satoshi has never spent any of their Bitcoin since its creation, drawing comparisons to Jack Bogle, who left a lasting legacy without cashing out. Satoshi’s mystery fuels speculation about whether they’re a hidden genius or long deceased.

Bitcoin’s Price Surge Elevates Satoshi’s Hidden Fortune

The recent BTC price increase has boosted Satoshi’s holdings to $120.46 billion, a 2.05% rise, highlighting the power of digital currency despite Satoshi’s anonymity. Bitcoin’s evolution from an experiment to a wealth generator underscores its impact.

Speculation abounds about why Satoshi has never sold their coins. Some see it as confidence in Bitcoin’s future, while others find it enigmatic.

While Bitcoin grabs attention, other cryptocurrencies like XRP also show bullish trends, with analysts predicting significant price movements this month, reminiscent of past bull markets.

Low Bitcoin Funding Rates Signal a Robust Bull Market

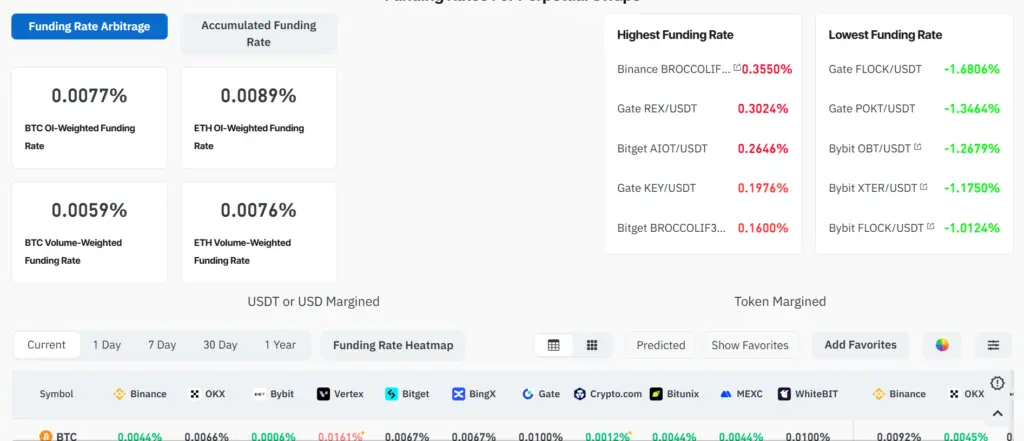

Coinglass data indicates that Bitcoin’s low funding rate of 0.0077% suggests a stable bull market. Funding rates and fees paid in perpetual swaps without expiration reflect market dynamics. Ethereum’s rate is slightly higher at 0.0089%.

Low rates indicate traders are avoiding excessive leverage, which can prevent sharp price drops during market shifts, a positive sign for long-term Bitcoin holders.

However, investors should stay cautious, particularly with developments like Ethereum’s Pectra upgrade, which could influence the broader crypto ecosystem.