Michael Saylor, Strategy’s chairman, reverses pledge, allowing new MSTR stock issuance below 2.5x mNAV to fund Bitcoin buys, despite a 2% stock dip.

Michael Saylor, the executive chairman of Strategy, has relaxed the company’s financing rule for MSTR stock issuance to purchase more Bitcoin within the past month. This occurs amid the stock market’s underperformance over the past few months, which has resulted in the loss of the premium it once held over Bitcoin. The company will issue stock at a minimum net asset value (mNAV) of 2.5 to finance its most recent Bitcoin purchases, as per the most recent revision.

Michael Saylor Facilitates the Issuance of Strategy Stock

Michael Saylor is reducing the funding limits for MSTR stock issuance within the next three weeks to finance his recent Bitcoin acquisitions. Strategy guaranteed investors in late July that it would refrain from issuing new shares at a price less than 2.5 times the value of its Bitcoin holdings. Saylor refers to it as the “mNAV premium,” which has declined from 3.4x to 1.6x since November 24.

Shareholders of Strategy (NASDAQ: MSTR) have consistently opposed the dilution of their shares. Nevertheless, the management has defended the recent reversal by referring to it as “management flexibility,” as suggested by the Bloomberg report. As the company’s previously substantial premium over its Bitcoin holdings diminishes, the modification provides Saylor with increased flexibility to raise cash and cover expenses.

On Monday, August 18, MicroStrategy acquired Bitcoins valued at $51 million, which resulted in the most recent change in the stand. MicroStrategy’s market value-to-Bitcoin holdings ratio (mNAV) has declined below 2.5x in the past few weeks, resulting in a bearish signal for the MSTR stock. Consequently, the velocity of BTC purchases has decreased from billions to a few million dollars.

Saylor revised his strategy to permit the issuance of additional MSTR shares even when mNAV is below the 2.5x threshold, in recognition of this change. This represents a departure from his previous stance, which was to refrain from pursuing share dilution. Brian Dobson, the managing director of Clear Street’s Disruptive Technology Equity Research, stated:

“I think the additional language in the guidance gives them more leeway with issuing common stock. That should allow the company to be more opportunistic in its Bitcoin purchases.”

As BTC experiences a decline, strategy shares are experiencing pressure

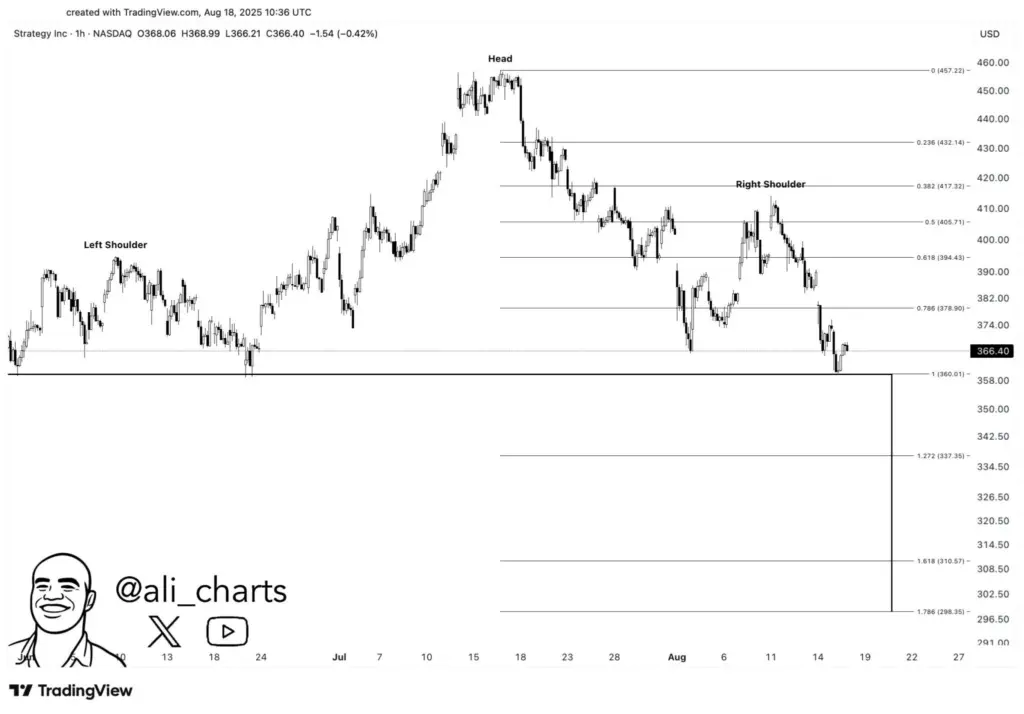

MSTR stock has been trading at approximately $360 for the past four months but has not gained sufficient momentum. Conversely, the premium disparity has decreased as the price of BTC has reached new all-time highs. The share price of MSTR is currently exhibiting a classic head-and-shoulder pattern, according to renowned crypto analyst Ali Martinez. Consequently, a further decline to $300 could result from a price below $360.

Additionally, Vanguard has divested its 10% stake in MSTR during the second quarter. Retail participation has also decreased in response to the rapid reduction in stock price volatility.