Saylor hints at Strategy’s next Bitcoin buy, pushing holdings past 600K BTC, potentially worth $64B, fueling MSTR’s 126% stock surge.

Strategy (formerly MicroStrategy) is anticipating the release of another acquisition announcement following 11 consecutive weeks of unwavering Bitcoin acquisitions. Michael Saylor has provided a hint regarding an upcoming acquisition that could elevate Strategy’s holdings to over 600,000 BTC.

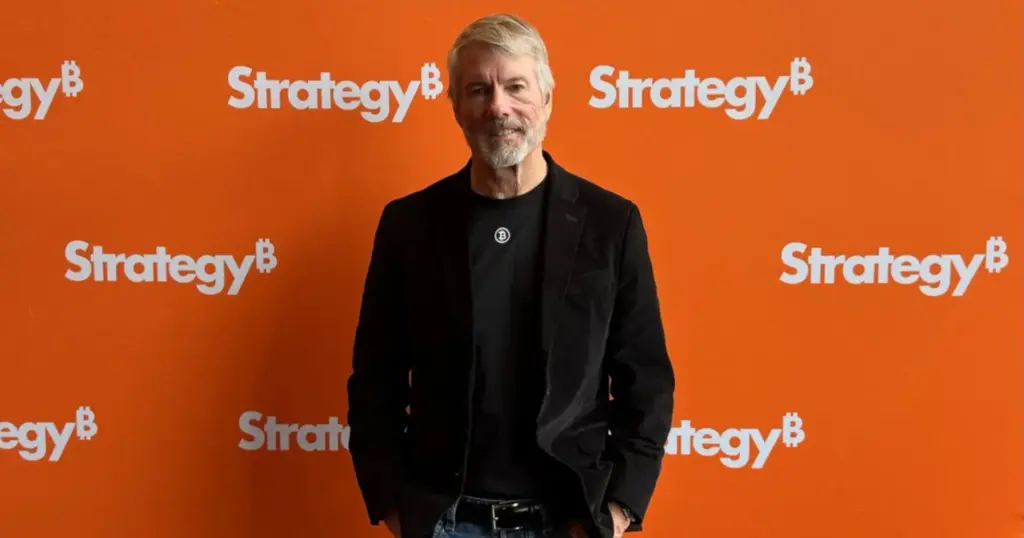

Michael Saylor Issues a Buy Signal for His Strategy

Strategy founder Michael Saylor has disclosed the primary indicator for an incoming Bitcoin purchase for the company. Saylor shared the Strategy’s portfolio tracker in an X post, which revealed the company’s Bitcoin holdings, a purchasing streak, and a caption encouraging followers to accumulate the flagship cryptocurrency.

Strategy’s current holdings of 592,345 BTC are valued at $64.28 billion at current prices, which is just 7,655 short of the 600,000 mark, according to the tracker. Michael Saylor’s portfolio posts have consistently preceded an announcement of a Bitcoin purchase, resulting in an 11-week purchasing streak.

Strategy invested $26 million in its Bitcoin accumulation campaign last week, taking advantage of the market’s decline. A potential purchase will match Strategy’s previous 12-week BTC buying record; however, it is uncertain whether the company will invest significantly to achieve the 600K BTC milestone.

“In 21 years, you’ll wish you’d bought more,” read Saylor’s caption on X.

Strategy rests on an unrealized profit of $21.3 billion from its consistent Bitcoin accumulation plan. Michael Saylor is demonstrating no indication of slowing down his accumulation rampage as Strategy continues to raise funds by issuing convertible debt and selling preferred stock.

In 21 years, Bitcoin is expected to trade at $21 million

Saylor predicted that 21 would be the determining factor in Bitcoin’s future, and his caption for the portfolio tracker is a testament to his conviction. Michael Saylor previously forecasted that the Bitcoin price would reach $21 million, with a 21% annual increase over 21 years.

Several organizations are implementing Strategy’s blueprint to establish their Bitcoin reserves, as they are confident in the asset’s long-term growth. ProCap Financial, which is led by Pompliano, was the first to accumulate nearly 6,000 BTC among new Bitcoin treasury companies last week.

In addition to the fact that corporations are investing in the most prominent cryptocurrency, the regulatory environment is evolving, which suggests that prices will increase. The Federal Housing Finance Agency has now acknowledged cryptocurrency as a mortgage asset, and Cathie Wood anticipates a BTC rally due to this development.