US Treasury’s Scott Bessent confirms $15B–$20B Bitcoin reserve and halts sales, while keeping gold policy unchanged.

The US Treasury Secretary Scott Bessent acknowledged that the US has a $15–$20 billion Bitcoin reserve and that sales have stopped.

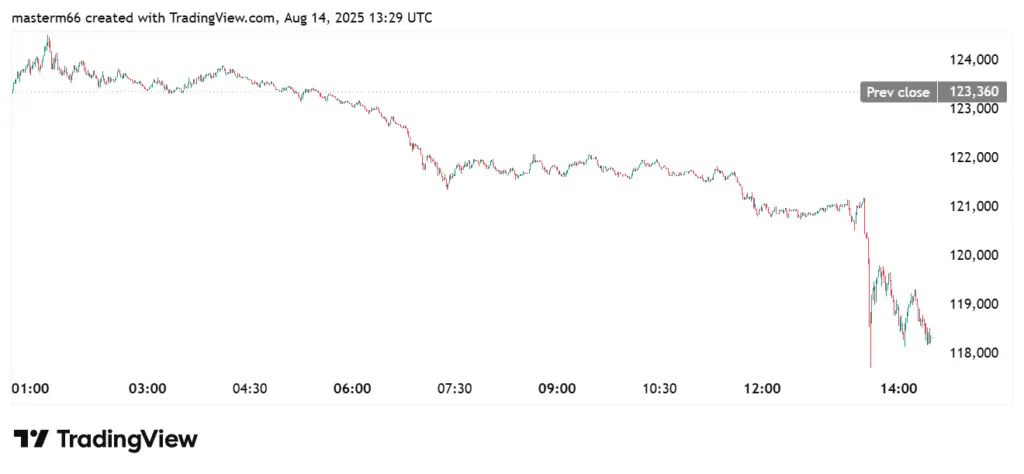

Before falling, Bitcoin reached a record $123,360.

Bessent Signals Strategic Reserve Shift As US Stops Selling Bitcoin, Maintains Its Gold Policy

According to confirmation from US Treasury Secretary Scott Bessent, the government’s Bitcoin holdings are worth between $15 billion and $20 billion.

Matthew Sigel also mentioned in an X article that the United States will stop selling Bitcoin, which suggests that there will be a significant change in how these holdings are managed.

Bessent:

Unlikely to revalue Gold holdings

Will “stop selling” Bitcoin pic.twitter.com/eLZ7Omahoz— matthew sigel, recovering CFA (@matthew_sigel) August 14, 2025

As a result of the action, Bitcoin is now seen as a long-term strategic asset.

Scott Bessent’s remarks offer insight into the US Bitcoin holdings, which rank among the world’s largest state-controlled reserves.

It is thought that some of the hoard was obtained in recent years through asset seizures.

Alongside the Bitcoin update, Bessent addressed the state of US gold reserves.

He stated that although it is unlikely to revalue gold, the Treasury will keep it as a store of value.

Depending on other market conditions, less pressure on Bitcoin sales would support a price increase.

According to Scott Bessent’s remarks, Bitcoin is viewed as an asset that may be used in addition to more conventional safe-haven assets.

By sticking to its “gold policy” while focusing more on Bitcoin reserves, the US is demonstrating its trust in a diversified reserve portfolio.

This would establish the United States as a significant player in the cryptocurrency and gold markets.

Furthermore, the Secretary of the US Treasury excluded acquiring Bitcoin to expand the nation’s BTC reserve.

Instead, he stated that the reserve will only consist of Bitcoins that have been seized.

The US reserve position for Bitcoin coincides with congressional members’ support for formal systems.

For example, the BITCOIN Act was proposed by Senator Cynthia Lummis.

This entails strategic accumulation to increase the financial resilience of the United States.

At $123,360, Bitcoin Sets Record Before Sharp Sell-Off Reduces Gains

The price of Bitcoin reached a new all-time high today before plummeting after Bessent revealed the US Bitcoin reserve.

The cost of the cryptocurrency hit $123,360 during the last trading session.

Prices dropped to $119,339 due to intense selling pressure; thus, the spike was short-lived.

Bitcoin is still up 27.51% this year and 96.39% so far, according to TradingView data.

Despite today’s decline, the asset is still 908.89% higher than it was five years ago.

The day’s value was reduced by 3.52% due to the intraday reversal.

The steep decline follows a steady price increase in the preceding months, which was aided by supply constraints and increased institutional interest.