SEC drops Custody Rule and Rule 3b-16, easing crypto custody restrictions and DeFi oversight, fostering innovation and institutional adoption.

The US SEC has withdrawn several high-profile crypto custody proposals introduced during Gary Gensler’s tenure, which is a critical development for the crypto industry. Eleanor Terrett shared an X post that indicated the withdrawn proposals, which include the contentious Custody Rule and Rule 3b-16. Is this a significant victory for the cryptocurrency industry?

The US SEC has withdrawn the crypto custody rule and other significant proposals

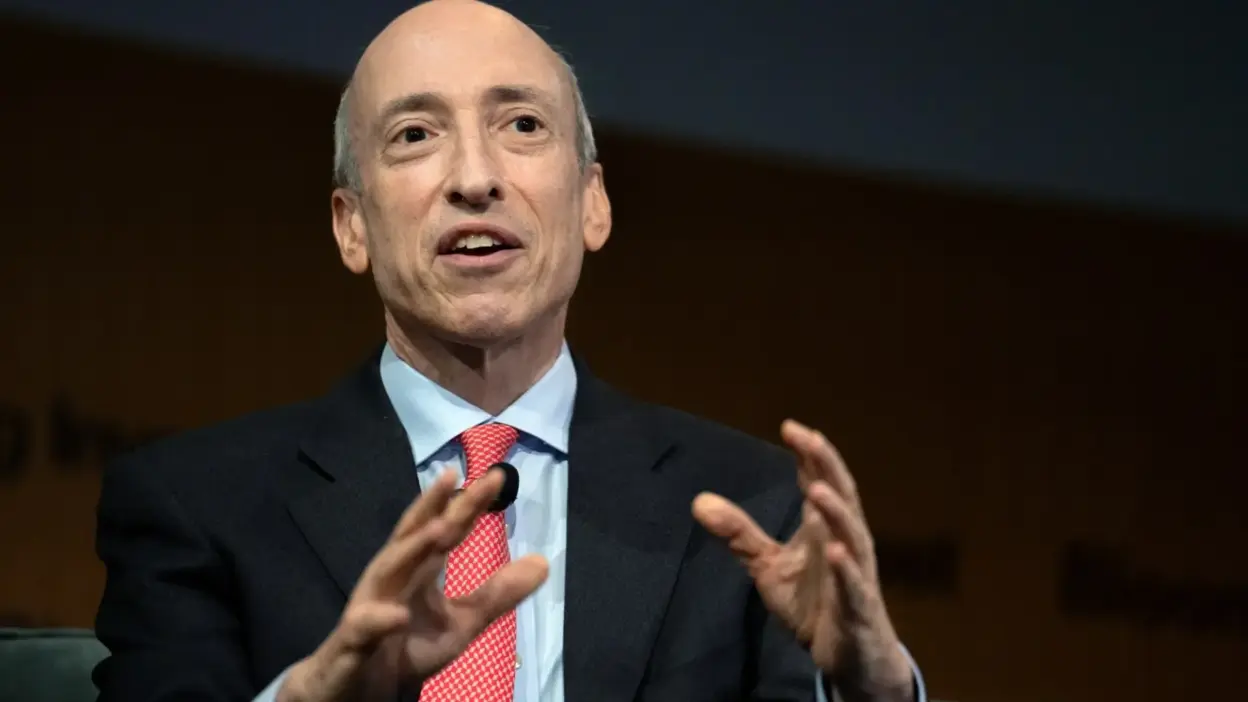

In an X post, Eleanor Terrett, a FOX Business correspondent, disclosed that the US SEC has withdrawn numerous proposed regulations that have provoked significant debate and criticism. Introduced during the Biden administration and under the supervision of former SEC Chair Gary Gensler, these regulations were designed to limit crypto-related activities.

The Custody Rule is a noteworthy proposal that the SEC has withdrawn. As per the crypto custody Rule, “An adviser has custody of client assets and must therefore comply with the rule when it holds, directly or indirectly, client funds or securities or [has] any authority to obtain possession of them.”

It is important to note that the rescinded proposal would have broadened the custody rule, requiring investment advisors to store crypto assets with qualified custodians and strengthening asset protections. According to critics, this could have exacerbated the banking industry’s reluctance to provide services to crypto firms, further restricting their access to conventional financial services.

The SEC also retracted its Exchange Act Rule 3b-16 proposal, which would have mandated that “exchanges” register as national securities exchanges or broker-dealers and comply with Regulation ATS. According to Terrett, “Rule 3b-16 proposed that DeFi exchanges/platforms could be regulated as national securities exchanges.”

Furthermore, the SEC has withdrawn proposals that pertain to investment firms’ ESG (Environmental, Social, and Governance) reporting requirements and enhanced cybersecurity risk management. This move is following the SEC’s most recent action regarding altcoin ETFs. The regulator has postponed the Grayscale Spot Hedera ETF decision.

The SEC’s decision has resulted in significant gains for cryptocurrency

The SEC’s decision to withdraw critical proposals and regulations significantly affects the crypto industry. As experts have noted, these regulations would have imposed restrictive conditions on the industry, impeding innovation and expansion. Terrett acknowledged the Custody Rule’s concerns, stating,

The Custody Rule aimed to cover all client assets including crypto, broadened what counts as “custody,” and raised concerns about whether certain state chartered entities should be qualified custodians.

Intriguingly, crypto advocates believe that the rule change indicates a significant regulatory overhaul in the United States. A new era is anticipated to emerge, diverging from Gensler’s “regulation by enforcement” approach. The current Chair, Paul Atkins, has the potential to facilitate this transition. Paul Grewal, the Chief Legal Officer of Coinbase, stated,

Down goes 3b16, qualified custodian, and all the other unfinished Gensler rule proposals. SEC just issued final notices rescinding them all.

Since President Donald Trump’s inauguration in January, the SEC has taken significant measures to ensure regulatory clarity. For instance, in April, the commission provided guidance on the disclosure of crypto assets that are classified as securities.