For the first time, the SEC has moved to combat romance scammers by accusing two purportedly fraudulent crypto exchanges of committing fraud.

By accusing two purportedly “fake crypto asset trading platforms,” the US Securities and Exchange Commission claims to have launched its first-ever action against cryptocurrency “pig butchering” scammers.

According to a statement released on September 17, the filed lawsuits against five organizations and three individuals it claimed were associated with the purportedly fraudulent exchanges NanoBit and CoinW6, accusing them of stealing close to $3.2 million after winning over investors and cultivating relationships with them on social media.

It was also stated that, “These charges represent the SEC’s first enforcement actions alleging these scams.”

Director of the Division of Enforcement Gurbir Grewal said, “In these two cases, we allege that fraudsters created fake crypto ecosystems that displayed false information to investors.”

Grewal continued, saying that the risk of these relationship investment scams “is increasing rapidly as these scams become more popular with fraudsters” and that investors should “be on heightened alert” when considering investments that strangers offer on the internet.

SEC believes scammers posed as “attractive” pros.

On September 17, the filed a lawsuit against CoinW6 in a federal court in California, claiming that the company ran a fraud operation using “a web of individuals” posing as “young, attractive professionals” that tricked at least 11 investors out of more than $2.2 million.

Between July 2022 and December 2023, it was stated that the accused scammers had contacted investors on LinkedIn and Instagram to pursue romantic connections over WhatsApp.

According to the regulator, the con artists fooled investors into opening CoinW6 accounts by promising them daily profits of up to 3% from the company’s yield farming, mining, and staking services, all of which that the US Securities and Exchange Commission claimed “were entirely fictitious.”

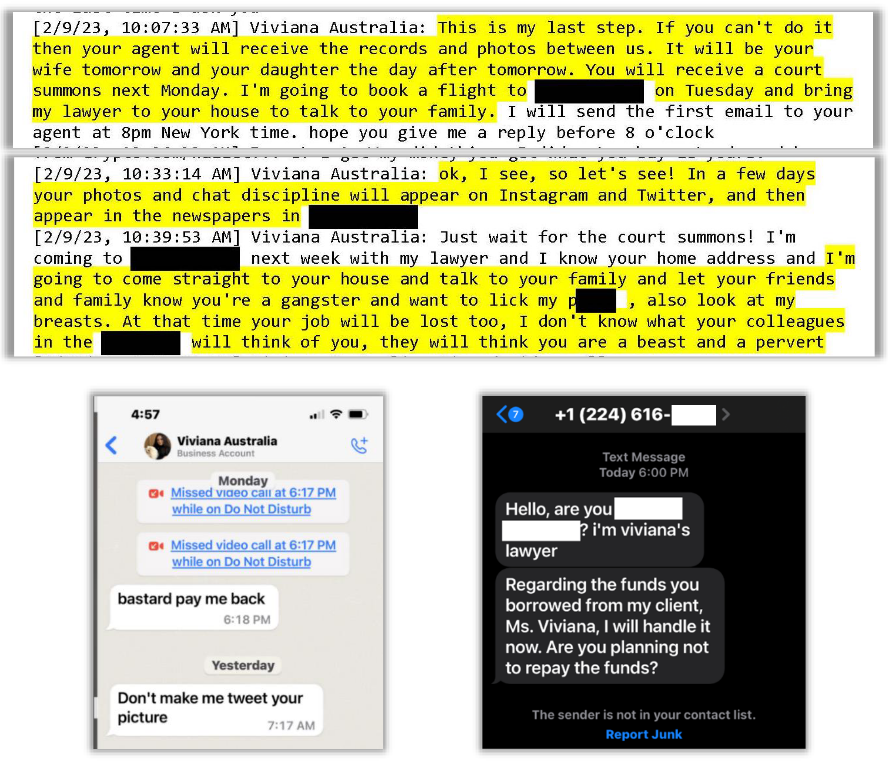

When investors attempted to withdraw their money, they were allegedly threatened with blackmail—that their passionate, private WhatsApp chats would be revealed to friends and family—or asked for additional payments for taxes and fees.

According to SEC, an anonymous investor was threatened with having their private correspondence revealed to their family, which made them refuse to transfer more money for a security deposit.

On September 17, the SEC filed a parallel lawsuit against NanoBit and six other parties in a federal court in New York, alleging that they had deceived at least eighteen people out of around $968,000 by “posing as financial industry professionals in WhatsApp groups.”

The agency claimed that to instill confidence, Nanobit and others enticed investors to utilize the platform between October 2023 and June of this year by stating that its subsidiary, NanobitUS Securities, was an SEC-registered broker.

Additionally, Iit was asserted that they promoted “entirely fake” initial coin offerings. Additionally, the agency said that the NanoBit platform was fraudulent and that investor monies were routed to Hong Kong bank accounts.

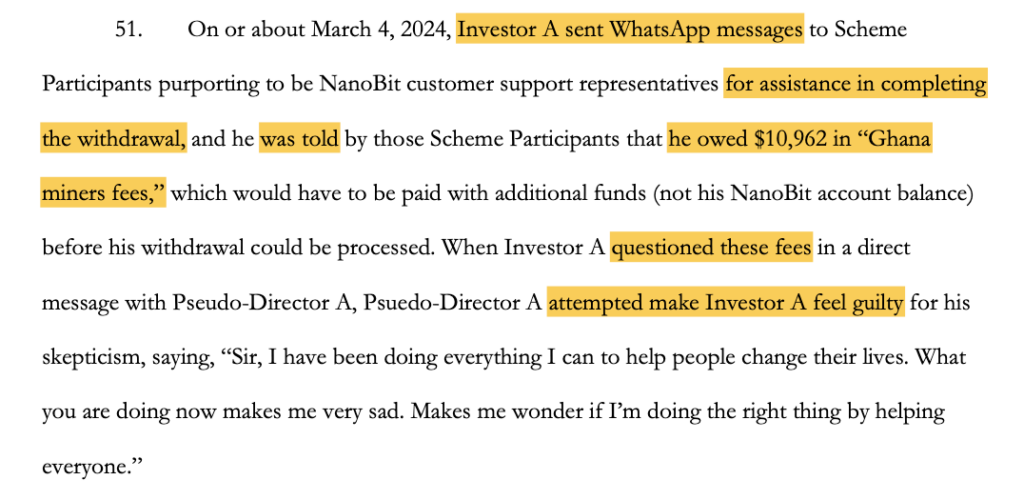

When investors attempted to withdraw money from NanoBit, they were met with more fees and justifications for being unable to do so. Per the complaint, one anonymous investor was informed that they could not withdraw money because they owed almost $11,000 in “Ghana miners fees.”

Both CoinW6 and NanoBit were accused by the SEC of breaking antifraud provisions of securities laws. CoinW6 was also charged with promoting and vending securities that were not registered.

The SEC is suing both companies for disgorgement with prejudgment interest, fines, and permanent injunctions.