SEC defeats YouTuber as a US federal judge sided with the SEC that the YouTuber broke securities laws by participating in a 2018 crypto ICO promo.

A Texas federal court judge has ruled that cryptocurrency YouTuber Ian Balina sold unregistered securities when he purchased Sparkster (SPRK) tokens and offered them to United States investors in an investment pool.

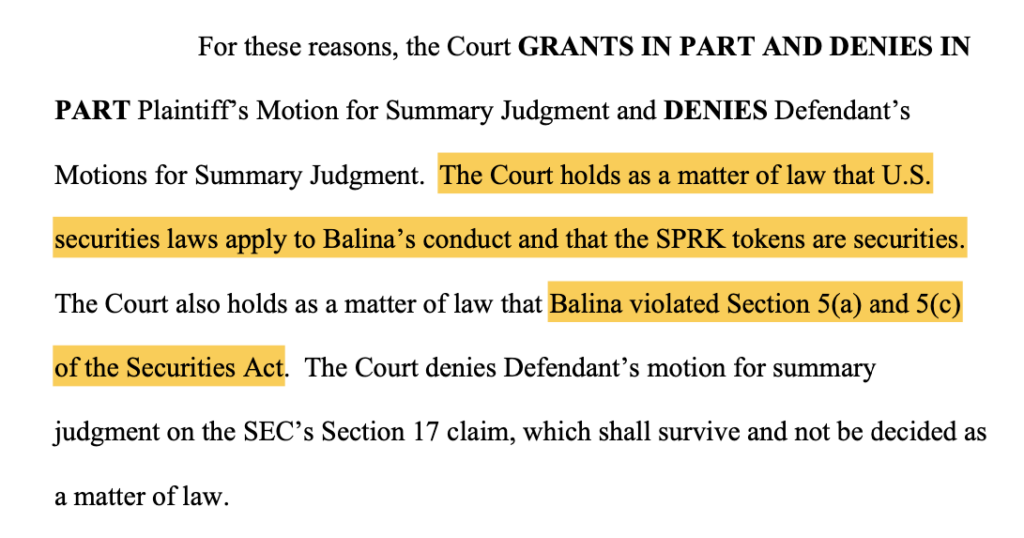

In a May 22 order, Judge David Alan Ezra stated, “As a matter of law, the Court has determined that U.S. securities laws govern Balina’s actions and that SPRK tokens qualify as securities.” This decision partially favored the Securities and Exchange Commission, which initiated the lawsuit in 2022.

By the securities-determining Howey test, the court determined that SPRK was an investment contract in which investors consolidate funds into a joint enterprise with the expectation of profiting from the efforts of others.

By the SEC’s conclusion that Balina “targeted United States investors on purpose,” Judge Ezra denied the influencer’s motion for summary judgment, arguing that the SEC had no authority because the sales occurred outside the United States.

As a result of factual inconsistencies identified by the court, the SEC’s claim that Balina needed to disclose a compensation agreement with Sparkster CEO Sajjad Daya adequately was unsuccessful.

According to the lawsuit filed by the SEC, Balina acquired SPRK worth $5 million between May and July 2018, promoted the tokens on numerous social media platforms, and created a Telegram group to serve as an investment pool.

Furthermore, he should have informed investors that Sparkster had awarded him a 30% incentive on his acquired tokens. Balina said the purported SEC incentive was a standard volume discount from a private pre-sale transaction.

Sparkster promoted itself as a “low-code” blockchain application development platform between April and July 2018 and conducted its SPRK token initial coin offering (ICO).

It agreed with the SEC in September 2022 to eliminate all trading platforms and extinguish its remaining SPRK tokens without admitting or denying the regulator’s claims. It was ordered by the SEC to pay a disgorgement of $30 million, interest of $4.6 million, and a civil penalty of $500,000.

Ballina failed to provide an immediate response when contacted for comment.