SEC Chief Accountant Paul Munter says staff opinions on a controversial rule restricting banks from offering cryptocurrency custody services “remain unchanged.”

The US Securities and Exchange Commission appears to be “digging in” on its position about a rule that would limit the amount of cryptocurrency custody services available to regulated financial institutions.

The chief accountant Paul Munter addressed the agency’s regulatory position on accounting for cryptocurrency assets in a speech at a banking conference on September 9, with a particular emphasis on SEC Staff Accounting Bulletin No. 121 (SAB 121) and its uses.

He declared, “The staff’s opinions in SAB 121 remain unchanged.”

“The staff believes an entity should record a liability on its balance sheet to reflect its obligation to safeguard crypto-assets held for others, absent particular mitigating facts and circumstances,” Munter continued.

The president of ETF Store, Nate Geraci, stated in an X post dated September 10 that the SEC “appears dug in” on SAB 121.

He continued, “They just don’t want to give regulated financial institutions the capacity to custody cryptocurrency.”

In March 2022, the SEC it released SAB 121, outlining its accounting standards for organizations wishing to hold cryptocurrency assets.

Since it forbade banks and other regulated financial organizations from custodying cryptocurrency assets on behalf of clients, the rule caused division in the political community.

According to the Securities and Exchange Commission , companies that have these kinds of safeguards in place ought to list digital asset liabilities on their balance sheets.

According to Munter, the Securities and Exchange Commission has examined several accounting situations involving cryptocurrency and blockchain assets and has admitted that not all of the arrangements adhere to the suggested standards outlined in SAB 121.

According to him, bank-holding companies that preserve cryptocurrency through bankruptcy protection could avoid listing a liability on their balance sheets.

Furthermore, it’s possible that “broker-dealers” who assist with cryptocurrency transactions but maintain ownership of the cryptographic keys won’t need to disclose their obligations.

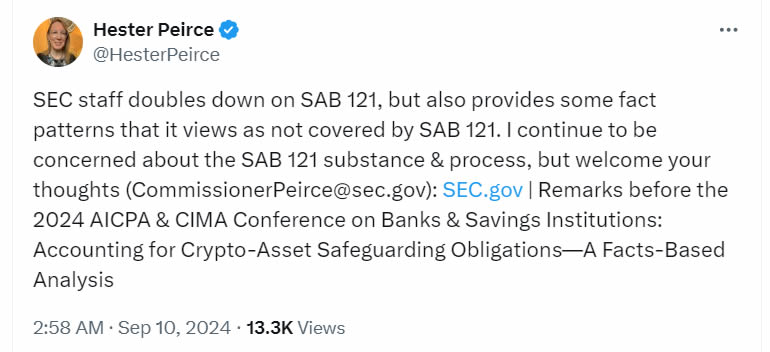

SEC Commissioner Hester Peirce, who has been outspoken in her criticism of the rule, stated on X that she was still “concerned about the SAB 121 substance and process.”

In May, the US House of Representatives passed a resolution to repeal contentious SEC guidance. But the next month, President Biden vetoed the repeal.