The SEC argued in a court filing that Coinbase cannot require the regulator to create new cryptocurrency regulations “from the ground up”

The United State Securities and Exchange Commission (SEC) has requested in a new filing that the court deny Coinbase’s petition to establish a novel regulatory framework for cryptocurrencies.

In a March filing, Coinbase asserted that the regulator “does not have statutory authority” to expand the current securities regime to include crypto assets. The company further claimed that the regulator was “advancing without authorization from Congress” and “getting away with it through enforcement actions.” According to the cryptocurrency exchange, any decision to extend the current securities regime should be “made and implemented through prospective rulemaking.”

Coinbase’s claim that current regulations are “impracticable” and a novel regulatory structure ought to be established “from the foundation up” was rejected by SEC attorneys in a filing with the United State Court of Appeals for the Third Circuit on Friday.

“Rational and well within the Commission’s discretion,” the regulator argued of its “incremental approach” to applying the existing regulatory framework to crypto asset securities.

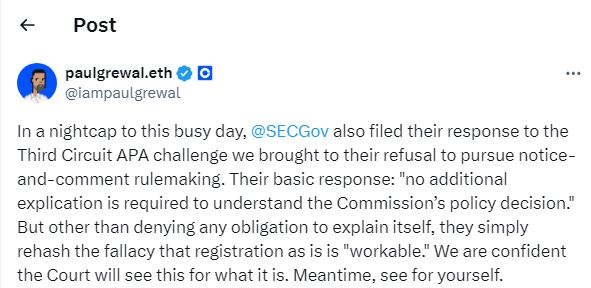

Paul Grewal, chief legal officer of Coinbase, referred to the SEC’s claim that the existing registration process is “workable” as a “fallacy” in a tweet. The exchange is “confident the Court will recognize this for what it is.”

Coinbase and the SEC

Since the regulator filed suit against Coinbase in June 2023, contending that it had not registered as an exchange, clearing house, or broker despite offering these services to investors and had sold unregistered securities through its staking service, the SEC and Coinbase have been at odds.

Coinbase, in its denial of the allegations, asserts that the tokens it lists do not meet the definition of securities as per the standards for “investment contracts.”

Using court filings and public statements, the exchange has waged a vigorous campaign to refute the SEC’s “regulation by enforcement” strategy and advocate for “new legislation and rulemaking” to govern the cryptocurrency industry.

Coinbase has also begun pursuing political candidates who support cryptocurrencies by contributing $21.5 million to the Fairshake super PAC. Grewal stated earlier this month in a tweet that the SEC’s “litigation campaign” prompted its support of the PAC and demanded the election of pro-crypto candidates who “understand the need for clear rules of the road.”

Notwithstanding Coinbase’s utmost endeavours, the SEC’s lawsuit against the exchange persists. In late March, the federal judge presiding over the case rendered a decision permitting its progression. The judge determined that the regulator’s arguments against the cryptocurrency exchange are predominantly “plausible” and rejected Coinbase’s motion to dismiss the case entirely.