SEC renews attempt to dismiss Debt Box suit, says case dismissal without prejudice is normally granted when a plaintiff requests it.

The United States Securities and Exchange Commission (SEC) has taken an additional step in its ongoing effort to dismiss its lawsuit against Debt Box, also known as Digital Licensing, a software provider for cryptocurrency mining. In response to the agency’s motion for the case to be dismissed without prejudice, the court granted the agency the opportunity to re-file suit against Debt Box.

The U.S. District Court for Utah Northern Division sanctioned the SEC for an “egregious abuse of authority,” and its initial motion to dismiss the case without prejudice was denied. Additionally, it mandated that Debt Box be held liable for reimbursement of legal expenses. Debt Box petitioned the court not to prejudice the dismissal of the case, describing the motion as an attempt to evade permanent dismissal.

According to the SEC, Debt Box investors benefited from the ability to resubmit an action, and precedent demonstrated that a court “normally should grant” a plaintiff’s motion to dismiss without prejudice. The statement read:

“The SEC seeks dismissal without prejudice to allow the new team of attorneys assigned to the case to analyze the case file and take additional investigative steps before determining whether or not to proceed with a new complaint.”

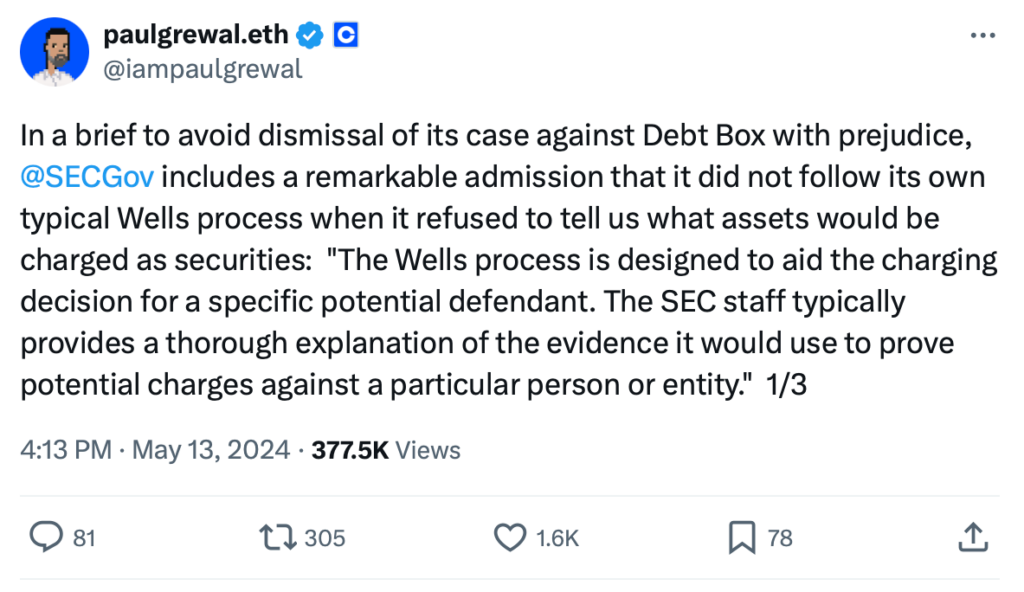

If a dismissal were to be granted without prejudice, Debt Box intended to impose eleven conditions on the SEC if the case was to be refiled. The SEC accepted the majority of those conditions in whole or in part. Completing investigation files and issuing a Wells notice—a warning from the SEC that charges are imminent—were prerequisites. The SEC endeavored to restrict the quantity of information that would be appended to the notice.

An objection was raised by the SEC to a condition that would have mandated the submission of all material subpoenaed in the case to Debt Box and the presence of a representative at non-subpoenaed interviews during the investigation. In conclusion, it expressed opposition to a requirement that its investigation yield potentially exculpatory information—that is, information that would be advantageous to the defendant.

Debt Box is charged with defrauding $50 million from investors and selling unregistered securities in the form of licenses to extract digital assets using their software.

In August, the SEC temporarily froze the company’s assets. The court sanctioned the agency for this decision after concluding that it had justified it with a “false narrative” concerning the company’s alleged intentions to relocate overseas. “Deep regrets” were expressed by the SEC regarding that action.