The SEC claims Cumberland traded crypto assets like POL, SOL, FIL, ALGO, and ATOM, which it classifies as securities under investment contracts.

Chicago-based cryptocurrency market maker Cumberland was charged by the US SEC on Thursday for operating without a dealer license in securities transactions worth more than $2 billion.

According to their complaint, Cumberland has been regularly conducting business by buying and selling cryptocurrency assets categorized as securities for its own accounts without registering them since March 2018.

Additionally, the complaint claims that Cumberland uses its Marea platform or the phone to perform deals continuously. Furthermore, according to The Securities and Exchange Commission, Cumberland often trades cryptocurrency assets on third-party exchanges regarded as investment contracts.

More precisely, Cumberland is accused of having enabled the trade of several assets regarded as securities because they are investment contracts. The organization also listed assets, including ATO, SOL, FIL, ALGO, and POL (formerly MATIC).

Cumberland contests the SEC’s designation of securities in cryptocurrency transactions.

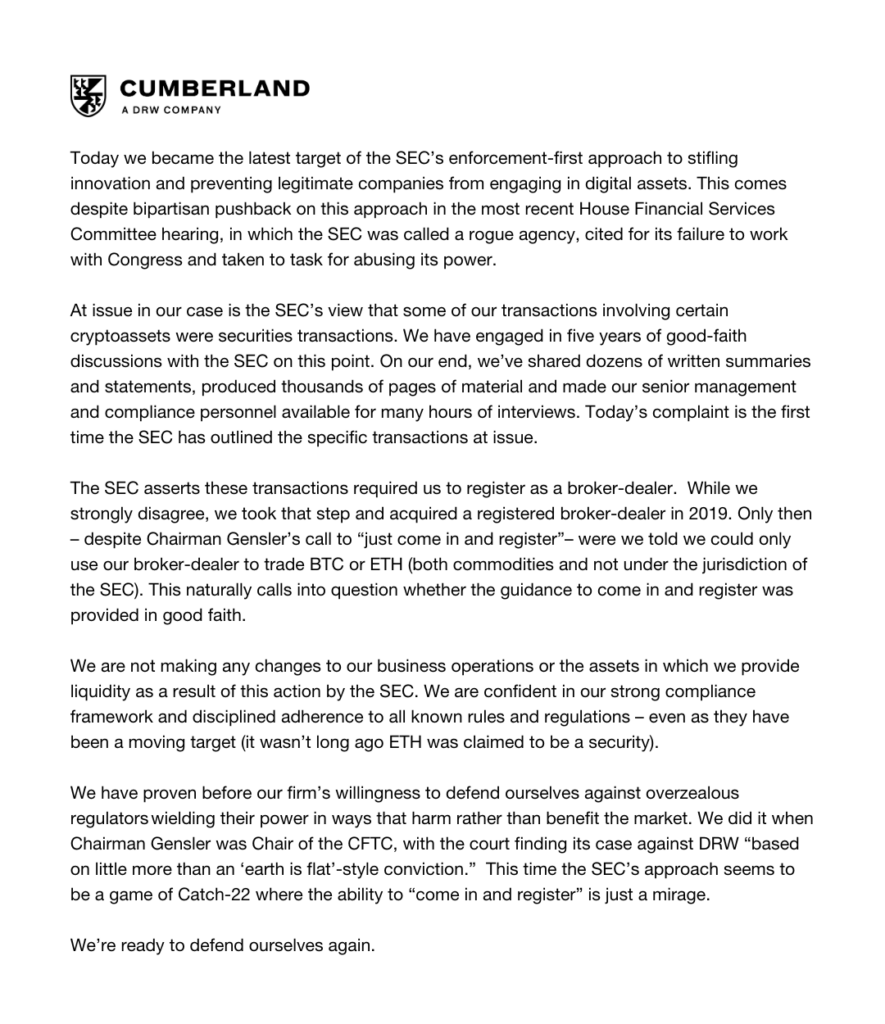

In response to the SEC’s accusations, Cumberland said it had become the latest target to restrict innovation and criticized the agency’s enforcement-first strategy. The business expressly contested the SEC’s classification of some transactions involving crypto assets as securities.

The company stated, “We have had good-faith discussions with The SEC regarding this matter for the past five years.” “We have provided hundreds of pages of content, offered dozens of written summaries and declarations, and made our senior management and compliance staff available for numerous hours of interviews. The SEC has yet to describe the precise transactions as part of its complaint today.

In reaction to the SEC’s move, Cumberland further stated that it will continue business as usual.