SEC Commissioner Paul Atkins says the agency will shape crypto policy using the “notice and comment” process, inviting public input on future regulations.

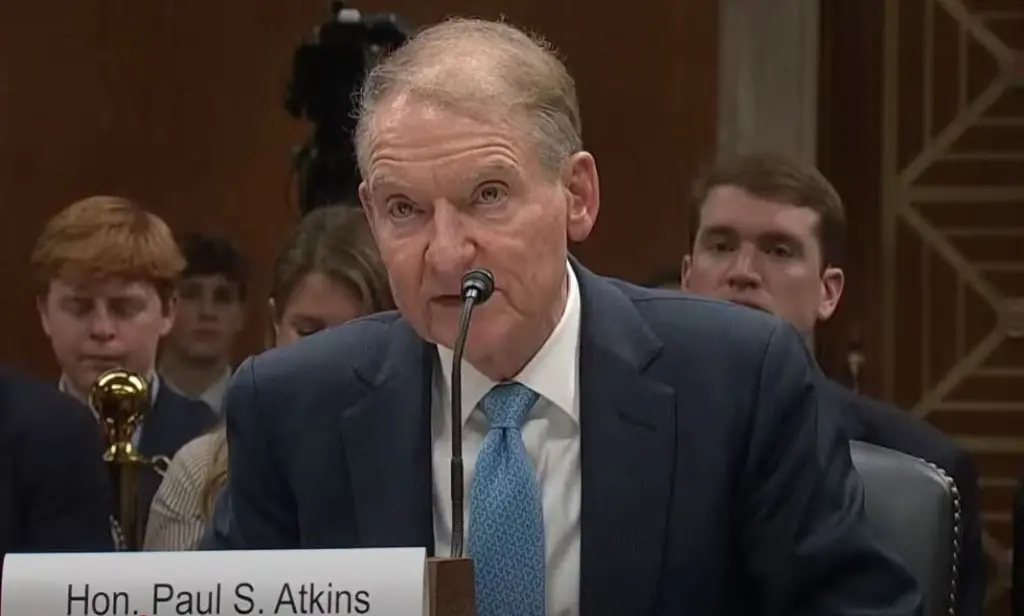

Paul Atkins, the chair of the Securities and Exchange Commission, stated to a Senate panel that he would handle cryptocurrency “through notice and comment rulemaking, not through regulation by enforcement.”

Paul Atkins said to Congress that the agency would no longer use the courts to shape its regulations but instead use “notice and comment” to refine its crypto policy.

Atkins stated that the agency’s crypto policymaking “will be done through notice and comment rulemaking, not through regulation by enforcement” in remarks on June 3 to the Senate Appropriations Subcommittee on Financial Services.

He said, “The commission will use its current authority to set fit-for-purpose standards for market participants.”

According to Atkins, a former crypto lobbyist, one of the SEC’s top priorities during his term will be developing a “rational regulatory framework for crypto assets.”

The crypto sector attacked former SEC Chair Gary Gensler, arguing that he developed crypto policy through lawsuits and settlements rather than establishing rules.

“The enforcement approach of the commission will revert to the original intent of Congress, which is to police violations of these established obligations, especially about fraud and manipulation,” Atkins stated.

To prevent lawbreakers from breaking the law, he noted, the agency will set “clear rules of the road” for issuing, custody, and trading cryptocurrency.

“Investor protection against fraud requires clear rules of the road, not least to assist them in identifying scams that do not comply with the law,” he stated.

Senator Chris Coons, a Democrat, questioned Atkins about his willingness to support cryptocurrency exchanges that deal with both digital tokens and conventional stocks.

Instead of directly responding to the query, Atkins stated that the agency’s Crypto Task Force is developing rules “that make sense for the industry and that allow for innovation.”

In a May 20 appearance before parliamentarians, Atkins stated that the Crypto Task Force would publish its initial report within the coming months.

Acting SEC chair Mark Uyeda established the agency’s Crypto Task Force on January 21 to create a practical crypto framework that the agency could utilize.

FinHub of the SEC is under threat.

Additionally, Atkins stated that he has requested congressional authority to dissolve the agency’s Strategic Hub for Innovation and Financial Technology, which was established in 2018 with an emphasis on fintech-related areas.

“Innovation should not be restricted to a relatively small office but should be embedded in the culture of the SEC as a whole,” Atkins stated.

“The values and goals that guided its founding weave through the SEC’s foundation.”

The agency has taken a different stance on cryptocurrency since Gener’s resignation on January 20 and has dropped long-running enforcement actions against cryptocurrency companies.

Along with information about how federal securities laws may apply to cryptocurrency, the agency staff has also issued guidance regarding the most popular crypto staking activities, stating that they do not contravene securities rules.