Sei, the layer-1 blockchain for high-frequency crypto trading, experienced a more than 25% increase in the price of its native token over the past 24 hours

Sei experienced a significant increase in value on Sept. 25, rising from an intraday low of $0.366 to a high of $0.471 earlier in the day on prominent exchanges.

The token’s market capitalization has reached $1.6 billion, marking the most significant level since June 12, according to CoinGecko data. This places it as the 59th largest digital asset globally.

The price increase coincided with an 187% increase in its daily trading volume, presently at approximately $523 million.

Additionally, Coinglass data indicates that SEI’s daily open interest increased by 34.4% to $170.3 million at the time of writing, suggesting that SEI’s ongoing rally is driven by increased investor activity.

SEI had exited a falling wedge pattern on the 1-day chart, a technical configuration that typically indicates additional upside potential.

Additionally, it has breached the upper Bollinger Band, which is currently at $0.4503, suggesting that upward momentum remains robust.

The Directional Movement Index indicates diminished selling pressure, as evidenced by a rising +DI and a declining -DI, which suggests that bullish momentum is on the rise.

Simultaneously, the Average Directional Index is increasing, indicating that the bullish trend, which was previously weak, is gathering momentum.

Traders should monitor the $0.50 mark in light of the current trend, which can serve as the next psychological resistance. A successful breach of this level and robust volume could potentially propel the price to $0.55 or higher.

Nevertheless, the Relative Strength Index, currently overbought at 74, suggests the potential for a near-term correction or consolidation. The middle Bollinger Band, located at $0.3224, may function as a critical support level in the event of a reversal.

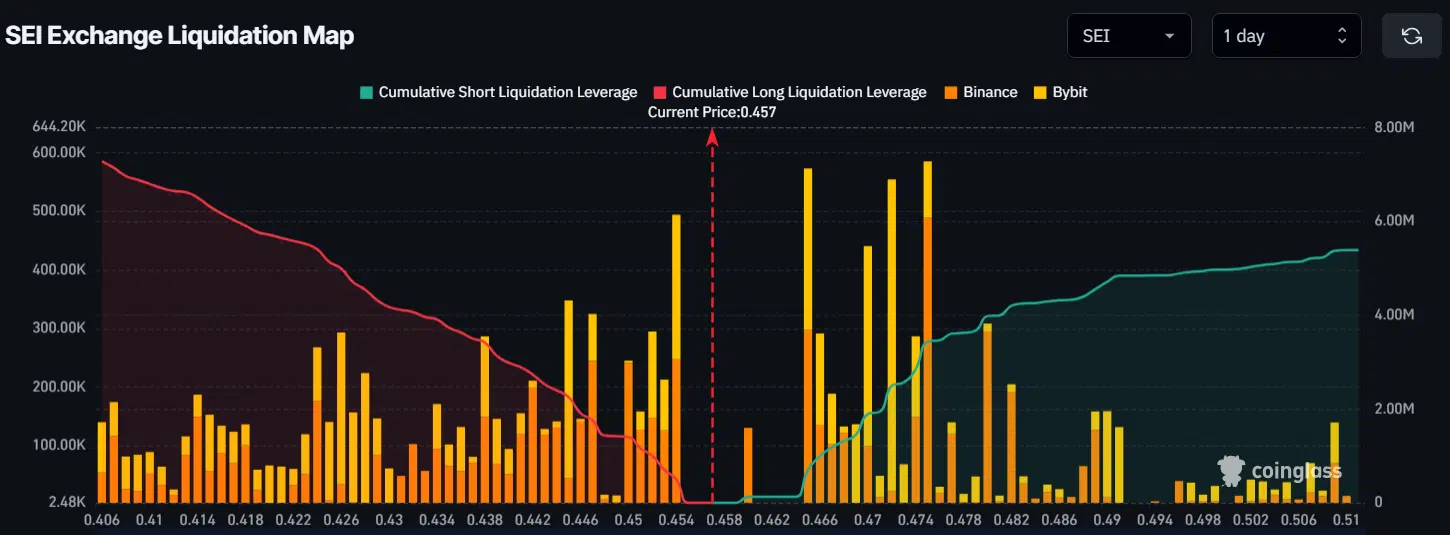

Major liquidation levels

According to Coinglass, the primary liquidation thresholds for SEI are approximately $0.454 on the downside and $0.475 on the upside, with intraday traders employing substantial leverage at these levels.

Nearly $494.47K in long positions could be liquidated if SEI falls to $0.454. In contrast, the liquidation of approximately $3.44 million in short positions could result in a rise to $0.475 in the stock price.

Bulls appeared to be in control at the time of publication, and there was a possibility that short positions could be liquidated at higher levels.