With its most recent acquisition, Semler Scientific now owns 1,273 BTC, valued at $114 million at current market values.

Since implementing its Bitcoin treasury strategy earlier this year, tech solutions business Semler Scientific reported a 37.3% Bitcoin yield, indicating notable growth for stakeholders.

The organization evaluates the effectiveness of its BTC acquisition strategy using the Bitcoin BTC$90,672 yield as a key performance measure. According to the corporation, the KPI is used to “supplement an investor’s understanding” of the company’s choice to issue more shares of its ordinary stock to finance Bitcoin purchases.

In addition to Semler Scientific, business analytics company MicroStrategy tracks the performance of its Bitcoin purchases using BTC yield.

Bitcoin holdings at Semler Scientific have increased to 1,273.

The business revealed on November 18 that, between November 6 and 15, it had paid $17.7 million in cash for an extra 215 Bitcoin. The average cost of purchasing the coins, including additional costs and fees, was $82,502.

Semler Scientific recently acquired 1,273 Bitcoin, bringing its total holdings to $88.7 million at an average price of $69,682. At the current price of $89,600, the company’s Bitcoin holdings are worth almost $114 million.

According to a press release from Semler Scientific chairman Eric Semler, the company’s Bitcoin yield statistics show “substantial Bitcoin accretion” for its owners. Semler stated:

“We have achieved a BTC Yield of 37.3% since adopting our Bitcoin treasury strategy in the second quarter of this year.”

Doug Murphy-Chutorian, the company’s CEO, stated on November 4 that Semler Scientific is “laser-focused on acquiring and holding Bitcoin.” The CEO added that the business is looking into financing options to purchase further Bitcoin.

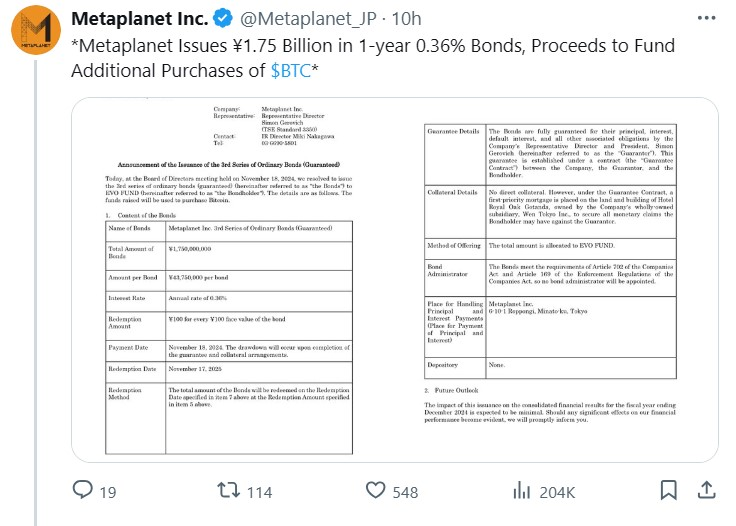

Metaplanet plans to issue bonds for $11.3 million to purchase more Bitcoin.

On Monday, November 18, the Japanese investment firm Metaplanet also revealed plans to buy more Bitcoin.

Metaplanet said that to purchase more Bitcoin, it issued one-year ordinary bonds valued at 1.75 billion yen, or roughly $11.3 million. According to the publicly traded corporation, the board of directors issued the bonds at a 0.36% yearly interest rate. On November 17, 2025, the corporation established the redemption rate.