As the Senate Crypto Bill, a landmark effort to regulate stablecoins, encounters an unexpected stall in Washington, the future of digital finance remains uncertain

The Senate Crypto Bill, introduced with bipartisan support, aimed to bring transparency and compliance into this space, proposing federal oversight to prevent misuse, ensure reserves, and manage systemic risk. Yet despite growing urgency and high-level debates, the bill has stalled—leaving the industry and regulators in a precarious limbo.

This article dives into why the Senate Crypto Bill has lost momentum, analyzing the political, economic, and industry-specific challenges that have slowed its progress. We’ll also explore what this means for the future of stablecoin regulation, the potential implications for crypto innovation, and what stakeholders can expect as new discussions unfold in Congress.

The Senate Crypto Bill: An Overview

Origins and Objectives

The Senate Crypto Bill, formally known as the GENIUS Act (Guiding and Establishing National Innovation for U.S.

Stablecoins), was introduced in early 2025 by Senator Bill Hagerty (R-TN), with co-sponsorship from Senators Kirsten Gillibrand (D-NY), Cynthia Lummis (R-WY), and Tim Scott (R-SC).

This bipartisan initiative aimed to establish the first comprehensive federal regulatory framework for stablecoins, addressing the growing need for oversight in the rapidly expanding digital asset market.

The bill sought to balance innovation with consumer protection, ensuring that stablecoins could be integrated safely into the U.S. financial system.

The Senate Crypto Bill was designed to provide clarity and security in the issuance and management of stablecoins, which are digital assets pegged to traditional currencies like the U.S. dollar.

By setting clear guidelines, the bill intended to foster innovation while mitigating risks associated with unregulated digital currencies.

Key Provisions

Central to the Senate Crypto Bill were several key provisions aimed at regulating stablecoin issuers and ensuring financial stability:

- Licensing Requirements: Stablecoin issuers would be required to obtain a federal license, subjecting them to stringent regulatory oversight.

- Reserve Backing: Issuers must maintain 1:1 reserves, ensuring that each stablecoin is backed by U.S. dollars, insured bank deposits, or short-term Treasury bills.

- Transparency and Auditing: Regular audits and public disclosures would be mandated to verify the backing of stablecoins and maintain public trust.

- Prohibition of Algorithmic Stablecoins: The bill would ban algorithmic stablecoins, which rely on complex algorithms rather than traditional assets to maintain their value.

- Consumer Protections: The legislation included measures to protect consumers, such as clear disclosures about risks and mechanisms for dispute resolution.

These provisions were crafted to create a secure environment for stablecoin transactions, promoting confidence among users and investors.

Bipartisan Efforts

The Senate Crypto Bill garnered initial bipartisan support, reflecting a shared recognition of the importance of regulating the burgeoning stablecoin market.

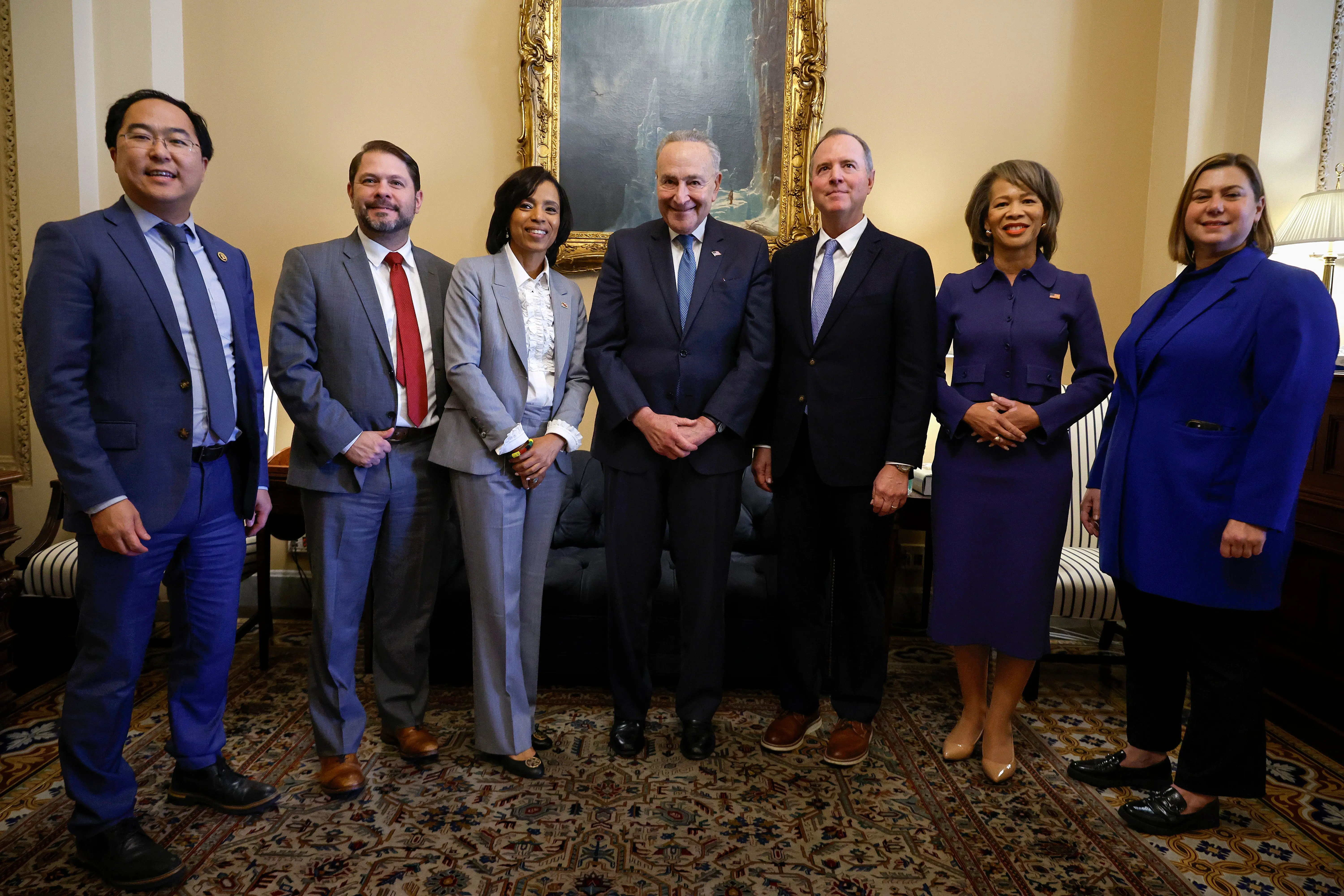

The Senate Banking Committee advanced the bill with an 18-6 vote, including backing from Democratic Senators Mark Warner, Andy Kim, Lisa Blunt Rochester, Ruben Gallego, and Angela Alsobrooks.

This cross-party collaboration underscored a collective effort to establish a regulatory framework that balances innovation with financial security.

However, the bill’s progression faced challenges as concerns arose over its provisions, leading to debates and calls for revisions to address issues related to consumer protection and financial system risks.

Despite these hurdles, the bipartisan foundation of the Senate Crypto Bill highlighted a significant step toward comprehensive stablecoin regulation in the United States.

The Stall: Unpacking the Roadblocks

Democratic Withdrawal

The Senate Crypto Bill, initially enjoying bipartisan support, encountered a significant setback when nine Senate Democrats withdrew their backing.

These senators, including Ruben Gallego, Mark Warner, Lisa Blunt Rochester, and Andy Kim, expressed concerns that the bill’s revised version failed to adequately address issues related to money laundering and financial system risks.

They emphasized the need for stronger provisions on anti-money laundering, national security, and accountability standards to ensure the integrity of the financial system.

This withdrawal of support from key Democrats has complicated the bipartisan efforts to advance the Senate Crypto Bill, highlighting the challenges in achieving consensus on crypto regulation.

Ethics Concerns

The progress of the Senate Crypto Bill has also been influenced by ethical concerns surrounding former President Donald Trump’s alleged ties to a $2 billion stablecoin deal.

World Liberty Financial, a crypto company partly owned by Trump and his family, is involved in a significant investment from Abu Dhabi’s MGX into a Trump-connected crypto venture.

This arrangement has raised conflict-of-interest and national security concerns, prompting Democratic senators to demand an ethics investigation.

The intertwining of political interests with crypto ventures has heightened scrutiny and skepticism among lawmakers, further stalling the Senate Crypto Bill.

Internal Party Divisions

Internal conflicts within the Democratic Party have also played a role in the stalling of the Senate Crypto Bill.

Senator Elizabeth Warren, a prominent critic of cryptocurrency, has expressed strong opposition to the bill, citing concerns over potential fraud and corruption in the crypto space.

She has been vocal about the need for stricter regulations to prevent illicit activities and protect consumers.

These internal divisions underscore the broader challenge of forming consensus on crypto policy within the Democratic Party, contributing to the bill’s stalled progress.

The Political Chessboard: Stakeholders and Strategies

Republican Stance

Republican lawmakers, led by Senator Bill Hagerty (R-TN), remain steadfast in their support for the Senate Crypto Bill, viewing it as a crucial step toward establishing a clear regulatory framework for stablecoins.

Senator Hagerty has advocated for an incremental approach to crypto legislation, emphasizing the need for simplicity and clarity to foster innovation in the rapidly evolving digital asset space.

He has criticized the current regulatory environment, particularly the Securities and Exchange Commission’s (SEC) approach, which he perceives as overreaching and stifling to the industry.

The Block

Despite setbacks, Republicans are actively seeking to revive bipartisan support for the Senate Crypto Bill, arguing that a well-defined regulatory structure is essential for the United States to maintain its leadership in financial technology.

Democratic Leadership

On the Democratic side, Senate Majority Leader Chuck Schumer has expressed cautious optimism regarding the Senate Crypto Bill.

While acknowledging the importance of regulating the burgeoning crypto market, Schumer has called for thorough revisions to address concerns related to consumer protection, national security, and potential conflicts of interest.

He has urged fellow Democrats to leverage their influence to ensure that any legislation passed includes robust safeguards against money laundering and other illicit activities.

Schumer’s approach reflects a broader Democratic strategy of balancing the promotion of innovation with the imperative of protecting the financial system and consumers.

Crypto Industry Response

The crypto industry has responded to the legislative developments with a mix of support and criticism.

Prominent figures like Tyler Winklevoss, co-founder of the Gemini cryptocurrency exchange, have voiced strong opinions on the matter.

Winklevoss has criticized regulatory efforts he perceives as overly restrictive, arguing that they hinder innovation and unfairly target the crypto sector.

The industry’s reactions underscore the complex dynamics at play, as stakeholders navigate the challenges of establishing a regulatory framework that fosters innovation while ensuring financial stability and consumer protection.

Implications for Stablecoin Regulation

Regulatory Uncertainty

The stalling of the Senate Crypto Bill, formally known as the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act, has significantly heightened regulatory uncertainty within the U.S. cryptocurrency market.

This legislative impasse leaves stablecoin issuers, investors, and financial institutions navigating a fragmented and ambiguous regulatory landscape.

Stablecoins, digital assets pegged to traditional currencies like the U.S. dollar, have become integral to the crypto ecosystem, facilitating transactions and providing liquidity.

However, the absence of a comprehensive federal framework, as proposed by the Senate Crypto Bill, means that these assets operate under a patchwork of state regulations and informal guidelines.

This lack of clarity hampers innovation, as companies are hesitant to develop new products without clear compliance standards.

Moreover, the uncertainty affects consumer protection. Without standardized regulations, consumers may be exposed to varying levels of risk, depending on the jurisdiction and the specific stablecoin issuer.

The Senate Crypto Bill aimed to address these concerns by establishing uniform reserve requirements and oversight mechanisms, thereby enhancing trust in stablecoin transactions.

Global Competitiveness

The delay in enacting the Senate Crypto Bill also has implications for the United States’ position in the global digital asset landscape.

Other countries are rapidly advancing their regulatory frameworks to accommodate and encourage crypto innovation.

For instance, the European Union’s Markets in Crypto-Assets (MiCA) regulation provides a comprehensive approach to digital asset oversight, offering clarity and fostering growth within the sector.

In contrast, the U.S.’s regulatory ambiguity may drive crypto enterprises to relocate to jurisdictions with more favorable regulatory climates.

This potential exodus could lead to a loss of technological leadership and economic opportunities.

The Senate Crypto Bill was designed to prevent such outcomes by creating a balanced regulatory environment that promotes innovation while ensuring financial stability.

Furthermore, the bill’s provisions aimed to reinforce the U.S. dollar’s dominance in the global financial system.

By establishing clear guidelines for dollar-backed stablecoins, the legislation sought to encourage their adoption in international transactions, thereby extending the reach of the U.S. currency in the digital age.

Investor Confidence

Investor confidence is another critical area affected by the stalling of the Senate Crypto Bill. Investors seek assurance that the assets they engage with operate under a transparent and secure regulatory regime.

The current legislative gridlock may erode confidence, leading to increased market volatility and hesitancy in capital deployment within the crypto sector.

The Senate Crypto Bill aimed to bolster investor trust by mandating stringent reserve requirements and regular audits for stablecoin issuers.

These measures were intended to ensure that each stablecoin is fully backed by tangible assets, thereby mitigating risks associated with de-pegging and insolvency.

Moreover, the bill proposed clear consumer protection standards, including transparency in operations and accountability mechanisms.

Such provisions are crucial for safeguarding investors against fraud and ensuring the integrity of the stablecoin market.

Without these protections in place, investors may remain wary of participating in the crypto economy, slowing its growth and adoption.

What’s Next? Potential Paths Forward

Revisions and Compromises

The Senate Crypto Bill, formally known as the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act, has encountered significant hurdles due to ethical concerns and partisan divisions.

To revive support, lawmakers are considering targeted revisions. One proposal is to enhance anti-money laundering provisions and strengthen oversight of foreign-backed stablecoin issuers like Tether.

Senate Majority Leader Chuck Schumer has advocated for further revisions to address these concerns, emphasizing the need for bipartisan collaboration.

Additionally, some Democrats have suggested reintroducing previously rejected amendments to bolster consumer protections and ensure greater transparency.

These compromises aim to address the ethical issues raised by former President Trump’s alleged ties to a $2 billion stablecoin deal, which have influenced the bill’s progress.

Alternative Legislation

While the Senate Crypto Bill remains in flux, other legislative efforts are gaining attention. The Stablecoin Transparency and Accountability for a Better Ledger Economy (STABLE) Act, introduced in the House, seeks to establish clear regulatory guidelines for stablecoins.

This bill emphasizes the importance of transparency and accountability in the issuance and operation of stablecoins.

Moreover, the House of Representatives is revisiting efforts to regulate cryptocurrencies, with key Republican leaders introducing a new draft of digital asset market structure legislation.

This proposed framework aims to clarify which digital assets fall under securities laws and which do not, addressing a long-standing conflict between regulators and the crypto industry.

These alternative legislative efforts indicate a broader commitment to establishing a comprehensive regulatory framework for digital assets, even as the Senate Crypto Bill faces challenges.

Timeline and Outlook

Despite the current impasse, there is cautious optimism about the future of stablecoin regulation.

Senate Majority Leader John Thune announced that a vote on the Senate Crypto Bill will take place before Memorial Day, marking a significant step in crypto regulatory reform.

However, the outcome of this vote remains uncertain, given the recent withdrawal of support from key Democrats.

Crypto Briefing

Looking ahead, Senator Tim Scott, chairman of the Senate Banking Committee, has expressed confidence that a comprehensive crypto market bill will be enacted by August 2025.

This timeline aligns with expectations from industry stakeholders who believe that market structure and stablecoin legislation will be finalized within this period.

Conclusion

The turbulent journey of the Senate Crypto Bill has underscored just how complex and politically charged the issue of stablecoin regulation has become.

From its bipartisan beginnings to the recent stall caused by ethical concerns and intra-party conflicts, the bill’s trajectory reflects broader uncertainties in U.S. crypto policy.

With Democrats divided, Republicans rallying to revive the bill, and the crypto community expressing both hope and frustration, the legislative chessboard remains in flux.

The debates surrounding the Senate Crypto Bill aren’t just about party lines or political optics—they center on real concerns: national financial security, innovation competitiveness, and investor protection.

Ethical questions around alleged ties to a $2 billion stablecoin deal, internal disagreements among Senate Democrats, and concerns over anti-money laundering gaps have added significant weight to the discussion.

Yet, these same challenges also present opportunities for constructive revisions that could pave the way for a more balanced and robust regulatory framework.

As Congress explores potential amendments and alternative legislation such as the STABLE Act and GENIUS Act, the focus must remain on striking a delicate balance.

A regulatory framework that is too rigid risks stifling innovation and pushing digital asset entrepreneurs offshore.

On the other hand, a lack of guardrails invites instability and erodes investor confidence. The Senate Crypto Bill—despite its current roadblocks—remains a vital part of the conversation.

Ultimately, the future of stablecoin regulation will shape not only how Americans engage with digital assets but also the nation’s position in the global crypto economy. Whether you’re a policymaker, developer, investor, or everyday user, it’s essential to remain informed and engaged.

Stay vigilant, ask questions, and track the progress of the Senate Crypto Bill and related legislation. The future of digital finance may very well depend on what happens next on Capitol Hill.