SharpLink finalizes a $425M deal to buy ETH as its main treasury reserve, led by Consensys, with Joseph Lubin as the new board chairman.

SharpLink Gaming is advancing its Ethereum Reserve treasury strategy after finalizing a private placement deal. The company plans to use the funds to acquire ETH and has announced intentions to raise $1 billion to become the public company with the largest Ethereum holdings.

SharpLink Gaming Secures $425 Million

SharpLink Gaming confirmed in a press release that it completed a $425 million private placement, led by Consensys Software and other investors, to support its ambitious Ethereum treasury strategy, the largest among public companies.

As previously reported, SharpLink plans to raise $425 million through common stock sales to fund its ETH accumulation.

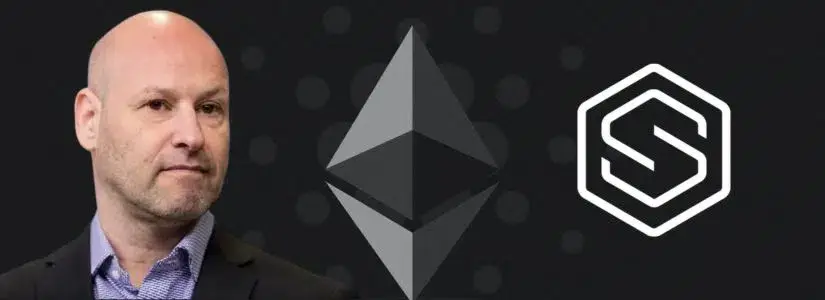

Following the deal’s closure, Consensys founder and CEO Joseph Lubin was appointed Chairman of SharpLink’s board. The private placement also saw participation from major crypto VC firms, including ParaFi Capital, Electric Capital, Pantera Capital, and Galaxy Digital.

SharpLink noted that this milestone strengthens its growth strategy, enabling it to adopt ETH as its primary treasury reserve asset while maintaining focus on its core operations.

As reported, SharpLink also filed a $1 billion shelf offering to expand its Ethereum treasury further. This exposure will allow the company to engage in Ethereum ecosystem activities like staking, with custody services provided by ParaFi and Galaxy Asset Management.

Consensys Comments on Private Placement

In a press release, Consensys addressed the private placement, stating that SharpLink aligns with its vision of Ethereum as a foundational economic infrastructure for the internet’s trust layer.

Lubin’s firm emphasized that SharpLink’s use of proceeds to buy ETH reflects their confidence in Ethereum as the backbone of a programmable global economy. Consensys highlighted Ethereum’s staking, restaking, and DeFi ecosystem as offering “structurally superior opportunities” for SharpLink’s treasury management and growth.

BTCS, another firm, is also advancing its Ethereum strategy, recently acquiring 1,000 ETH and increasing its holdings to 13,500, as reported.

ETH accumulation is growing among corporate and institutional investors, with Ethereum’s exchange supply hitting a seven-year low amid this corporate buying trend.