SharpLink Gaming, a top ETH holder with ~729K ETH, boosts treasury but sees stock dip despite long-term gains and ETH-focused leadership.

One of the biggest corporate owners of Ethereum is still SharpLink Gaming. It currently has slightly under 729,000 ETH in its Ethereum treasury.

Its expansion follows the launch of its Ethereum-based treasury plan on June 2, 2025, establishing ETH as the company’s primary reserve currency.

To Get More Ethereum, SharpLink Gaming Raised $2.6 Billion

SharpLink Gaming’s Q2 2025 report states that the company raised over $2.6 billion during a strong fundraising drive to increase its ETH treasury.

The ETH was bought with the money raised via PIPE and Registered Direct offers.

SharpLink’s “ETH Concentration,” a new statistic that shows ETH held per 1,000 presumed diluted shares, has almost doubled since the strategy debut.

Its change from 2.00 to 3.95 illustrates the firm’s rapid accumulation rate.

SharpLink Gaming has generated an additional $900 million to support its Ethereum purchases in the past seven days.

The investment aligns with a broad rise in Ethereum’s institutional demand.

As the price of ETH got closer to its all-time high, $1 billion worth of ETH was bought by U.S.-listed Ethereum ETFs.

Without selling any assets, the company has already produced 1,326 ETH in incentives from its nearly 100% ETH staking, generating a consistent yield.

Despite Ethereum Treasury Expansion, SBET Shares Decline

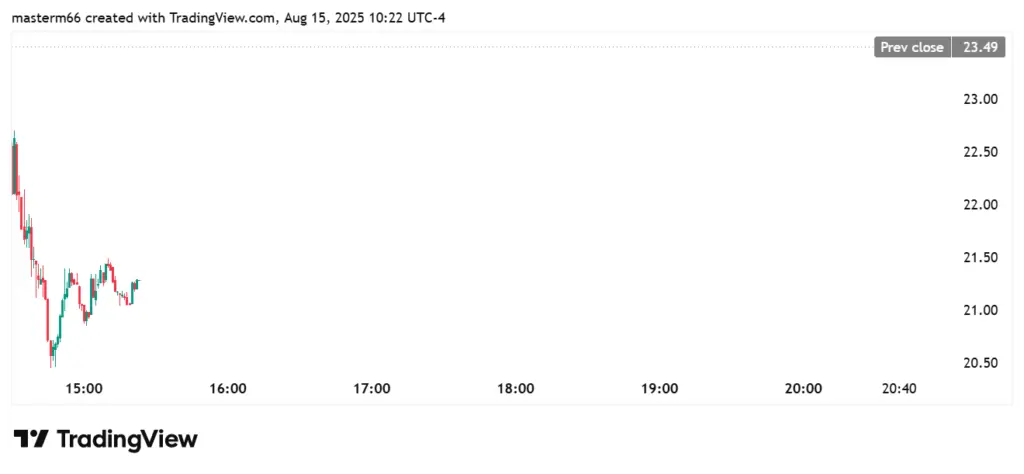

Following the earnings release, SharpLink Gaming stock (SBET) closed at $21.25, a 9.45% decrease.

The stock drop implies that investors took the company’s announced $103.4 million Q2 net loss into consideration.

Although SBET shares have temporarily decreased due to this net loss, the stock price has risen by 127.08% in a single year and 176.76% this year.

Revenue for Q2 2024 was $1.0 million, while revenue for Q2 2025 was $0.7 million.

This comprises a $0.2 million gross profit, or 30% of the gross.

Sales in the first half of 2025 were $1.4 million, compared to $2.0 million in the same period last year.

The leading causes were a $16.4 million share-based payment to the Consensys advisory and a $87.8 million write-down in accounting for liquid staked Ethereum—this company, which is the largest Ethereum software provider, partnered with SharpLink Gaming.

SharpLink’s Long-Term Ethereum Growth Strategy Is Improved by New Leadership

Governance changes demonstrate SharpLink’s ongoing interest in expanding its ETH treasury.

Ethereum co-founder Joseph Lubin joined as the board’s chairman.

Joseph Chalom, who most recently served as BlackRock’s head of digital assets, was promoted to co-CEO.

While staking dividends and the price growth of its ETH assets offer long-term potential, SharpLink Gaming’s focus is still on Ethereum for the time being.