SharpLink Gaming has added $515M in ETH in 9 days, boosting its 280K ETH treasury as it eyes more via a $6B share offering.

In only the last nine days, Joseph Lubin-backed SharpLink Gaming has added $515 million in Ether to its treasury, significantly increasing the shares it plans to sell to acquire additional Ether.

SharpLink said in a prospectus update submitted to the US Securities and Exchange Commission on Thursday that it has raised the maximum quantity of common stock it is permitted to sell by an additional $5 billion, from the $1 billion allowed in its original filing on May 30.

Sharplink Gaming stated in its previous prospectus that it will purchase Ether with the majority of the proceeds.

“We plan to purchase Ether with a significant portion of all our cash proceeds.”

Additionally, we plan to use the money raised from this offering for core affiliate marketing activities, general corporate purposes, operating costs, and working capital requirements.

SharpLink would own almost 1.38% of the circulating quantity of ETH if it spent $6 billion today to purchase ETH for its treasury.

Acquisition Of ETH Is Still Ongoing

In a more recent X post, SharpLink stated that it plans to store one million ETH for its treasury, making it the largest corporate holder of ETH as of Monday.

With almost 99.7% of the assets staked as of Tuesday, the corporation had more than 280,000 ETH in reserve.

Between June 2 and July 15, SharpLink produced 415 ETH, or $1.49 million, as a staking reward.

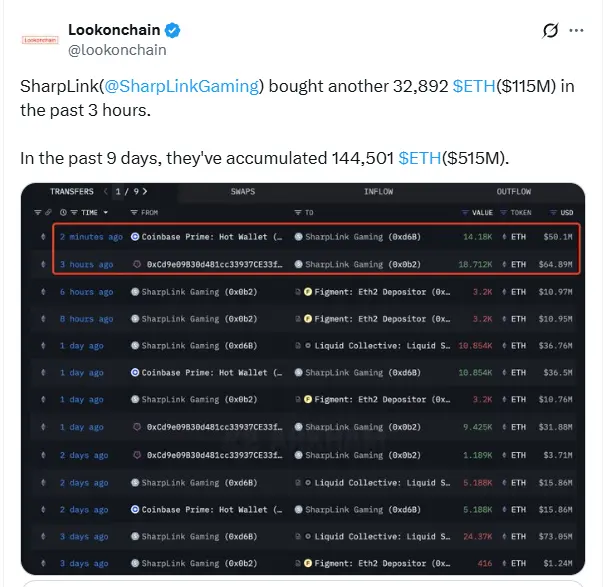

SharpLink purchased an additional 32,892 ETH, valued at $115 million, after submitting its enlarged share offering with the authorities.

Lookonchain said the company bought $515 million worth of Ethereum in the last nine days.

Galaxy Research shows that SharpLink’s increase in ETH holdings over the Ethereum Foundation is a beneficial ecosystem driver.

Sharplink Gaming Stock Declines

The stock of Sharplink Gaming (SBET) dropped 2.62% to $36.40 at the end of Thursday’s trading session.

According to Google Finance, the stock continued to decline after the bell and closed the after-hours trading session at $34.60, a decrease of 4.95%.

Although SBET is up 350% this year, the stock has dropped 54 percent from its peak of $79.21 on May 29.

SharpLink’s revenue fell 24% year over year in the March quarter, and the company’s net profit margin dropped 110%.

Nasdaq predicts the company will release its following quarterly results on August 13.