SHIB’s 2.3B token burn, surging Open Interest, and technical breakout signal strong bullish momentum and growing investor interest.

Shiba Inu (SHIB) has consumed over 6.3 million tokens in the past 24 hours, resulting in a whopping 3401% increase in its burn rate. This audacious burning policy has many implications for the token’s scarcity and can potentially increase its perceived value among investors.

The open interest in the SHIB has increased to $295 million

These burn increases have also been accompanied by bullish speculation, and this pattern is currently being reaffirmed. This level of burn also suggests a community-led commitment to long-term valuation, which could serve as a solid foundation for the subsequent phase of the top meme coin’s market entry.

Coinglass also reports that the open interest in Shiba Inu has increased by over 20% to 295 million in conjunction with the burn surge. The increase is indicative of the speculative appetite and the accumulation of long positions on leverage. Traders, particularly those new to the market, typically exhibit bullish confidence when open interest increases, as opposed to sell-out tendencies.

This trajectory shift has the potential to attract additional capital into SHIB derivatives. Furthermore, the bullish narrative is further bolstered by the convergence of strong fundamentals, such as a burn increase and a significant amount of open interest. As a result, the data suggests that the market participants are preparing for the possibility of a price continuation rather than a reversal.

On-Chain Growth Signals Healthy Recovery

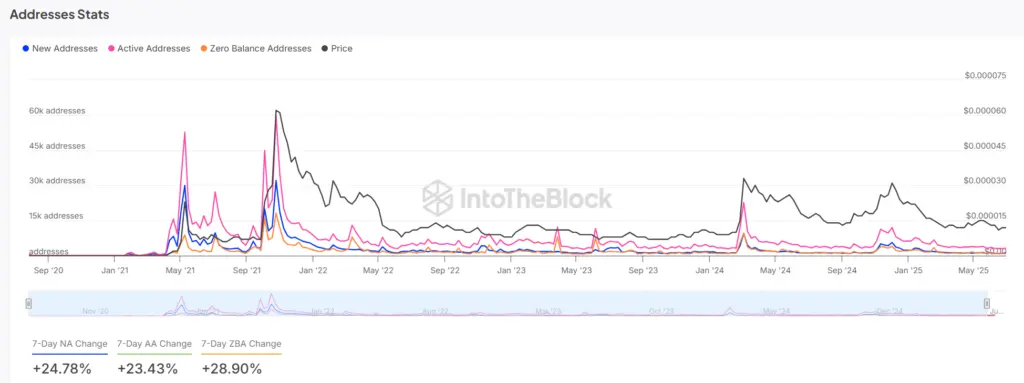

IntoTheBlock analytics corroborate that user interest is rising, as on-chain metrics indicate. Over the past week, there has been a 24.78% increase in the number of new addresses and a 23.43% increase in the number of active addresses. This suggests that there has been a rise in retail participation and network activity. Furthermore, the nearly 29% increase in zero-balance addresses may indicate wallet consolidation or user re-engagement. As previously reported, Shiba Inu social media activity has also experienced a significant increase of 126%.

The relative increase in prices and addresses may indicate underlying support for the price action of SHIB. The rally’s sustainability can be demonstrated, and the broader crypto community may be encouraged to participate long-term if the address growth persists.

Is the price of SHIB in jeopardy?

Following the confirmation of a double bottom at the $0.00001063 resistance range, SHIB has recently breached a descending trendline. The double bottom pattern, a dependable reversal signal, signaled the conclusion of a multi-week downtrend. After this affirmation, the price of SHIB surged past the resistance of $0.00001428 and is currently trading at approximately $0.00001507.

Momentum is shifting as SHIB is currently approaching the $0.00001580 resistance level. The breakout suggests that the bulls are regaining momentum and may be able to reclaim the $0.00001759 zone. A bullish continuation is more probable in this technical structure, provided that trading volume does not decrease and instances of reductions in trading are absorbed.

The optimistic market structure has been reflected in the DMI signals. The +DI is at a high of 37.57, while the -DI is at a depressed 11.60, indicating a strong upward movement. Additionally, the Average Directional Index (ADX) is currently at 27.98, suggesting a strong trend.

This divergence of the indicators suggests that the bulls have a firm grip on the market’s direction. These DMI patterns have been used to indicate prolonged trends, notably compression caused by structural Breakouts. Therefore, the current momentum indicators support the hypothesis that SHIB may extend its rallying phase in the short term, without imminent unsustainable behavior.

When is the optimal time to purchase?

In conclusion, the short-term outlook for SHIB is optimistic due to the departure from technical resistance, increasing open interest, and surge in token burns. SHIB is in a favorable position to increase its value, as evidenced by momentum and on-chain indicators. As is customary, conduct your own investigation before investing.