Bybit’s proof-of-reserves reveal nearly 3T Shiba Inu holdings, strengthening SHIB fundamentals and fueling bullish sentiment.

Bybit’s most recent proof-of-reserve update revealed trillions in Shiba Inu holdings.

Demand will continue due to the expanding, favorable fundamentals of the token’s ecosystem.

Nearly 3 Trillion In Shiba Inu Holdings, Per Bybit Data

According to Bybit’s 25th audit series, the company has 2.94 trillion Shiba Inu tokens, or almost three trillion coins.

As a result, SHIB is one of the Shiba Inu holdings’s greatest assets and frequently shows up in user balances.

The audit also revealed that while USDT has decreased, significant cryptocurrencies like Ethereum and Bitcoin have increased.

This demonstrates the extent to which Shiba Inus are now included in exchange portfolios.

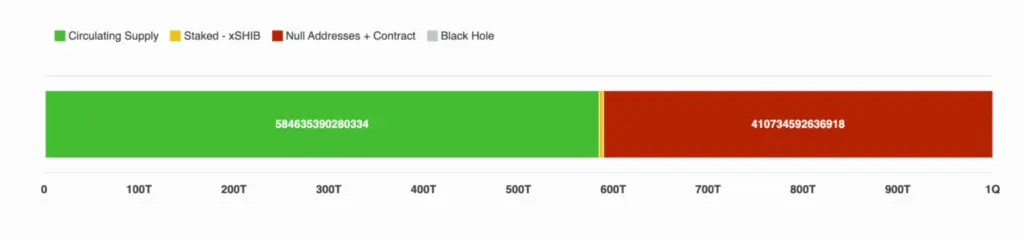

Since roughly 40% of SHIB’s supply has already been delivered to the burn address, the token can establish a permanent position in the larger market structure.

Over the previous three weeks, the same Bybit audit also showed changes in the market. Bitcoin balances rose to 58,954 BTC, a 5.6% gain.

Ethereum increased 6.5% to 604,131 ETH as well.

USDT holdings, on the other hand, dropped 4.7%, suggesting that more money is moving into erratic assets as opposed to stablecoin reserves.

Beyond Bybit, Shiba Inu has been widely accumulated over other top platforms, according to blockchain statistics.

At the moment, Robinhood has roughly 39 trillion tokens.

With over 60 trillion tokens in its wallets, Binance is also among the top 10 holders.

Expanding Foundations In Shiba Inu Environment

There have been some recent modifications to the Shiba Inu ecology.

Details of the Torii Gateway project were disclosed in connection with SHIB’s expansion, as CoinGape previously reported.

This project operates on over 60 networks and supports over 1,500 tokens.

Soon, non-EVM chains like Tron and Solana might be added.

Shibarium’s market reach would grow as a result.

In the meantime, Shiba Inu holdings upgraded its Shibarium developer hub significantly.

This promoted decentralization and gave validator nodes more detailed instructions.

As seen by a rise in daily transactions and SHIB burns, this suggests growing network activity and long-term sustainability.

SHIB’s on-chain analytics also show significant bullish trends.

Even when prices settle, positive Chaikin Money Flow (CMF) levels show that consumers are still making purchases.

Analysts frequently interpret a situation where demand exceeds short-term selling as an indication that larger price rises could ensue.

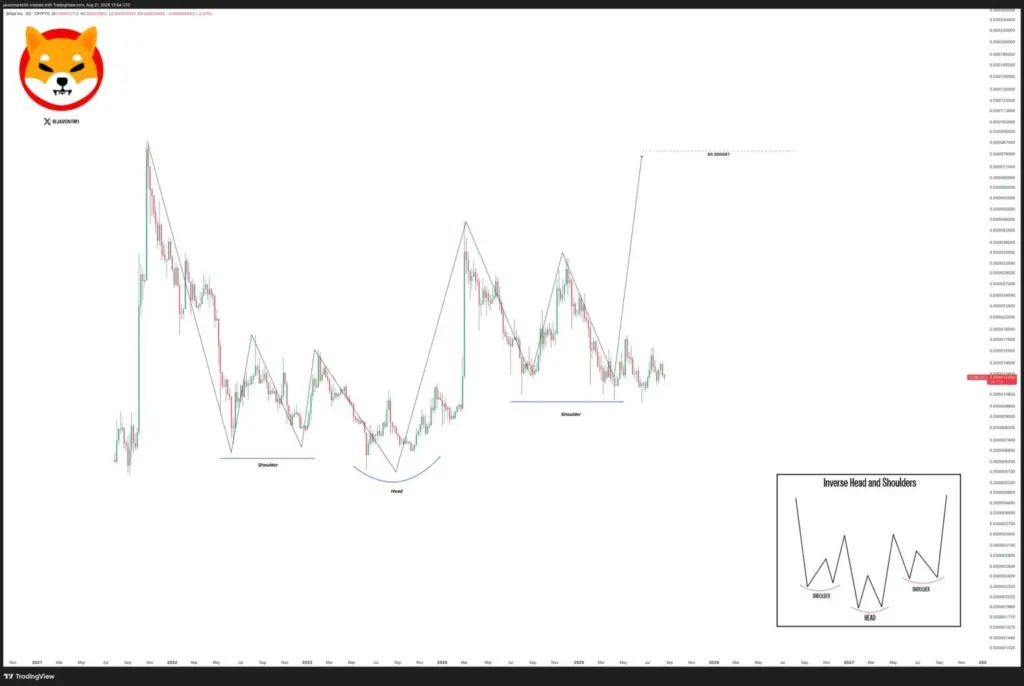

Crypto specialist Javon Marks also noticed SHIB’s persistent Inverse Head & Shoulders pattern.

The analysis suggests that prices might be ready for a significant breakthrough.

According to his forecast, a potential objective of $0.000081, or a jump of over 540%, may set the stage for new all-time highs.

Despite short-term volatility, the token’s accumulation and fundamentals indicate that it might be preparing for a new boom phase.