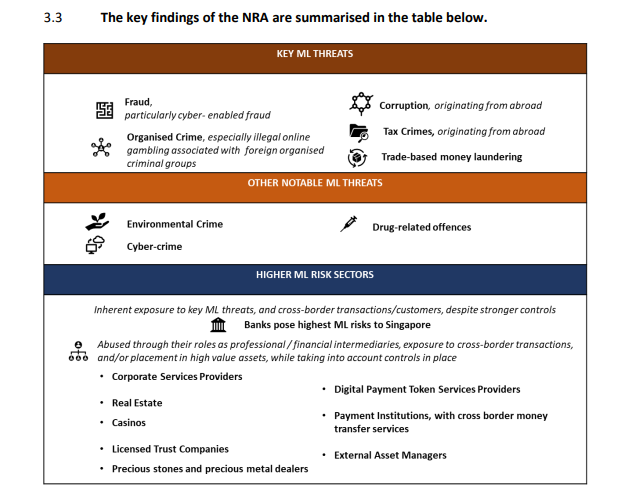

According to Singapore, DPT and virtual asset service providers stand out in the financial industry as a high-risk group.

Singapore’s updated Money Laundering (ML) National Risk Assessment (NRA) has highlighted significant risks in the anti-money laundering (AML) landscape, particularly in the financial sector, where digital payment token (DPT) service providers pose additional vulnerabilities.

The comprehensive 126-page study, published in 2014, reveals additional risk sectors left out of the previous one. These include traders of precious stones and metals and virtual asset (DPT) service providers.

It is determined that the banking industry, which includes wealth management, presents the greatest ML dangers. Banks are more vulnerable to criminal exploitation because they handle high-risk clients and facilitate many transactions.

DPT service providers, or virtual assets service providers, are a high-risk group in the financial industry. The NRA draws attention to a rise in cases that have been documented using DPTs and a range of exploitation techniques.

Even though the country only hosts a small percentage of global DPT operations, the authorities carefully monitor the risks involved. External asset managers and payment institutions providing cross-border money transfer services are two more high-risk areas of the financial industry.

According to Singapore’s risk assessment analysis, organized crime, corruption, tax crimes, trade-based money laundering, and fraud—particularly cyber-enabled fraud—are the main dangers to money laundering.

Using fictitious businesses, concealing illicit money in Singaporean bank accounts, and investing in priceless commodities like precious metals or real estate are standard money laundering techniques.

The NRA report incorporates feedback from international authorities, the Financial Intelligence Unit, and Singapore’s law enforcement and supervisory agencies.

Money Laundering in Singapore

Due to its open economy and position as a global financial center, Singapore is vulnerable to money laundering threats. Criminals use the nation’s economic and financial infrastructure to move or launder money.

Furthermore, serious risks are associated with transforming illegal money into assets like real estate, digital payment tokens, or precious metals.

The Payment Services Act (PS Act) in Singapore will be amended, the Monetary Authority of Singapore (MAS) said in April, to broaden the range of regulated services for digital payment token (DPT) service providers.