Toronto’s Sol Strategies, a Solana-focused crypto firm, has filed for listing on Nasdaq to boost institutional access, liquidity, and global visibility

Sol Strategies, a Canadian corporation listed on the Canadian stock exchange, has submitted a filing with the US Securities and Exchange Commission (SEC) to be listed on Nasdaq.

The organization intends to conduct business under the ticker symbol STKE. Sol Strategies has been amassing Solana (SOL) as a treasury asset. Currently, the company possesses 420,355 SOL, which is valued at approximately $61.13 million.

Will there be an increase in the purchase of Solana?

Sol Strategies has previously divested its Bitcoin holdings to concentrate on SOL. The company has achieved another significant milestone with the most recent 40-F filing with the SEC. The action underscores the firfirm’screasing confidence in the SOL network.

We may observe an increase in Solana (SOL) exposure for the company if the SEC approves the 40-F filing. If everything goes according to plan, the underlying assasset’sice will likely increase.

Solana (SOL) is also awaiting approval from the Securities and Exchange Commission (SEC) for numerous spot ETF applications. James Seyffart, an analyst at Bloomberg ETFs, predicts that the SEC will authorize a spot SOL ETF with a 90% probability this year.

Despite the positive developments, the asset continues to emit a red glow.

Over the past few days, numerous favorable developments have occurred in Solana (SOL).

VanEck announced the recent registration of its SOL ETF with the Depository Trust & Clearing Corporation (DTCC). Despite the optimistic environment surrounding the asset, SOLSOL’sice does not appear to fluctuate.

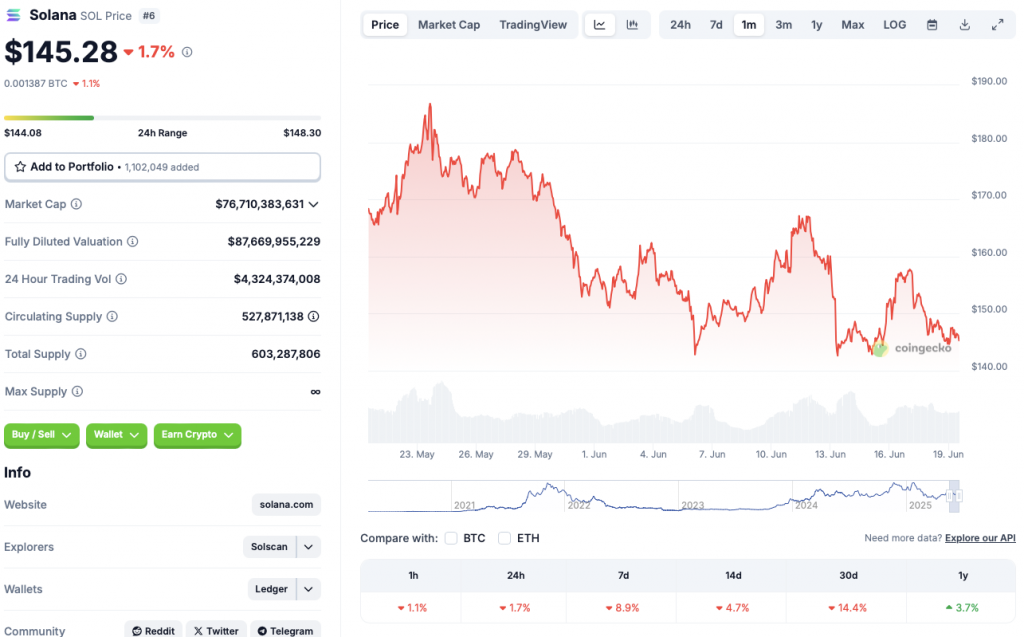

At present, SOL is experiencing difficulty in surpassing the $150 threshold. The asset is down 1.7% on the daily charts, 8.9% on the weekly charts, 4.7% on the 14-day charts, and 14.4% over the previous month.

Although the current decline is alarming, Solana (SOL) has demonstrated its resilience in the past few years. Following the collapse of FTX in 2022, the assasset’sice had plummeted to below $9.

SOL has achieved numerous all-time highs since its 2022 lows. The asset may recover from its current situation if market sentiment improves.