Solana price targets $200 as the first U.S. SOL staking ETF launches this week, with retail wallet numbers hitting an all-time high.

After news broke yesterday that the first SOL staking ETF would debut in the US on July 2, Solana (SOL) temporarily rose to $159.

The ETF revelation has raised market interest, even if the price of Solana has since dropped to trade at $151 today, July 1, up 0.8%.

At $4.79 billion, trading volumes had increased by more than 70%. Therefore, how will the Solana price change once this product launches? Is $200 possible?

Focus On Solana Price As First US SOL ETF Launches

This week, REX-Osprey will introduce a spot SOL ETF, which will provide investors with access to staking revenue and exposure to SOL, as CoinGape recently revealed.

The goal of this product is to open the door for institutional cryptocurrency use, which will boost the price of Solana.

Leading industry voices, such as Bloomberg analysts, are taking notice of this product’s impending introduction and predict that a spot SOL ETF will soon be approved.

According to Eric Balchunas, the introduction could result in price increases.

“Get ready for a potential Alt Coin ETF Summer with Solana likely leading the way.”

Alongside other cryptocurrencies like Litecoin and XRP, spot SOL ETF approval odds have increased to 95%, according to James Seyffart.

Retail traders are setting themselves up for a possible Solana price rally as these odds rise.

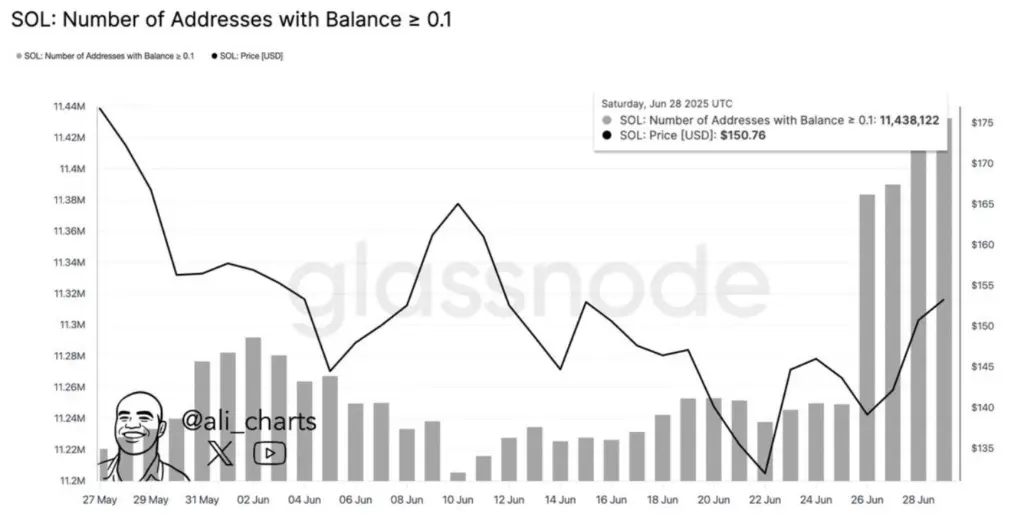

The addresses that contain more than 0.1 SOL tokens have surpassed 11.44 million, setting a new record, according to Glassnode data.

Depending on the market’s mood, these little addresses are popular with traders, and if they are purchasing today, it indicates that they expect a comeback.

The Solana price may rise due to the growing curiosity and likely institutional investment sparked by the SOL staking ETF, and the technical structure already favors a bullish outlook.

What Will SOL Do?

As previously noted, a bull run is the most anticipated response in the SOL price as ETF excitement rises.

Developing a symmetrical triangular pattern, which suggests an impending breakout from consolidation, has increased the likelihood of this rise.

This triangle formation triggers a bullish Solana price prediction if it can surpass the upper resistance level of $159.

SOL was rejected at this price yesterday, but a 47% rally to $235 might start if a buying pressure spike appears and it closes decisively above it.

This bullish view is supported by the AO histogram bars, which turn green even though they are still below the mean level.

A rally may be on the horizon, as this structure indicates that the bearish pressure holding SOL below the $200 psychological support is waning.

The price of Solana is also encountering significant resistance at the $157 50-day SMA level.

To increase the likelihood of a rally above $200, the price must rise above this short-term MA and the 200-day SMA of $166.

However, the 47% symmetrical triangle breakthrough might be on the horizon if the REX-Osprey staking SOL ETF opens in the US tomorrow and there is a clear closing below this critical SMA level.

Therefore, traders may expect a surge above $200 if the price of Solana responds to this news.