Solana is rising in institutional adoption and may become the top blockchain for financial institutions, sparking speculation about a SOL-based ETF.

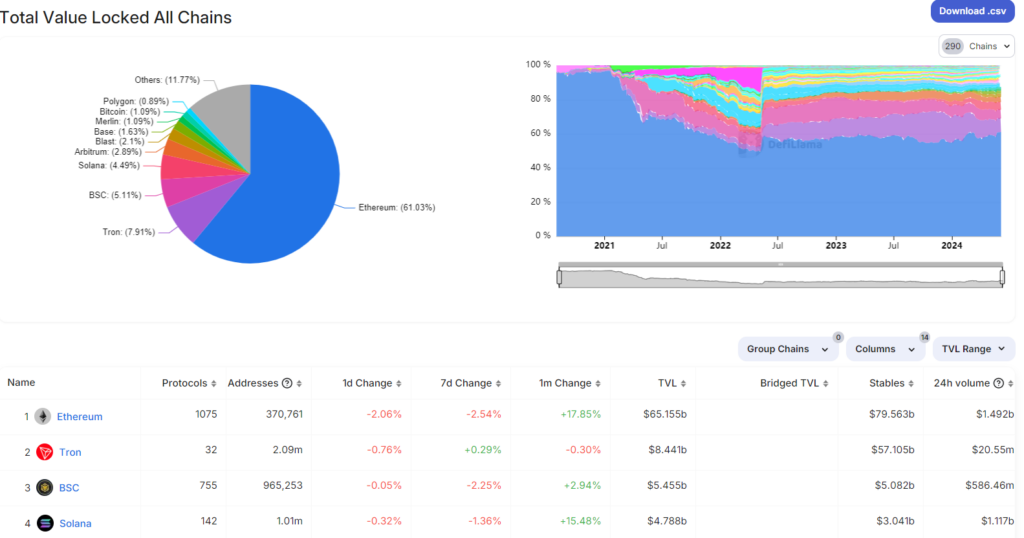

Regarding total value locked (TVL), SOL is the fourth-largest blockchain and is quickly rising to the top of the institutional adoption network.

Wormhole Foundation CCO and co-founder Robinson Burkey predict that more financial institutions will merge with the SOL blockchain to “future-proof” their products.

In a research note that Burkey provided, he wrote:

“Solana and institutions make sense. Industry leaders like PayPal, Stripe, and Visa must future-proof their offerings. The best way to do that is by meeting their most forward-thinking users on the platforms they’re adopting. You’ll likely see many more institutional moments for Solana in the coming years.”

The PayPal USD 1.00 stablecoin was added to the network last week, the company’s first step away from the Ethereum network.

The integration will allow users to make low-cost transactions on the network using PYUSD, increasing the stablecoin’s usefulness for regular transactions.

The SOL blockchain is the second network to support the stablecoin after Ethereum, where global payments firm Visa introduced its USD Coin USDC$1.00 in September 2023.

Increased institutional deployment of Solana: Fireblocks

SOL is one of the most scalable blockchain networks, managing many transactions.

Compared to Ethereum, which can only process 15 transactions per second (TPS) and has far higher gas fees (which start at $1 and can go as high as $50 during network congestion), it can theoretically process up to 65,000 TPS at an average transaction cost of $0.0025.

According to Ran Goldi, vice president of payments at Fireblocks, SOL’s architecture can effortlessly integrate the current flows of traditional payment institutions, which will lead to greater institutional adoption:

“With confidential transfers, a basic payment requirement for large-volume processors, we will see additional names adopting the blockchain into their flows. The key, as I see it, is making sure your blockchain can support the “under the hood” payment requirements for compliance, regulation, and privacy.”

Goldi said Solana could forge even more institutional alliances if they included a private transfer option.

“Doing that, plus speed and vast liquidity, [Solana] can become a sharp tool in the hands of payment institutions.”

With nearly $4.7 billion in TVL or 4.49% of all blockchains’ TVL, Solana is now the fourth-largest blockchain network, according to DefiLlama data.

Next up, a Solana ETF?

Zeta Markets founder Tristan Frizza believes that SOL$166 may become the next cryptocurrency to be included in an exchange-traded fund (ETF) in addition to growing institutional usage.

In a note that Frizza provided, she wrote:

“Solana is seen as one of the ‘big three’ cryptos alongside BTC and ETH, with many analysts expecting a Solana ETF soon. With major partnerships like Visa, Stripe, Shopify Pay, and PayPal, merchant and institutional adoption of Solana is likely to grow.”

A trillion-dollar asset manager, Franklin Templeton, hailed Solana for its monolithic approach to blockchain scalability, calling it a “powerful use case of decentralized blockchains,” which generated hopes for a SOL-based exchange-traded fund (ETF) in January, according to a Jan. 17 X post.

Brian Kelly, a CNBC Fast Money trader and cryptocurrency investor, has predicted that SOL might be the next cryptocurrency to receive an ETF spot in the US.