Solana Network’s activity and the lack of interest from derivatives traders can be used to explain the weakness in the price of SOL.

After a brief increase to $151 on June 16, the native token of Solana, SOL SOL$136, has had a 24% decline from June 7. In comparison, the entire cryptocurrency market value has decreased by 14% within the same period, and it has underperformed.

This implies that SOL’s problems are more severe than the market’s general decline in cryptocurrency enthusiasm.

The demand for leveraged positions and Solana Network’s on-chain activities are two signs that suggest the continuation of SOL’s bearish momentum. There may be a retest of the $130 mark or below if demand is unchanged.

The lack of an ETF could cause SOL’s stock to struggle.

Because of the S&P 500 index’s remarkable performance, which peaked on June 17, there has been less interest in cryptocurrencies.

Tech companies have been the main driver of the stock market’s advances, and recent consumer and job data point to strong second-quarter earnings releases. It is estimated by investors that there is a two-thirds likelihood that the U.S. central bank will start reducing interest rates by September.

Given the high interest rates, investors are worried that the U.S. economy may not expand for long despite the cryptocurrency market’s more significant potential. Because Bitcoin BTC$65,191 and Ether ETH$3,403 have preferential access to institutional money through exchange-traded funds (ETFs), this risk is incredibly substantial for altcoins like SOL.

There will be intense competition for blockchains prioritizing intelligent contracts, even if the cryptocurrency market sees a surge in the upcoming months. The Solana Network is home to several apps that provide asset bridges between rival blockchains that compete in yield, airdrops, liquidity, and token launches.

The native staking reward rate of Solana is just 1.3% higher than the inflation rate of SOL tokens. On the other hand, StakingRewards reports that Ethereum has an effective reward rate of 2.8% because of its burn mechanism, which leads to a yearly inflation of only 0.4%. Solana’s total value locked (TVL), which has remained below $30 million since May, is directly impacted by this.

Arthur Hayes, the former CEO of BitMEX and co-founder, believes that Solana won’t become a top base layer decentralized application (DApp) network in the next one to three years. Wu Blockchain reports that Hayes believes Aptos is the most likely contender for the leadership, albeit he needed to give more information on this decision.

Utilizing a sharded architecture, Aptos processes batches of transactions using a “modular approach” to transaction processing.

Investors are worried about Solana’s on-chain and derivatives metrics.

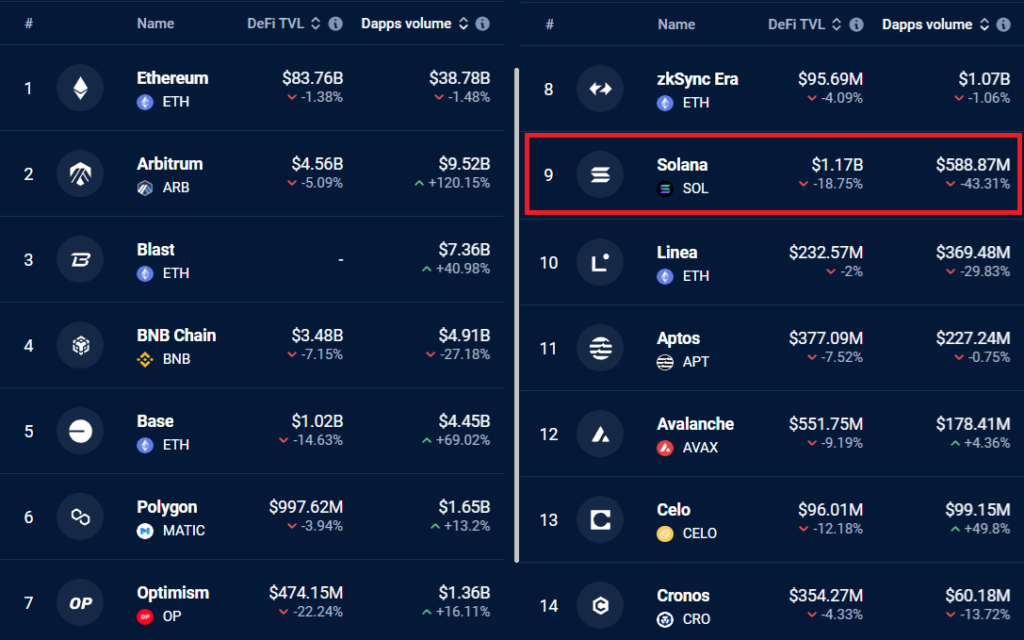

Apart from the direct competition from layer-1 alternatives, Solana is under more pressure because Ethereum’s TVL (the total value of its layer-2 ecosystem) is still higher than $40 billion. Regarding DApp activity, other blockchains, such as Optimism, Base, and Arbitrum, have already eclipsed Solana Network.

Compared to BNB Chain’s $4.9 billion and Arbitrum’s $9.5 billion activity during the same period, Solana’s $589 million weekly volume is noticeably smaller. Similarly, DappRadar reports that the decentralized finance TVL on Solana is $1.2 billion, significantly less than BNB Chain’s $4.9 billion but more than rivals Aptos and Avalanche.

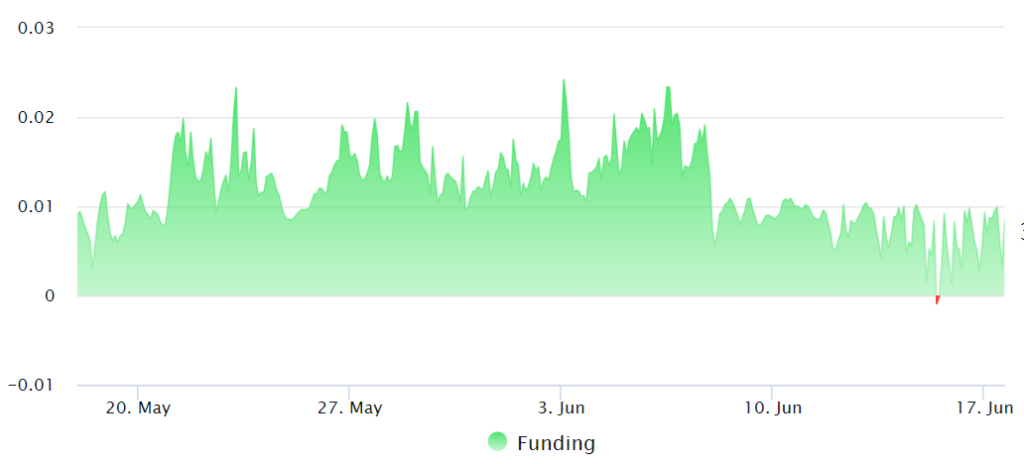

Traders are urged to watch the derivatives markets to understand the market’s emotions better. Inverse swaps, or perpetual contracts, have an inherent rate updated every eight hours. In summary, a positive rate means longs (buyers) want to use more considerable leverage.

For the previous seven days, the funding rate for SOL permanent futures has stayed below 0.01% every eight hours, or 0.2% weekly, characteristic of neutral markets. The cost of leverage longs spiked to 0.5% per week on June 6, marking the end of the last period of mild excitement.

The likelihood of Solana Network’s DApp deposits, volumes, and traders’ lack of interest in SOL derivatives makes it unlikely that the price of SOL would break below the $130 support level shortly.