An analysis of the various types of funds and institutions that possess Bitcoin ETF shares by Sam Baker at River

In retrospect, introducing an exchange-traded fund (ETF) was all that was necessary for the genuine institutional adoption of Bitcoin. A significant advance over the futures-based ETFs that commenced trading in 2021, the SEC approved nine new ETFs in January that offer exposure to Bitcoin through the spot market.

The size and quantity of institutional allocations to these ETFs have exceeded consensus expectations in the first quarter of trading. Blackrock’s ETF established a record for the quickest time an ETF has reached $10 billion in assets.

In addition to the remarkable AUM figures that these ETFs have generated, the deadline for institutions with assets exceeding $100 million to submit 13F filings to the SEC was this past Wednesday. The results of these filings are nothing short of bullish, as they provide a comprehensive understanding of the ownership of Bitcoin ETFs.

Institutional Adoption Is Based On a Wide Range

In the past, the mere disclosure of a single institutional investor’s ownership of Bitcoin would have been a significant event, potentially affecting the market. Tesla’s decision to include bitcoin in their balance sheet three years ago resulted in a 13% increase in bitcoin’s value in a single day.

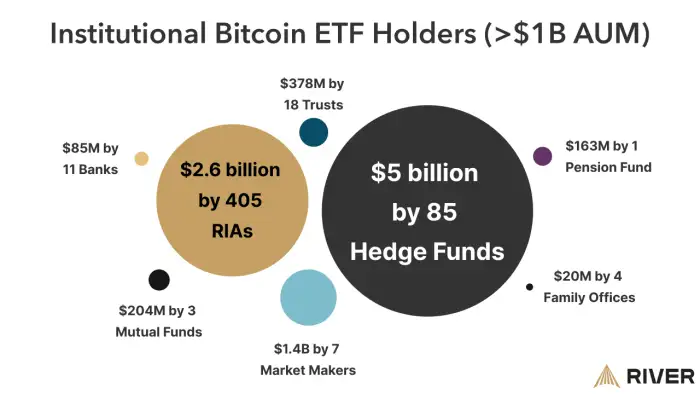

2024 is distinct. As of Wednesday, 534 distinct institutions with assets exceeding $1 billion have elected to allocate funds to Bitcoin in the first quarter of this year. The breadth of adoption is extraordinary, from hedge funds to pensions and insurance companies.

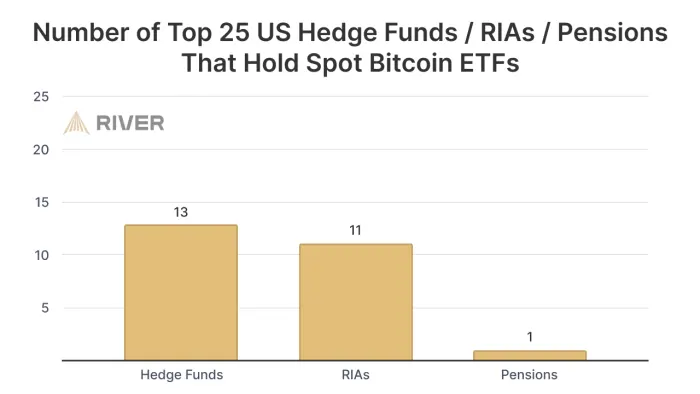

Over half of the top 25 hedge funds in the United States currently have exposure to Bitcoin, with Millennium Management’s $2 billion position being the most notable. Furthermore, 11 of the top 25 Registered Investment Advisors (RIAs) are currently allocated.

However, why do Bitcoin exchange-traded funds (ETFs) appeal to institutions that could have just purchased Bitcoin?

Large institutional investors are slow-moving organisms From a financial system steeped in tradition, risk management, and regulations.

For a pension fund to update its investment portfolio, it necessitates months, and sometimes years, of committee meetings, due diligence, and board approvals that are frequently repeated.

A comprehensive vetting of multiple trading providers (e.g., Galaxy Digital), custodians (e.g., Coinbase), and forensics services (e.g., Chainalysis) is necessary to acquire exposure to Bitcoin through the purchase and holding of real Bitcoin. Also, establishing new processes for accounting, risk management, and other related functions is necessary.

In comparison, acquiring exposure to Bitcoin by purchasing an ETF from Blackrock is effortless. According to Lyn Alden in a TFTC podcast, “In developer terms, the ETF is essentially an API for the fiat system.” It enables the fiat system to integrate with Bitcoin more effectively than previously.

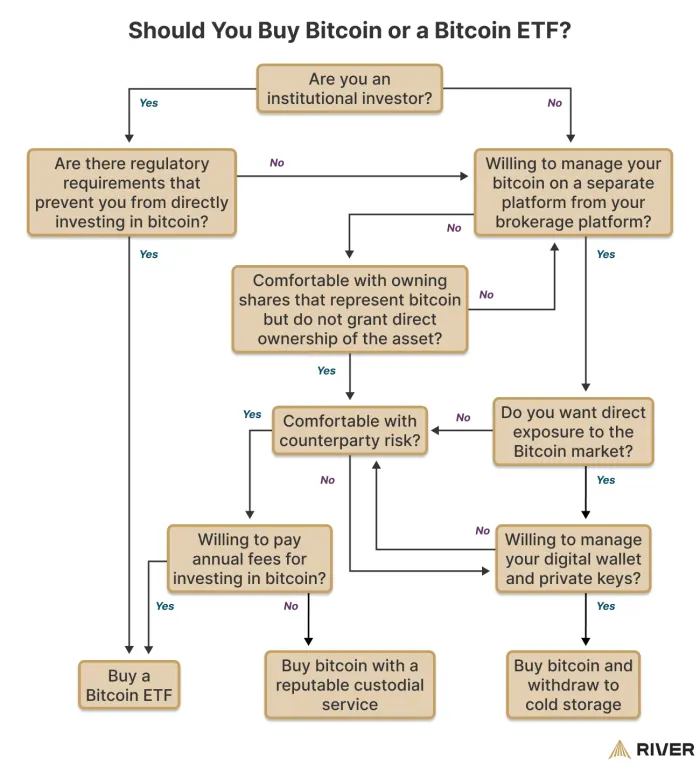

This is not to suggest that ETFs are the optimal method for individuals to acquire exposure to Bitcoin. In addition to the management fees associated with owning an ETF, numerous tradeoffs associated with this product may undermine the fundamental value of Bitcoin—incorruptible money. Although these tradeoffs are beyond the scope of this article, the flowchart below illustrates some of the factors at play.

Reasons for the lack of greater Bitcoin appreciation this quarter

It may come as a surprise that the price of bitcoin has only increased by 50% year-to-date, given the robust rate of ETF adoption. The extent of the potential upside is uncertain when 48% of the best hedge funds have been allocated.

The average allocations of the institutions that own the ETFs are quite modest, even though they have broad-based ownership. The weighted average allocation of the major hedge funds, RIAs, and pensions that have made an allocation is less than 0.20% of AUM ($1b+). Millennium’s $2 billion allocation constituted less than 1% of its reported 13F holdings.

Institutions will be remembered as ” getting off of zero” during the first quarter of 2024. What is the anticipated time frame for them to progress beyond the initial phase of exploring the water? Time will ultimately determine the outcome.

“This is a guest post by Sam Baker from River.” The opinions expressed are solely theirs and do not necessarily represent those of BTC Inc. or Bitcoin Magazine.