South Korea unveiled a 26 trillion won ($19 billion) chip assistance package on Thursday to keep up with ‘all-out battle’ in the global semiconductor market

The presidential office reports that, as part of the bundle, President Yoon Suk Yeol announced a financial support program through the state-run Korea Development Bank worth approximately 17 trillion won to subsidize investments by semiconductor companies.

“At this time, everyone knows that semiconductors are the site of an all-out national war.” “Whoever can produce cutting-edge semiconductors first will determine victory or defeat,” Yoon stated during a meeting with senior government officials.

South Korea has experienced a decline in performance relative to specific competitors, including SK Hynix (000660. KS) and Samsung Electronics (005930. KS), both prominent memory chip manufacturers, particularly in chip design and contract chip manufacturing.

According to Yoon’s office, Nvidia (NVDA), an American giant that designs semiconductors but outsources production, controls a 1% share of the global fabless market.

It was also stated that a gap existed between domestic chipmakers and prominent contract chip manufacturers such as Taiwan’s TSMC (2330. TW), which opened a new tab.

Yoon announced the establishment of a one-trillion-won fund to assist equipment manufacturers and fabless firms.

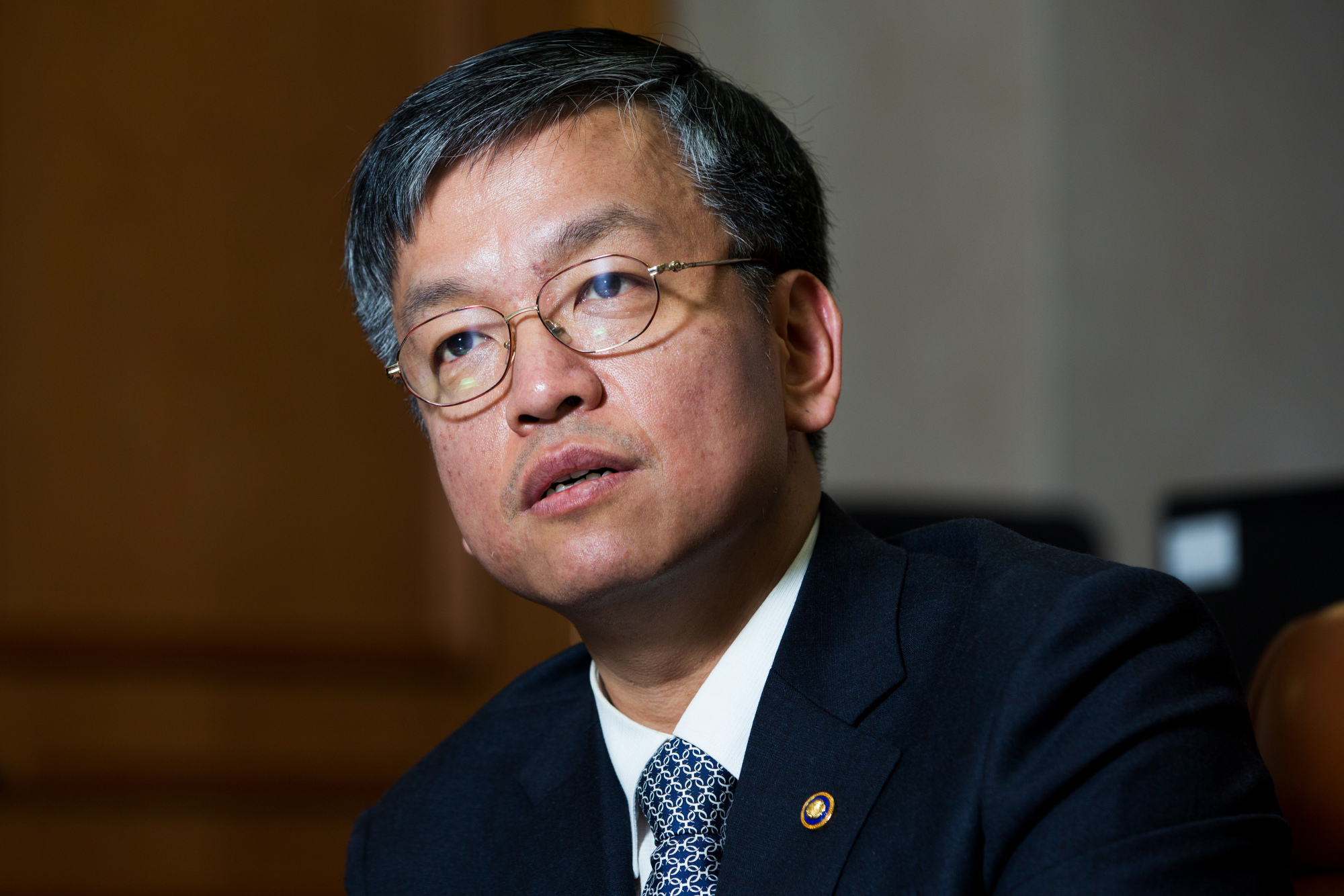

Ahn Duk-Geun, minister of industry, stated that the government’s objective was to assist in increasing South Korea’s proportion of the global market for non-memory chips, including mobile processors, from 2% to 10%.

The package exceeds the initial estimates presented by Choi Sang-mok, the country’s finance minister, earlier this month. He stated that the government aimed to assist with research and semiconductor investments of over 10 trillion won.

During a press briefing, Choi characterized South Korea’s semiconductor support package as “equivalent to” that of any other nation.

Nations, including the United States and China, among others, have contributed tens of billions of dollars through grants and other funding mechanisms to support their respective semiconductor industries.

“It appears that the government is attempting to emulate the practice of other nations subsidizing their chip manufacturers,” said Greg Roh, chief of research for Hyundai Motor Securities.

South Korea is constructing a mega chip cluster in Yongin, south of Seoul’s capital, billed as the world’s largest high-tech chipmaking complex, to attract semiconductor equipment and fabless companies.

Finance Minister Choi stated that to expedite the semiconductor cluster’s construction by two times its usual rate; the government would reduce red tape and streamline bureaucracy.

Yoon, who has pledged to invest every conceivable resource in the nation’s chip industry, announced in January that he would increase tax allowances for domestic semiconductor industry investments to increase employment and attract more talent.